Everything you need to know about WeChat, China’s billion-user messaging app – CNBC

WeChat is China’s most popular messaging app with a monthly user base of more than 1 billion people.

But it’s unlikely that you would have used it if you live outside China. It is owned by Tencent, one of Asia’s largest companies by market cap. While it started out as a messaging service, it has transformed into an app where you can do everything from payments to hailing a ride, or even booking flights.

It’s a very different prospect to the likes of Facebook‘s Messenger or WhatsApp.

Here’s a rundown of what WeChat is and how it works.

Messaging

One of the primary uses of WeChat is messaging. Just like WhatsApp, you have a list of conversations that you’re engaged in.

You can add people in a variety of ways.

When people exchange contact details in China, you often see one person scanning the other person’s phone. Each WeChat user has a unique barcode known as a QR code. One person can scan the other user’s QR code to add them to WeChat. You can also use a phone number or ID to add a person and search for people nearby.

WeChat is one of the main ways people communicate in China. Even when doing business, people prefer WeChat to email. It’s even more prevalent because services like Facebook are blocked here.

There is also a social feature called “Moments.” Users can upload a number of images or videos and their friends can comment or like the post.

From major supermarkets to the smallest of street vendors and taxis, you can pay for things with WeChat almost anywhere in China.

As long as you have a Chinese bank account, you can link that to WeChat.

There are two ways to pay for something via the app. Firstly, the store can scan your unique WeChat barcode, which looks like the image below.

Secondly, you could scan the barcode of the merchant you are buying items or services from, as seen in the picture below.

If you’re buying something online in China, there will be an option to purchase with WeChat Pay. You will need to put in a passcode or use a biometric authentication tool to authorize the transaction.

Instant money transfers to your WeChat contacts can also be made via the messaging function, which makes it easy to split bills or just move money around China. It is possible to be nearly cashless in China and actually go out for the day without a wallet.

The main rival to WeChat Pay is Alipay, owned by Alibaba affiliate Ant Financial.

Mini-programs

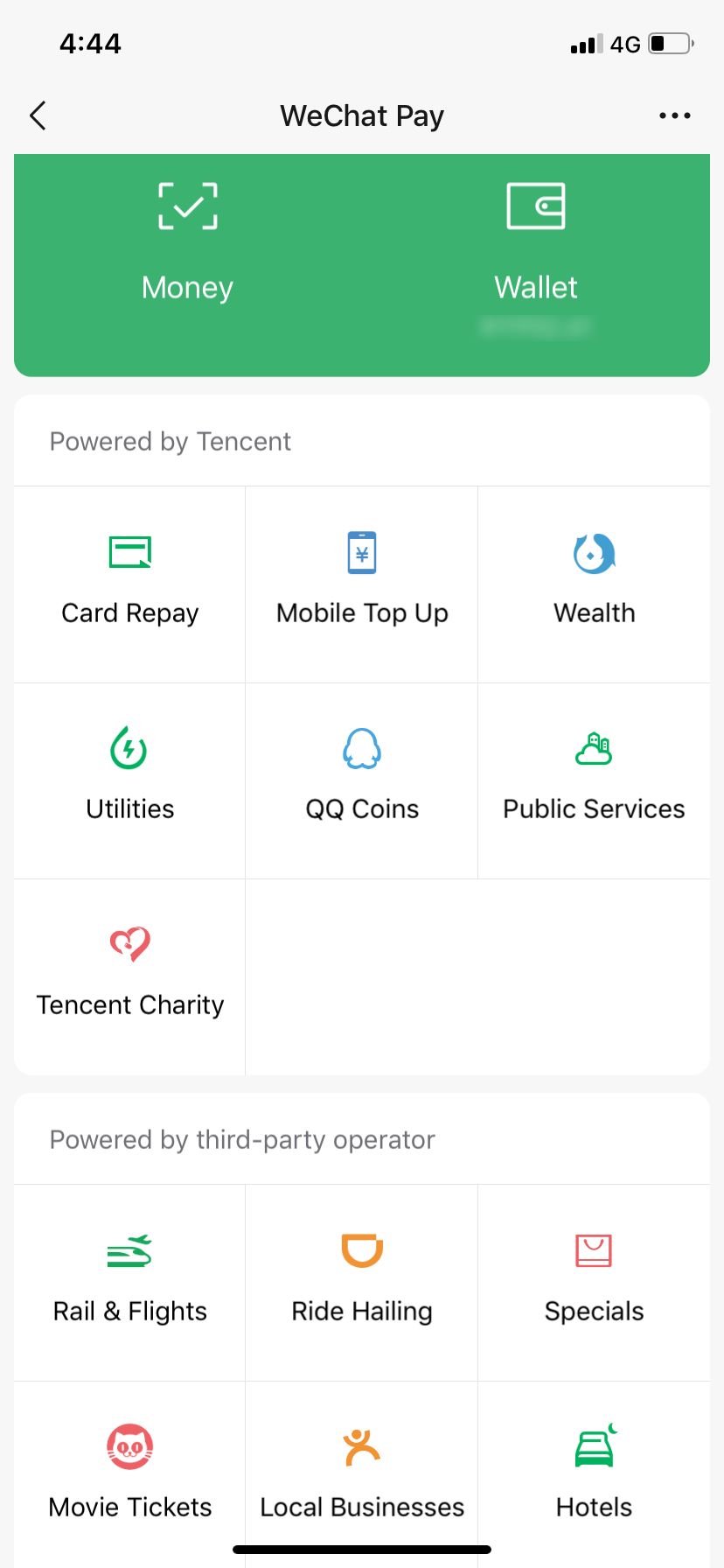

WeChat and Alipay have often been described as “super apps” because everything is integrated within one service. Instead of having one app for banking and another for ride-hailing, a lot of these are built directly into WeChat so that the app becomes a one-stop shop for its users.

