African Tech Hubs: Building a Conducive Setting for Innovators to Thrive by Afrilabs

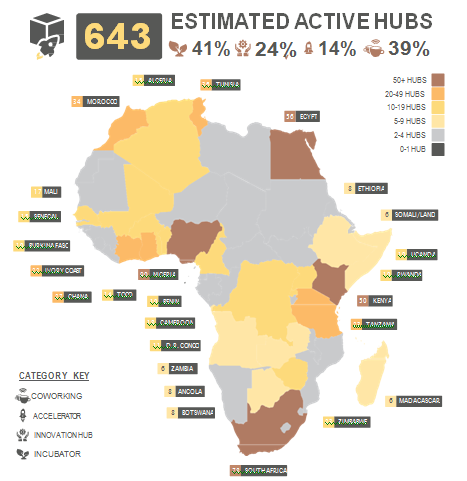

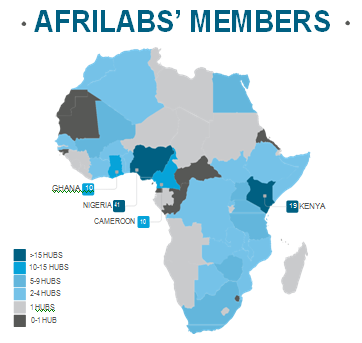

Last year, AfriLabs and Briter Bridges collaborated on a research project on the African Technology and Innovation Ecosystem, and one of the takeaways from that research was that they are currently 643 estimated active tech hubs in Africa.

Over the years, hubs have become major players in the growth of entrepreneurship on the continent and for Africa’s innovation economy to grow even bigger than it currently is, tech hubs have to clearly understand how to play their part today.

The role innovation hubs have been playing in catalysing the debate on technology across Africa over the past years has led more and more stakeholders, ranging from governments to the private sector, to further investigate the work these organisations do and the challeng- es they face in providing portfolio companies with the right type and degree of support, whilst also achieving financial sustainability. As of October 2019, the number of hubs identi- fied across Africa is 643, which includes coworking spaces, incubators, accelerators, and hybrid innovation hubs affiliated with government, universities, or corporates. It is important to note that around 25% of the total do not seem to offer any type of support to companies other than providing physical, o en shared facilities for entrepreneurs to work safely and hassle-free. The research also identifies over 110 hubs that have shut operations in the last few years due to bankruptcy, pivoting, or the expiration of their mandate.

The backbone of this study consists of the conversations and surveys with almost a hundred hubs across the continent about their business models, the support they provide to compa- nies, and the funding they receive from donors and partners. Identifying the types of respon- dents and their characteristics is important to set a conversation on the many roles innova- tion hubs play in their respective ecosystems and in the debate about the pathways to start- up success. Due to the geographical distribution and the high diversity of the respondents, the responses could be used to identify general trends in the life of the typical hub in Africa.

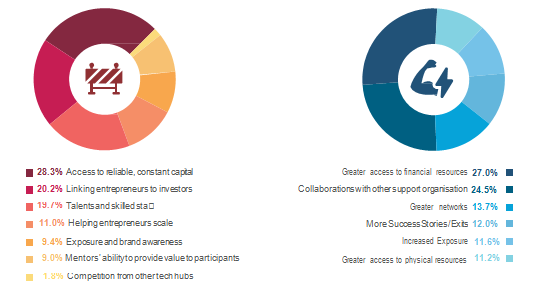

The findings suggest that hubs are o en to be identified as safe spaces for young innovators, rather than necessarily venture builders – e.g. organisations able to drive their portfolio com- panies on a direct path to scale – and the data show how such hubs are o en involved in a variety of initiatives that concur to promote the creation of a conducive ecosystem where entrepreneurs and other stakeholders can collaborate and promote their ideas. Insights from hub managers also suggest that greater financial support and collaboration within the ecosystem are vital success factors for hubs to effeciently and sustainably deliver their services.

