Inflationary pressures in Nigeria not yet abating – Coronation Economic Note

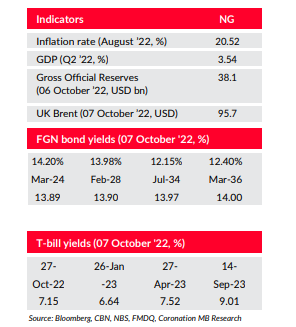

Over the past 18 months, the headline inflation has recorded upticks on a y/y basis. The headline inflation is currently at 20.5% y/y, it remains well above the CBN’s single-digit target, eroding consumers’ purchasing power. This year the highest increase in the headline measure has been 105bps in July while June and August registered rises of 89bps and 88bps respectively. Food inflation has been the primary driver of acceleration in the headline rate. Supply-side constraints which have worsened due to the Russia-Ukraine crisis are partly to blame.

Food inflation has been on the rise since the closure of the country’s land borders in August ’19. Although a slight slowdown was recorded in mid-2021, food inflation is still significantly higher than pre-pandemic levels. The National Bureau of Statistics’ (NBS) selected food price watch report for August recorded y/y increases in the prices of 41 out of the 43 food items surveyed. The rise in food prices is partly due to supply bottlenecks, stemming from persisting security challenges, especially in major food producing regions of the country.

Meanwhile, the price of imported food (which accounts for 13.3% of the basket) has been relatively stable, rising m/m between 1.20% and 1.34% since January ‘19. This is despite challenges in accessing fx, supported by anecdotal evidence suggesting that importers meet some of their fx needs via the parallel market. Based on our channel checks, in the parallel market, the Naira closed at an average of N735/USD on Friday (30 September ‘22).

The latest NBS inflation report reveals that the transport segment, which accounts for 6.5% of the basket, posted price increases of 1.64% m/m and 18.24% y/y in August, compared with 1.64% m/m and 17.58% y/y recorded in July. The transport segment is directly impacted by the price of Premium Motor Spirit (PMS, or gasoline).

The price increases recorded in the health segment were 1.4% m/m and 15.3% y/y in May. Pharmaceuticals and medical services have repeatedly featured as leading drivers of core inflation.

Inflation and consumer sentiment share an inverted relationship; as inflation rises, consumer confidence often declines. Consumers are allocating a higher share of wallet to goods and services that meet basic needs. Nigeria’s hospitality industry is directly impacted by rising food inflation and consumption patterns. In August, price increases of 1.3% m/m and 15.8% y/y were recorded in restaurants and hotels segment.

Inflationary pressures are expected to persist in the coming months. For end-year, we expect the headline inflation to increase by at least 213bps from 20.5% recorded in August ‘22. Furthermore, the CBN’s in-house estimates suggest that inflation is expected to remain considerably high, partly due to the build-up of increased spending related to the 2023 general elections. SOURCE: Coronation economic notes by Coronation Merchant Bank