Nigeria’s GDP Report: Shrinking oil economy leads to reduced GDP growth in Q3

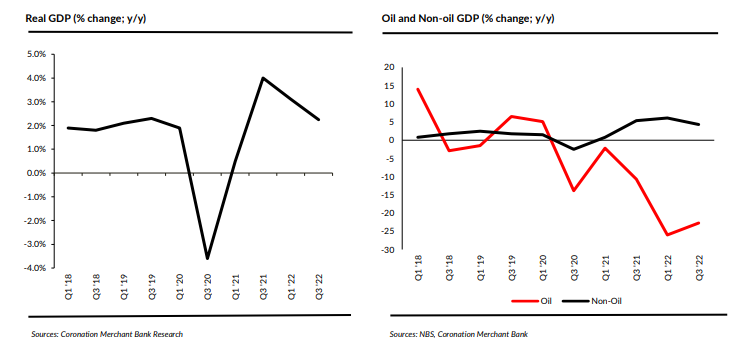

According to the National Bureau of Statistics’ (NBS) most recent national accounts, the GDP increased by 2.3% y/y in Q3 of 22 as opposed to 3.5% y/y in Q2 of 22. In contrast, on a quarter-over-quarter basis, it expanded by 9.7%, indicating greater economic activity as compared to the q/q decrease of -0.4% seen in the previous quarter. Base effects, the trickle-down impact of the Russian-Ukrainian crisis on the prices of deregulated petroleum products (such as diesel and aviation fuel), specific manufacturing inputs, and the impact of recent monetary policy rate hikes intended to combat high inflation are all possible explanations for the y/y moderation in growth. In Q3, the oil economy shrank by -22.7% y/y, compared to -11.8% y/y in Q2. The non-oil economy gained 4.3% in the meantime, the non-oil economy grew 4.3% y/y in Q3 ’22 compared with 4.8% y/y in Q2 ‘22.

The oil economy has shrunk by an average of 13.4% y/y during the last ten quarters. We observe that Bonny light fell by -27.2% q/q, closing at USD92.4/b at the end of September 22 from USD126.9/b at the end of June 22. The situation in Russia and Ukraine, as well as the relatively low supply, continue to have an impact on oil prices. But the ongoing COVID-19 lockdowns in China and worries about sluggish development in some advanced nations continue to put downward pressure on oil prices. The most recent monthly OPEC data indicates that production in October 22 averaged 40.4 mbpd. This falls short of the OPEC target for October of 43.9 mbpd. The price of Bonny Light was USD 87.4/b as of 24 November 22.

According to NBS data, average crude oil production in Q3 was 1.20 mbpd (condensates included), down from 1.57 mbpd in Q2 ’21 and 1.43 mbpd in Q3 ’20. This is less below the 1.8 mbpd OPEC output target for Nigeria and the 1.6 mbpd FGN production target.

Information from the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) shows that various ports, including the Bonny (-86.2% y/y), Brass (-79.6% y/y), Forcados (-66.3% y/y), and Escavros (-3.3% y/y), saw a reduction in crude oil production in Q3 of 22 (condensates included). Shutdowns brought on by crude oil theft, vandalism, lengthy repairs, employees’ strikes, low investment, and inadequate infrastructure are to blame for the fall in oil production. The underperformance was also impacted by international oil firms selling off their onshore properties. In Q3 ’22, the oil industry contributed 5.7% of the total GDP.

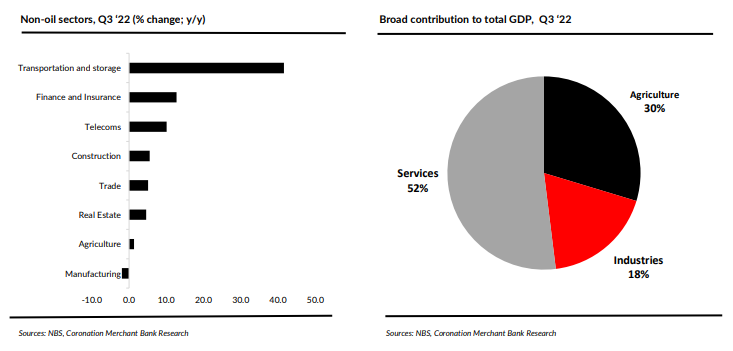

Agriculture experienced a 1.3% year-over-year growth in the non-oil sector in Q3 compared to the 1.2% year-over-year growth seen in Q2. In Q3 ’22, agriculture made up 23.2% of the overall GDP. The effectiveness of CBN-led initiatives in the industry may be a factor in how well it performs.

