Business Trends, Industry Insights and Policy Changes – Vol 4 by UBA

NIGERIA: The Monetary Policy Committee (MPC), for the first time in two and a half years, raised the Monetary Policy Rate (MPR), hiking the benchmark rate by 150bps to 13.0%. The MPC also maintained the Cash Reserve Ratio (CRR) of 27.5%. The MPR retained the asymmetric corridor of +100/-700 basis point around the MPR, while the Liquidity ratio was kept at 30.0%. The decision reflected the need to curtail Nigeria’s high inflation, which has reached 16.8% as of April 2022.

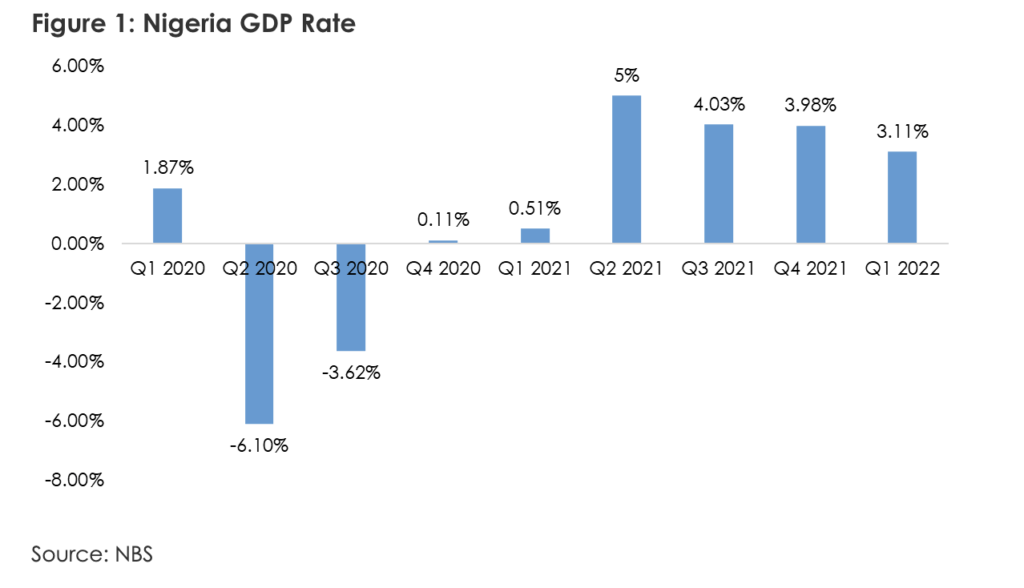

The National Bureau of Statistics (NBS) published Nigeria’s Q1 2022 GDP estimates. According to the report, real GDP grew by 3.1% y/y in Q1 2022 from 0.5% y/y in Q1 2021 to 4.0% in Q4 2021, showing improvement in economic performance with sustained positive growth for six consecutive quarters since the recession witnessed in 2020. According to the report, the oil sector contributed 6.6% to the real GDP while the non-oil sector contributed 93.4% in the period under review.

Senegal

The International Monetary Fund (IMF) has lowered its economic growth projection for Senegal in 2022 to around 5% from an initial 5.5% forecast, with inflation projected to reach 5.5% due to higher food and energy prices.

Following this, the IMF and Senegal have reached a staff-level agreement on economic and financial policies under which Senegal will receive a $217million loan to cushion the impact of inflation, made worse by the crisis in Eastern Europe.

Ghana

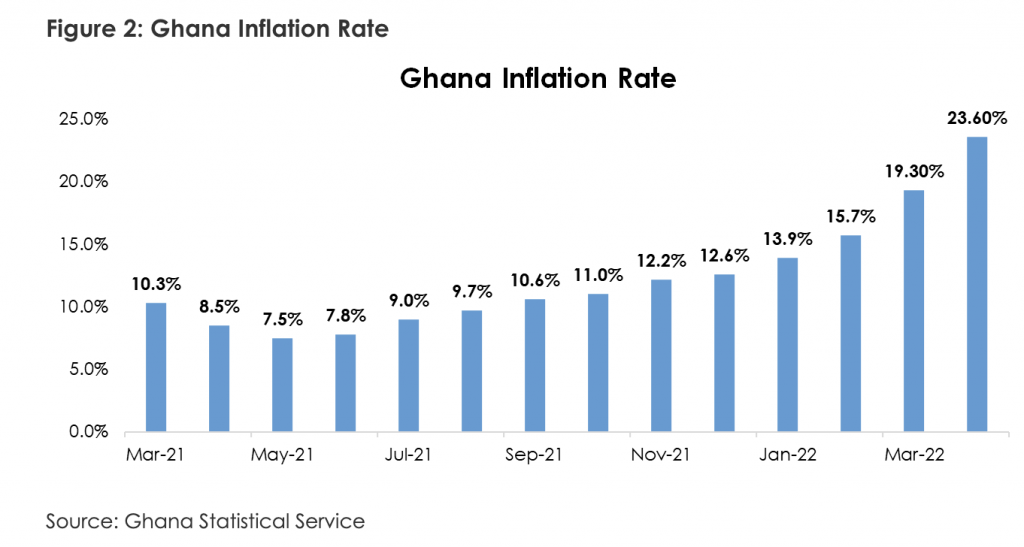

The Central Bank of Ghana hiked its benchmark interest rate by 200bps to 19% to curb inflationary pressures and promote its macroeconomic stability following April’s consumer inflation rate.

Ghana’s inflation rate climbed to the highest level in more than 18 years in April at 23.6%, from 19.4% in March. Headline inflation is now more than twice the top of the Central Bank’s target band of 6% to 10% and has been above the range for eight months. The persistent increase in the inflation level of the country represents a continuous decrease in the purchasing power of consumers and therefore a lower standard of living for citizens. Poverty index is at risk of increasing and the economic growth of the country is also affected. The increase in transportation and food prices can also lead to social unrest due to an increase in hardship level.

