Nigerian stock market gains 0.19% on Friday but records biggest weekly loss in nearly 3 years

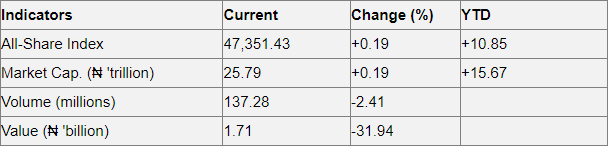

In today’s session, Nigerian equities ended their three-day losing streak, as the All-Share Index (ASI) closed 0.19% higher at 47,351.43 points. On market movers, a slight recovery in MTNN (+0.81%) and gains in INTBREW (+5.56%), ZENITHBANK (+1.30%), and UBA (+3.05%) underpinned the benchmark index’s positive performance.

However, declines in three (3) of the four (4) trading sessions this week culminated in a 3.30% w/w loss for the ASI, the most since the week ended 3 April 2020. The major drags on the index were selloffs in telecom heavyweights AIRTELAFRI (-10.00% w/w) and MTNN (-0.40% w/w) as well as steep declines in OKOMUOIL (-9.98% w/w) and PRESCO (-9.99% w/w). In addition, the Tier 1 banks ZENITHBANK (-2.25% w/w), GTCO (-4.23% w/w), FBNH (-2.94% w/w), STANBIC (-6.00% w/w), ACCESSCORP (-5.59% w/w) and UBA (-3.57% w/w) all faced an extended rout, most likely the continued fallout from the outcome of last week’s monetary policy meeting.

Consequently, the ASI’s year-to-date (YTD) return fell to 10.85%, while the market capitalisation slipped by ₦661.64bn w/w to close at ₦25.79trn.

Analysis of today’s market activities showed trade turnover settled lower relative to the previous session, with the value of transactions decreasing by 31.94%. A total of 137.28m units of shares valued at ₦1.71bn were exchanged in 3,845 deals. GTCO (+0.29%) led the volume and value charts with 33.79m units traded in deals worth ₦573.80m.

Market breadth closed negative at a 1.08-to-1 ratio, with declining issues outnumbering advancing ones. MAYBAKER (-9.78%) led thirteen (13) others on the laggard’s table, while FTNCOCOA (+7.14%) topped twelve (12) others on the gainer’s log. Find below key highlights of market activities