As of October 22, the CBN’s Anchor Borrowers’ Program (APB) had disbursed a total of approximately N1.1 trillion. The money was given to roughly 4.6 million smallholder farmers nationwide who were growing 21 different crops. The major engine of agricultural sector growth continues to be crop output. The sector increased by 1.3% y/y and made up 93% of the agricultural GDP.

In addition, the cattle, forestry, and fisheries segments all experienced growth of 1.6%, 2.2%, and 0.4% y/y, respectively. Since its start in 2009, N745.3 billion has been distributed through the Commercial Agriculture Credit Scheme (CACS) for at least 680 agro-processing and production projects. It is important to note that the massive informal economy, which is believed to make up around 50% of the economy, is partially responsible for the mismatch between the growth figures recorded in this sector and intervention attempts. Other difficulties include high input costs, security issues, lack of technology, storage and transportation problems, as well as adverse weather.

Smallholders and nomadic herders continue to dominate the livestock industry. Formal private firms are still relatively few in this market but are expanding, especially in the poultry subsegment. But given the high price of feed (particularly maize and wheat), demand is anticipated to be weak in the near future. This market also has issues with low breed quality, subpar animal husbandry techniques, restricted access to quality input and funding, inadequate animal health and extension service delivery, herder-farmer conflicts, livestock rustling, banditry, and other issues. In an effort to track down animals, stop cattle rustling, and stop conflicts between farmers and herders, the FGN introduced the National Animal Identification and Traceability System in November 22. Under the National Livestock Transformation Plan (NLTP), the initiative was started to solve security and socioeconomic challenges.

When we return to the national accounts, we see that the manufacturing sector experienced a decline of -1.9% y/y in Q3 as opposed to a growth rate of 3% y/y in Q2. The drop can be partially ascribed to increased operational costs brought on by deregulated items’ high costs as well as supply chain interruptions brought on by the Russia-Ukraine crisis. FX liquidity restrictions and increasing borrowing rates are further issues. In this industry, the food, the drinks and tobacco industry, which makes up 48.8% of the manufacturing GDP overall, saw a decline of -4.1% year over year in Q3 ’22. According to recently reported Q3 ’22 corporate data, most consumer goods businesses experienced decreased revenue growth, which was primarily caused by higher input costs and increases in operational expenditures.

Some FMCG companies obtain about 50% of their inputs locally. We anticipate that large FMCGs would be little affected by the recent flooding in a few states given that some businesses frontloaded their raw material purchases for the fourth quarter of 22. so offering protection from price and transportation increases. In Q3 ’22, the cement market had a 4.1% y/y increase. Conversely, the textile, apparel, and footwear category saw a decline of 3.9% year over year in Q3 of 22.

Comparatively to the 7.7% y/y growth seen in Q2 ’22, the telecoms segment rose by 10.1% y/y in Q3 ’22. The segment continues to gain from rising subscription numbers and rising data usage from current customers. We observe that the regulator reversed the roughly 10% data pricing rise that the telecoms providers had enacted in September of 22. The development of this market has also been aided by fintech and digital services. Internet (through mobile) subscriptions climbed by 8.9% y/y in Q3 ’22, according to data from the industry regulator.

In Q3 of this year, trade expanded by 5.1% y/y, compared to Q2’s 4.5% y/y growth, and made up 15.3% of total GDP. The reopening of four new land borders in April is one reason for the growth. These include Ikom in Cross River, Jibiya in Katsina, Kamba in Kebbi, and Idiroko in Ogun. Under the Export Facilitation Initiative (EFI), which started in April 2019, the CBN provided N44.6 billion in an effort to boost trade activities, particularly for exports. Furthermore, the CBN reported that export revenues returned into the country increased to USD4.9 billion in 2022 from USD3.1 billion recorded in 2021, indicating that the RT-200 plan it started in February of this year has been successful. These initiatives aim to increase foreign currency earnings and enhancing non-oil exports.

Judged on the bases of overall contributions to GDP, agriculture, industry, and services made up 29, 7, 18, and 51, 9 percent of the GDP in Q3 of 22. Services continue to be a key development driver.

Looking ahead, the CBN anticipates slower-than-expected output growth in the near future. This comes after a series of internal and external shocks. Insecurities, recent flood incidents, declining budget balances, and anticipated increases in inflation are what set off the internal shocks.

The Russia-Ukraine crisis uncertainty, the tightening of the global financial system, and the prolonged lockdown of China’s major industrial cities are examples of external headwinds. In 2022, we forecast 3.0% y/y GDP growth. SOURCE: Coronation Merchant Bank