Companies may choose to launch mini-programs — or apps within WeChat — instead of a standalone app. The program allows businesses to send promotional messages directly to the user via WeChat, as well as tap into the app’s user base of more than one billion.

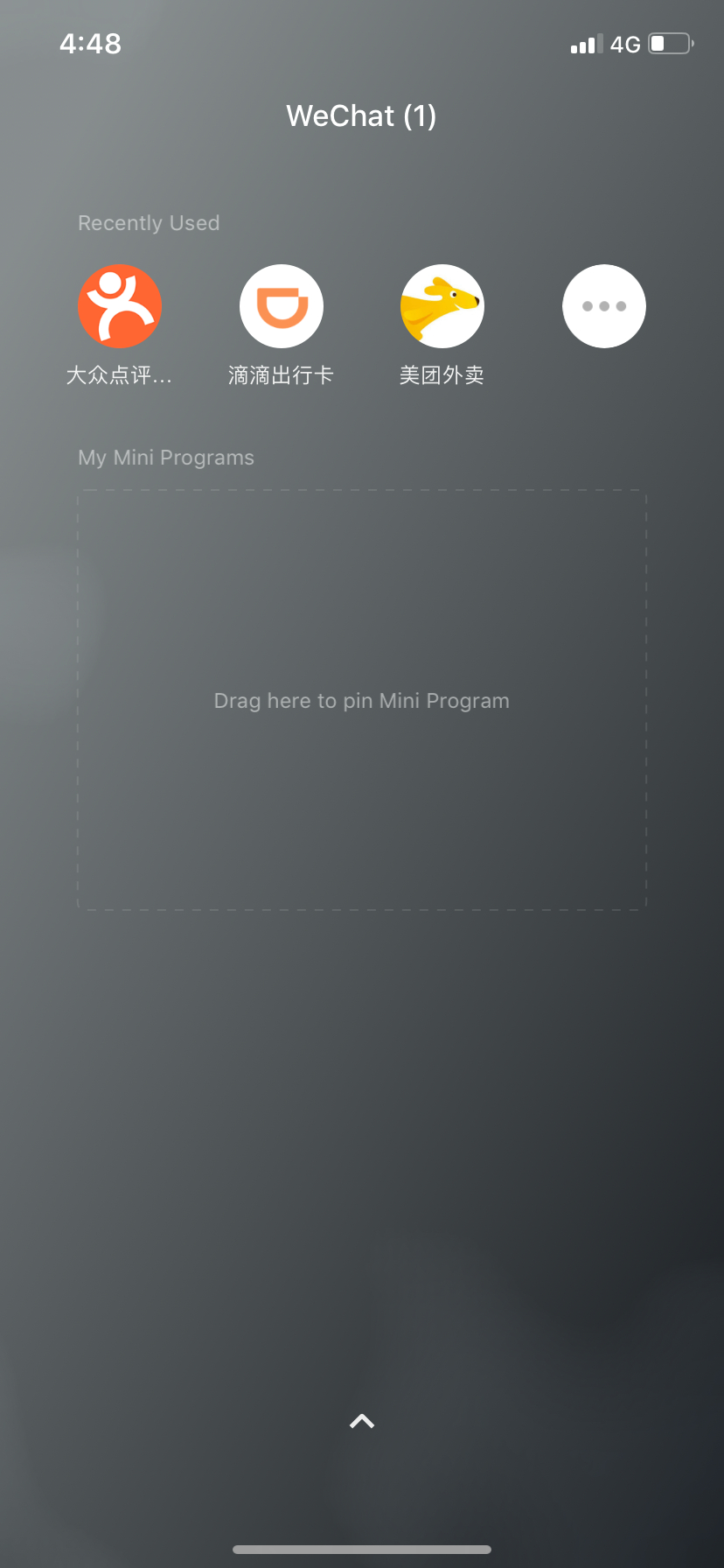

Mini-programs have become more prominent in the app, as WeChat makes a bigger push toward becoming a one-stop shop. Tencent recently updated the app so that the mini-programs feature now has its own page.

In the above image, you can see Dianping, a Chinese app that lets you see ratings for local restaurants and services, ride-hailing firm DiDi, and food-delivery service Meituan. You can use all of these services within WeChat and make payments without ever leaving the app. In this way, WeChat becomes like an app store as it tries to keep users connected to its ecosystem.

Games and top-up

There are several other things you can do via WeChat including wealth management and topping up your mobile phone.

You can also play games within WeChat. Games are extremely important for Tencent and accounted for around 32 percent of total revenue in the third quarter of 2018.

– SOURCE: CNBC