APPLY NOW for the Federal Government N150b Loan To MSMEs and Manufacturing Sector as FGN begins process of Disbursement

The loan disbursement process for micro, small, and medium enterprises (MSME) and the manufacturing sectors under the Presidential N200 billion Intervention Fund scheme will soon commence, according to the Federal Government. This scheme, launched by President Bola Tinubu on October 17, 2023, aims to mitigate the impact of the removal of petrol subsidy and other economic shocks.

In a statement, Minister of Industry, Trade and Investment, Doris Uzoka-Anite, announced the disbursement of funds, highlighting the success of the ongoing disbursements that have supported one million nano businesses across the country. Under the Presidential Intervention Fund, N75 billion has been allocated to support MSMEs, N75 billion to the manufacturing sector, and an additional N50 billion to support nano businesses.

MSMEs in Nigeria will receive up to N1m with manufacturers set to get up to N1bn. According to the Minister, National Identification Number (NIN) is a major requirement for the Federal Government Grants and Loans Scheme. “Loan applicants who have already filled the form should simply log in and update their loan application with their NIN,” Uzoka-Anite stated. Those who have not are advised to go to the official website www.fedgrantandloan.gov.ng and complete the loan application

Uzoka-Anite expressed the pride of the Federal Government in launching the MSME and Manufacturing segment of the Presidential N200 Billion Intervention Fund. She emphasized that the loan disbursement process for the MSME and manufacturing sectors will contribute to economic growth and industrial development.

The initial disbursement to nano businesses has already been successful, with thousands of beneficiaries confirming receipt and many more expected to benefit. Eligible enterprises are invited to join this transformative initiative by applying through the official application portal at www.fedgrantandloan.gov.ng. “Additionally, applicants seeking more information should visit the Bank of Industry (BoI) branch in their State.”

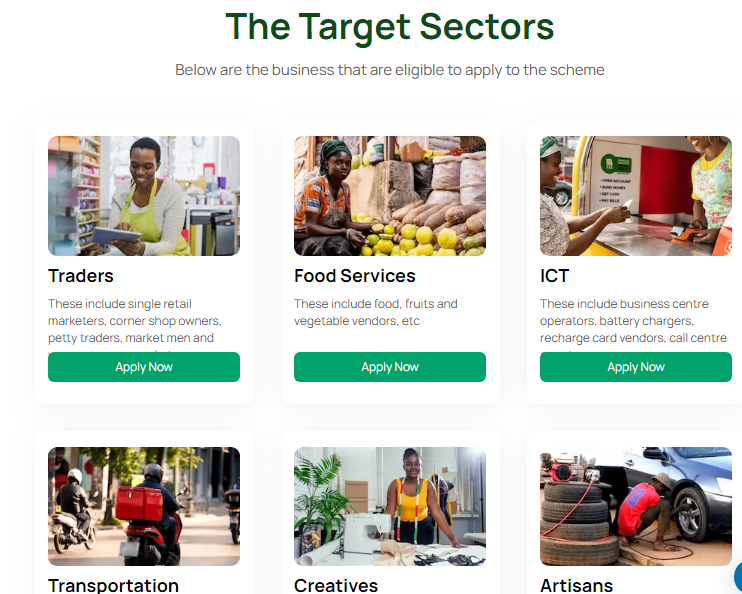

Target Sectors

- Traders

- Food Services

- ICT

- Transportation

- Creatives

- Artisans

- Manufacturing

Loan Eligibility Criteria

Loan up to 1M for MSMEs

- A) Eligibility Criteria

- Existing business must be in operation for one (1) year,

- Start-ups must be a registered business

- Provide CAC business registration documents.

- Company’s Bank Statement(s) for a period of one (1) year (for existing business)/ Chief Promoter’s (Director or Business owner) Bank Statement(s) for a period of one (1) year (for startups).

- Have required monthly turnover and other things as may be requested by the bank.

- B) Security

- Personal Guarantee of the promoter

- Acceptance of BVN Covenant (Global Standing Instruction- GSI), and any other thing that may be required by the bank

- C) Repayment Frequency

- Monthly equal installment (no moratorium) over a period of 3 years

Manufacturers up to N1billion (Working Capital or Asset Financing)

- A) Eligibility Criteria

- At least 6months business/ corporate banking relationship

- Provide CAC business registration documents

- 12 months bank statement for other bank

- Other documentations that may be required by the bank.

- B) Security

- As may be required by the bank

- C) Repayment term:

- i) Asset Financing

- 6 Months moratorium on principal and interest, 5 years repayment period for asset financing only

- ii) Working Capital Financing

- 12months equal installment of principal and interest

- i) Asset Financing

APPLY NOW for the Federal Government N150b Loan To MSMEs and Manufacturing Sector

- Loan applicants who have already filled the form should simply log in www.fedgrantandloan.gov.ng and update their loan application with their NIN,”

- Those who have not are advised to go to the official website www.fedgrantandloan.gov.ng and complete the loan application

- Applicants seeking more information should visit the Bank of Industry (BoI) branch in their State

- National Identification Number (NIN) is a major requirement for the Federal Government Grants and Loans Scheme