UNDP Nigeria launches SDG Investor Maps Initiative

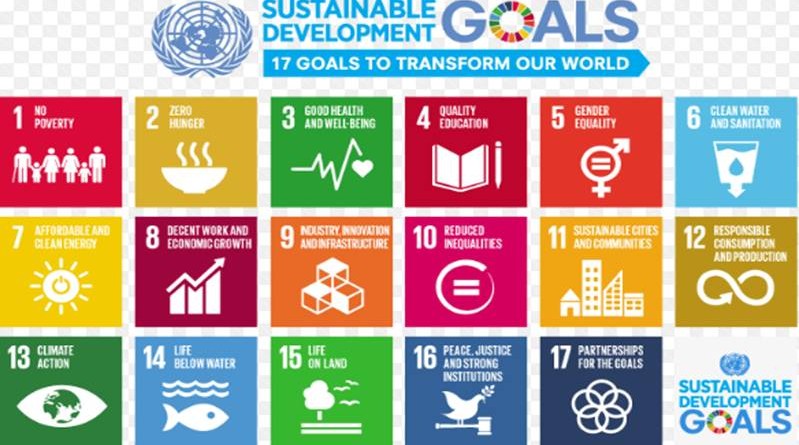

The United Nations Development Programme (UNDP) Nigeria launched the Sustainable Development Goals Investor Maps (SDG Investor Maps ) , as part of the Global UNDP SDG Impact Initiative, with the objective of driving greater and more diverse volume of capital to accelerate progress towards achieving the United Nations (UN) 2030 Sustainable Development Agenda.

The SDG Investor Maps is a digital tool that will provide market intelligence on investment opportunities and related impact data to identify and increase SDG-aligned actionable investments in Nigeria.

The 2030 Agenda for Sustainable Development articulates the UN’s universal call to action to end poverty, protect the planet and ensure that all people enjoy peace and prosperity, yet it is estimated that achieving the SDGs requires overcoming a critical financing gap of $5-7 trillion per year globally and an estimated $83trillion nationally in Nigeria. This will require a greater role for the private sector and significant transformation in how economic growth and investment opportunities are generated. Currently, the level of private sector investment that supports SDG achievement is low, with only a fraction of globally invested assets of banks, pension funds, insurers, and transnational corporations contributing to sustainable progress.

To ensure that key sectors, unaddressed priorities and investment opportunities are accurately identified in Nigeria, the involvement of governmental strategic actors, international development and financial institutions, as well as experts working in these areas are essential. The UNDP Nigeria is taking the lead to leverage its development expertise, local knowledge and presence on ground, to serve as a broker between the government and investors in realizing SDG targeted investments.

Developing an SDG Investor Map follows an 8-step methodology to identify the most appropriate business and investment opportunities aligned with the SDGs. The process involves extensive research as well as consultations and validation exercises with key stakeholders – domestic public stakeholders, international development and financial institutions as well as private sector actors.

In Nigeria, the process began with reviews to identify national policy priorities, critical sectors and subsectors as well as development needs across different subregions. These were then synthesized to derive at 21 specific Investment Opportunity Areas (IOAs) and business models relevant for each sector.