AFRICA’S INNOVATION HUBS

At least 643 hubs, which include coworking spaces, incubators, accelerators, hybrid hubs with affiliations to universities and/or governments, as well as maker spaces and technology parks, were identified as of October 2019 across 50+ African countries. 25% of these hubs only offer coworking facilities and no specific business support pro- gramme for startups and entrepreneurs, but the majority – almost 500 of the hubs – provi- de some degree of in-kind or cash support.

ESTIMATED ACTIVE HUBS IN AFRICA

SURVEY FINDINGS

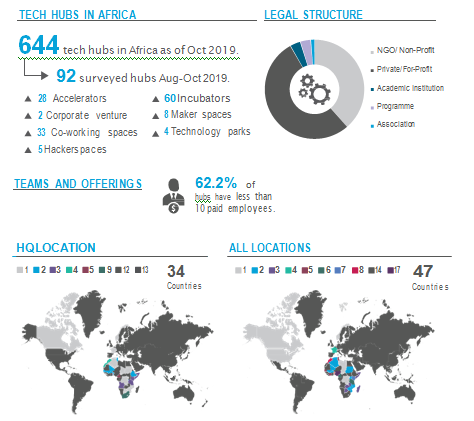

The survey was submitted to over 600 hub managers based on Briter Bridges’ latest data on innovation hubs in Africa. The pool of respondents differ by type, legal structure, location, and support criteria such as sectors of preference. 92 responses represent 15% of the total number of identified, eligible, organisations.

The respondents were split between private, for profit organisations and a mix of non-profit, academic institutions, programmes and associations, and were distributed across 34 countries.

BUSINESS MODELS OF HUBS IN AFRICA

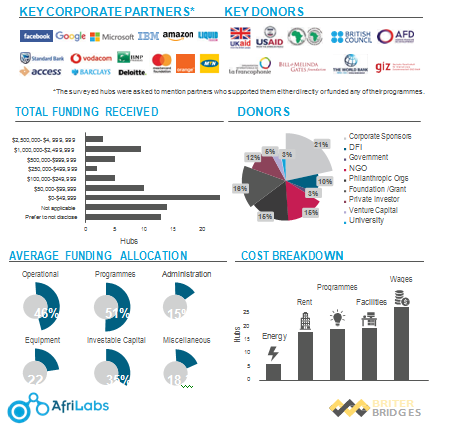

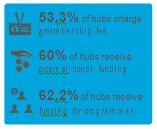

Because almost half of the existing hubs consist of non profit organisations or donor-funded organisations, the discussion around financing received and the allocation of funds has been crucial. 60% of all respondents claimed to receive external funding and, among the donors, corporate sponsors, philantropic organisations, and NGOs have proven to be the most active funders.

The majority of hubs surveyed claimed to have received less than $100,000 in funding from various sources. Several hubs establish strategic affiliations with corporates, which o en include a degree of asset sharing such as cloud, servers, optic fiber, and the like. Sev- eral hubs also partner with their local government or international subsidiaries to get sup- port for their activities. According to the surveyed hubs, the majority of funding received is largely used to cover operational costs and programmes. Wages and facilities still pres- ent the highest costs on average, whilst energy and rent-related costs vary respectively depending on whether the hubs are located in areas with unreliable access to electricity or in costly neighbourhoods.

REVENUE STREAMS

The survey highlights that hubs adopt 3 main revenue streams: 1) a membership fee to use facilities; 2) donor funding to both sustain operations and run startup support programmes; 3) consulting, which was identified as the largest additional revenue stream by 40% of the hubs. Such consulting o en takes the form of innovation-related research and programme implementation for specific donors. In addition, hubs with enough space capacity charge rent for events, while others offer paid training or partnership fees.

