NGX All-Share Index extends losses declining by 0.13% to close at 49,475.42 points

In the last trading session of the week, the domestic bourse succumbed to sell pressure as the All-Share Index declined by 0.13% to close at 49,475.42 points the lowest since 22 August. Bearish sentiments in Tier-1 banking names, FBNH (-1.48%), STANBIC (-1.67%), ACCESSCORP (-5.14%) and UBA (-4.70%) were the sole drivers of the market plunge. However, having lost in four (4) of five (5) trading sessions this week, the ASI closed 0.44% lower w/w, extending losses for the second consecutive week.

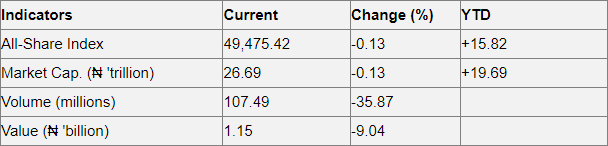

Over the course of the week, ZENITHBANK (-1.50% w/w), FBNH (-5.66% w/w) and STANBIC (-1.67% w/w) were the major drivers of the week’s loss. In addition, losses in ACCESSCORP (-6.21% w/w) following the Q2 results released contributed to the overall market decline. Consequently, the year-to-date (YTD) return dipped to 15.82%, while the market capitalization shed ₦118.50bn w/w to close at ₦26.69trn.

Analysis of today’s market activities showed trade turnover settled lower relative to the previous session, with the value of transactions decreasing by 9.04%. A total of 107.49m shares valued at ₦1.15bn were exchanged in 3,303 deals. FBNH (-1.48%) led the volume chart with 12.02m units traded while ZENITHBANK (+0.51%) led the value chart in deals worth ₦235.91m.

Market breadth closed negative at a 1.44-to-1 ratio with declining issues outnumbering the advancing ones. REGALINS (-7.41%) led twelve (12) others on the laggard’s log while NEM (+8.97%) topped eight (8) others on the leader’s table. Find below key highlights of market activities.