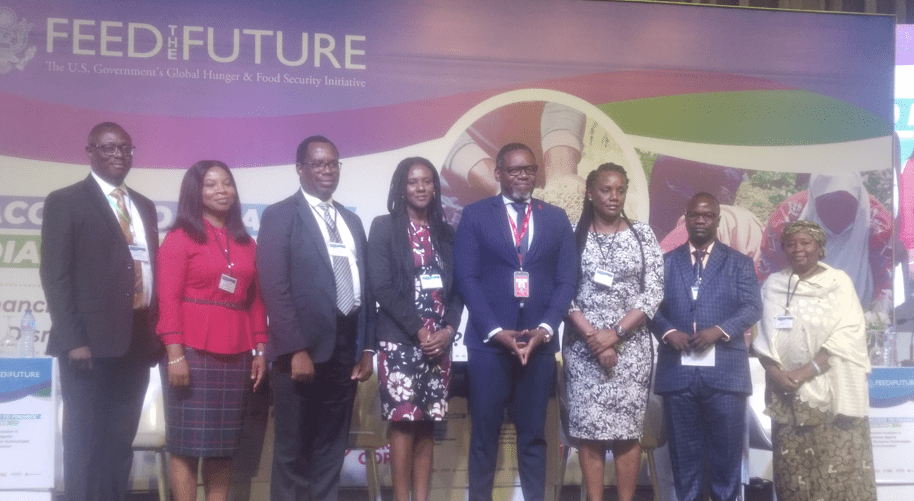

Mercy Corps Nigeria holds Access to finance Dialogue with Stakeholder and Experts – Chimaobi Agwu

Mercy Corps has held the access to finance dialogue, a one day round table dialogue to discuss and chart a way forward on improving access to finance for the poor, conflict affected and vulnerable communities in the Northeast.

The dialogue was aimed at achieving the objectives of :

- Present evidence of the diagnosis of the financial services sector to identity bottlenecks faced by farmers and MSMEs in accessing finance in the North East

- Showcase efforts of commercial and public sector institutions who are contributing to improving access to finance for smallholder farmers and microenterprise owners in the Northeast

- Showcase efforts of the Rural Resilience Activity in improving access to finance through strategic partnerships with Financial Services Providers

- Showcase the potential of the Northeast market systems, with a view to attracting new financial services providers and encouraging existing ones to invest in the financial services sector

- Provide stakeholders with insights and evidence based learning to improve access to finance in the Northeast and at the national levels.

The dialogue was attended by Efina, Kipa, Pula, FCMB, Sterling Bank, CBN, Nirsal, Federal Ninistry of Budget and National Planning, Center for Microenterprise Development, Deva Access and Empowerment Intl Ltd/Gtee, Lapo Microfinance Bank Limited, Standard Microfinance Bank Limited, Jewel Entrepreneurial and Business School, Angala Fintech, MotherHen Development Foundation, Royal Exchange Assurance, Nigerian Agricultural Insurance Corporation and a host other private sector organizations and farmers from the Northeast.

Mercy Corps are implementers of Feed the Future Rural Resilience Activity in Nigeria sponsored by USAID. The Feed the Future Rural Resilience Activity envisions a financial sector in which financial service providers are better equipped with the capacity to develop and deliver financial products and services that serve the needs of poor and underserved communities in the Northeast.

This is being done through effective and efficient mechanisms that enhance the potential of households, smallholder farmers and MSMEs to access useful and affordable financial products and services – transactions, payments, savings, credit, insurance and pensions delivered in a secured, responsive and sustainable method that meets their individual and business goals. The activity sees financial service as an essential ingredient in reducing poverty and achieving inclusive economic growth in Northeast Nigeria..