STARTUP SUPPORT BY HUBS IN AFRICA

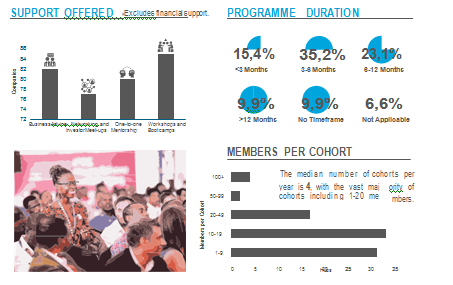

Hubs typically offer two types of support: 1) In-kind, which includes trainings, advice, and facilities; 2) financial support through programmes. Among the respondents, 94% (6 respondents le the answer blank) run startup programmes as part of their business and, among these, the most common programmes last 3-6 (35%) and 6-12 months (23%). In-kind support comes in the form of one-to-one mentorship or through workshops and bootcamps.

CRITERIA

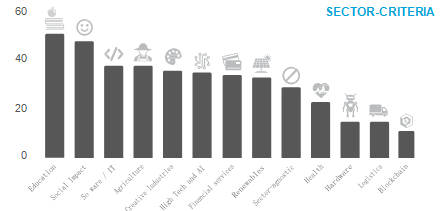

Due to the size of the ecosystem, hubs have historically been sector-agnostic organisations, providing generic business support to entrepreneurs and a promoting a conducive environ- ment. Recently, the need to tailor the type of support provided and the inefficiency of offering generic assistance to startups has led to an increase in specialisations. Sectors that tend to deliver high social impact, such as education and agriculture, are among the most selected among the survey respondents

IMPACT INDICATORS

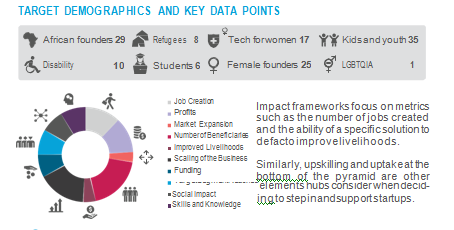

An increasing emphasis is being put on the socio-economic impact generated by the compa- nies supported by each hub. This has pushed for the creation of impact frameworks and the identification of ‘preferred’ addressable demographics such as female founders, refugees, and people with disabilities. Out of the 92 hub managers who took part in the survey, one third focus on supporting African founders, 40% to support kids and youth, and 27% women founders.

TARGET DEMOGRAPHICS AND KEY DATA POINTS

STARTUP FUNDING BY HUBS IN AFRICA

The fact that only 40% of the surveyed hubs offers funding to startups denotes the high diversity in the type of support that such organisations provide. Equity investment (30%) remains the most common type of funding although, as explained, hubs are o en endowed with donor or sponsor money which is used for funding – o en through competitions or at the end of an incubator or an accelerator programme. This type of cash injections are typically in the form of grants or non-equity (23% and 13%). One fi h of funding is also in-kind and it is not uncommon to see mixed funding round including in-kind and equity investment. Finally, a small proportion includes debt financing (12%).

MAJOR ALLIANCES

A growing trend across Africa has been the rise of networks and alliances, as hubs and ecosys- tem builders join forces to share and adopt best practices, avoid repetitions, and increase the exposure of their respective ecosystems. 95% of the respondents is part of a network or alliance and he map below outlines some of the predominant alliances across the continent.

CHALLENGES VS SUCCESS STRATEGIES

The study counts over 110 hubs that have shut down operations over the past half decade. This is due to an uncertainty around sustainability and business models that are partially dependent on external donors.

Access to funding is considered to be the primary challenge holding back the ecosystem and, as a consequence, the scope for connecting companies with investors or providing them with a clear pathway to fundraising, is limited. In addition, the lack of experienced staff able to effective provide value to founders is an increasingly recognised factor preventing hubs from taking a more central role in setting companies on a sound path to growth.