Zambia

The Zambian government will receive £1 billion from the British government over the next five years to help boost its investment in Zambia. According to the British high commissioner to Zambia, the British government will also help boost the finance for Zambia’s Small Medium Entrepreneurs (SMEs) by £100 million and increase investments in renewable energy by £500 million.

Burkina Faso

The government of Burkina Faso has announced that it will be providing 22 billion CFA francs ($35.4 million) worth of fertilizer to cotton farmers in the 2022-2023 season. This comes as the nation’s cotton industry faces pressure from the ongoing war in Ukraine. Burkina Faso’s cotton sector has come under pressure from severe headwinds stemming from the Russia-Ukraine war such as a fertilizer shortage crisis. The fertilizer shortage has made it much harder for farmers to source fertilizer for their cotton crops. Cotton is a major cash crop for Burkina Faso; the nation is the sixth-largest cotton exporter in the world. The government subsidies will allow Burkinabe farmers to source fertilizers at cheaper prices and lower production costs. The lower cost of production is expected to contribute to increased output, which will boost export earnings and government revenue in the nation.

Ivory Coast

After a meeting of the Council of Ministers on May 4th, a suspension of custom duties on wheat imports for 3 months was announced as part of efforts to control rising living costs in the country. The Economist Intelligence Unit (EIU) forecasts average inflation to rise to 5.5% in 2022, from 3.9% in 2021. Ivory Coast’s inflation stood at 4.9% y/y in Q1 2022. The removal of the wheat import duties will increase the supply of wheat into the country, as importers do not need to pay taxes to ship the crop into the country. The resulting increase in supply will also lead to lower prices of wheat in the country and therefore make the crop more accessible to both consumers and producers, especially for businesses that use wheat as a raw material input. Feeding cost is eased and will bring about a decrease in the inflation level. With the absence of the import duty, government revenue will decline depending on the level of the tax on wheat import. This can lead to a worsening of the country’s current deficit.

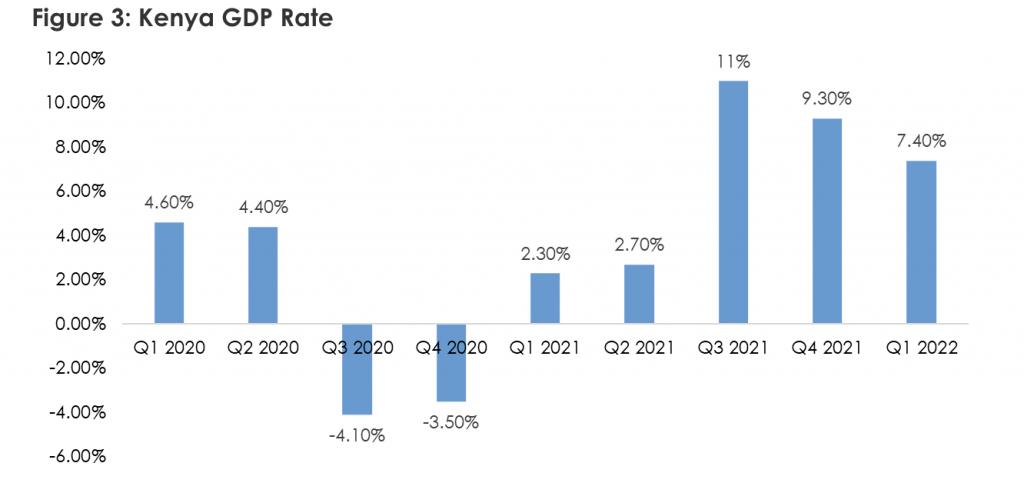

Kenya’s government still plans to raise a $1 billion Eurobond by the end of June. Kenya’s economy is struggling with a budget deficit equivalent to about 8.1% of gross domestic product in the year through June. A successful Eurobond sale by Kenya will provide the government with the needed funds to actualize its capital projects. The new Eurobond would also play a part in refinancing existing bonds as the government projects to have public debt at 55% of GDP by July from the current level of 65.6% of GDP. It is also expected to facilitate a reduction in the fiscal deficit to 6.2% of GDP from 8.1% currently. This would help quell investors’ concerns about the debt exposure of the country.

Kenya’s GDP grew by 7.5% in 2021, following a 0.3% contraction in 2020. This was the fastest growth since 2010 and represented a rebound from the pandemic induced contraction of the previous year. The positive growth trajectory of Kenya’s GDP implies that the nation is recovering from its worst economic contraction in several years. This is positive for investor confidence and will boost the country’s attractiveness to investors. However, growth is likely to be unsustainable in 2022 due to several foreign and domestic risks. Rising inflationary pressure due to the increase in prices for food and fuel because of the war in Ukraine is a major hindrance to Kenya’s growth prospects. Kenya has also been listed among countries on the verge of debt distress.

Democratic Republic of the Congo

According to the IMF, Democratic Republic of the Congo’s economy is forecasted to expand by more than 6% for a second consecutive year. This expansion will be supported by a booming mining industry amid the ongoing Ukraine crisis. The positive outlook of DR Congo’s growth will be mainly driven by the booming mining industry and higher energy prices. DR Congo is a major producer of copper and a major supplier of cobalt, a critical component of lithium-ion batteries, which power most electric vehicles.

The country’s favourable growth will increase the country’s attractiveness to more investors and firms. However, if the IMF approves DR Congo’s next disbursement in June, it will further boost the available revenue thereby increasing government spending which will lead to economic growth and development. SOURCE: UBA PLC