#NairaDevaluation: CBN quietly adopts a new and devalued Naira exchange Rate

The Central Bank of Nigeria (CBN) seem to have quietly devalued Naira going by the new exchange rate displayed on its website cbn.gov.ng.

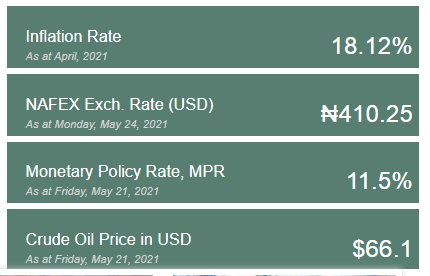

The displayed rate which quotes the rate as at Monday May 24, is the NAFEX exchange rate otherwise called the Investors and Exporters (I&E) window at N410.25/$ as against the hitherto fixed rate of N379 to the dollar used for official transactions

NAFEX is the Nigerian Autonomous Foreign Exchange rate. It is the Financial Markets Dealers Quotations Over The Counter (FMDQ OTC) reference rate for foreign exchange (“FX”) activities in the Investors’ & Exporters’ FX Window and is designed to represent Spot FX market rates in the Window.

The NAFEX window was created pursuant to the Central Bank of Nigeria (“CBN”) circular dated April 21, 2017 (Ref:FMD/DIRCIR/GEN/08/007) and titled Establishment of Investors’ & Exporters’ FX Window which provides in clause 4.0 that in order to support appropriate benchmarking and facilitate derivatives activities in the newly established Investors’ & Exporters’ FX Window (the “Window”), FMDQ OTC Securities Exchange (“FMDQ”) will be developing and publishing a new fixing called NAFEX – the Nigerian Autonomous Foreign Exchange Rate Fixing.

It was meant to improve dollar liquidity and encourage inflows from foreign investors that were exiting the country following the 2016 economic crisis.

This silent move means the CBN has weakened the naira by 7.6% against the dollar on the official forex window. Invariably, all exchange rate transactions involving the public and the private sector will now reference the prevailing NAFEX rate as its official exchange rate.

The Nafex rate has hovered between 408 and 412 for months, a significant fall from the 379 the CBN listed as the exchange rate on its website.

CBN Governor, Mr. Godwin Emefiele, had said last year that the apex bank will pursue exchange rate unification around the I&E window rate.

The CBN had adopted a multiple exchange rate regime to avoid an outright devaluation of the naira. It will be recalled that in March, the apex bank denied devaluing the Naira desite admissions by the Minister of Finance that the government had adopted the Nafex rate. The CBN governor had said that the bank still maintaining the “official rate” of N379, while the Nafex rate of N410 was adopted for certain government businesses. According to him, the CBN was operating a “managed float” policy, which allows it to watch market dynamics and intervene in the market whenever necessary.

NAFEX rates are determined by the FMDQ after pooling together rate submitted by the 10 contributing banks who bid for forex on behalf of their clients.

“NAFEX is a polled rate based on the submissions of ten (10) contributing banks and calculated using a trimmed arithmetic mean. Upon receipt of quotes, the individual contributing banks’ submission is ranked in descending order. The lowest and highest two (2) quotes are eliminated from the ranked rates leaving only the middle six (6) rates. The arithmetic mean of the remaining rates are then calculated to two (2) decimal places and disseminated as the NAFEX Spot Rate.”

The NAFEX market oerates independent of the government but the CBN as a major forex supplier can influence the rate