In the past few years, hubs seem to have – somewhat mistakenly – become the proxy to address the totality of the ecosystems they belong to. This has caused many to attribute to these hubs a role and a duty that has o en proven to be problematic. In this sense, whilst hubs have had fingers pointed at them for not living up to the expectations of several entre- preneurs, who were hoping to scale as a consequence of their involvement with such hubs. This has led to a shi in responsibilities from civil society, private sector, and the government to these hubs, which have found themselves being tasked with unlocking opportunities that can be out of their scope.

The lack of enough success stories and adequate track record that would enable bench- marking and to identify best practices, remains a problem for any African ecosystem. Hubs across the continent are now on a quest to establish partnerships and knowledge transfer networks and collaborate to avoid unnecessary costs and provide the organisations they support with the right resources.

HUB GLOSSARY

HUB

A hub is a centre, structure or network comprising of all actors supporting entrepreneurial ventures or innovation. Cities are also o en defined as hubs when they represent important nodes for business and invesment.

ACCELERATOR

An accelerator is a structure that offers cohort-based and fixed term programmes (usually between 3-6-9 months) to support growth stage ventures to achieve scalability and self-sufficiency, through offering advisory services, mentorship, workshops, networks and usually investments in cash or in-kind.

COWORKING SPACE

A co-working space is a shared physical workspace that provides office facilities and a community to startups, small companies and independent workers – offering reasonable and flexible contracts for its users and encouraging peer-learning, networking, capacity development, and collaboration.

ECOSYSTEM

An ecosystem is a dynamic framework consisting of a set of stakeholders – startups, hubs, investors, academic institutions, public institutions, corporations – who interact and engage with each other to seize new opportunities, support innovation and strengthen the overall business environment for entities at different stages, sectors, and geographical locations.

HACKATHON

A hackathon is a tech-focused event taking place across a set timeframe which can usually span between one day to a week, and that gathers specialists in computer programming, digital creation, technology or so ware development to collaborate on specific ideas or concepts to find solutions to a problem or to design, develop and create MVPs.

HACKERSPACE AND MAKERSPACE

A makerspace is a physical facility or lab fitted with machinery, technological tools and other equip- ment to help communities and individuals co-create and explore ideas, create prototypes and test products, as well as develop technical skills and knowledge.

INCUBATOR

An incubator is a support structure that helps early-stage start-ups transform from idea to venture, by offering advisory services, resources, workshops and hands-on training that guide entrepreneurs in defining and refining their business models and value propositions with the goal of becoming sustain- able businesses. They sometimes have a limited pool of cash to support the portfolio companies.

INNOVATION HUB

An innovation hub is a centre for learning, ideas, co-creation and community, that nurtures innovative ideas and market disruption, and supports creative ways of solving problems through offering on-the ground support across the entirety of the start-up lifecycle.

PORTFOLIO

A portfolio is a collection of individuals or organisations that either are part of/have successfully com- pleted a hub programme or are beneficiaries of direct or indirect investment by an investor or fund.

CONCLUSION

As their number grows as a symptom of the overall expansion of technology ecosystems across Africa, innovation hubs, which have been considered as a proxy for the state of play in each respective ecosystem, and which have functioned as a catalyst for external funding and media coverage, are increasingly called out in virtue of their role as nodes for the entrepre- neurial and investment community to seize the opportunity to drive the debate on innovation forward.

This implies consolidating their offerings and monitoring results, striving to achieve financial sustainability, and collaborating with peer organisations across the continent in order to adopt best practices and share learnings.

In addition, the availability of data and information about the type of support hubs offer is making it possible to broaden the conversation beyond the mere Silicon Valley model and the search for “unicorns” in favour of understanding the more holistic role hubs play promot- ing cohesion and dialogue among peers and stakeholders.

SOURCE: BUILDING A CONDUCIVE SETTING FOR INNOVATORS

TO THRIVE: A QUALITATIVE AND QUANTITATIVE STUDY OF A HUNDRED HUBS ACROSS AFRICA. October 2019 BY AFRILABS AND BRITER BRIDGES