Stock Market Update: NGX All-Share Index ends week positive rising 0.63% w/w – Coronation Securities Limited

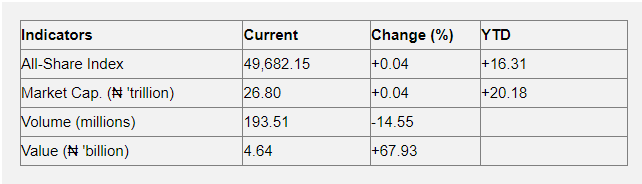

| Closing the week, the domestic bourse ended mixed with a bullish tilt as the benchmark Index managed to eke out a 4bps gain to settle at 49,682.15 points, the highest point since 16 August. Sustained buying interests in NESTLE (+3.26%) offset losses in ZENITHBANK (-0.45%), WAPCO (-0.21%) and INTBREW (-3.85%) to keep the broader index in the positive terrain. Consequently, having gained in three (3) of five (5) trading sessions this week, the ASI recorded a 0.63% w/w gain, ending two consecutive weekly declines. Bullish sentiments in AIRTELAFRI (+7.06% w/w), NESTLE (+3.85% w/w), MTNN (+2.04% w/w) and STANBIC (+8.93% w/w) in the course of the week were significant enough to push the market’s performance into the green despite the rout in DANGCEM (-5.33% w/w), BUACEMENT (-3.44% w/w), BUAFOODS (-6.92% w/w) and SEPLAT (-8.44% w/w). As a result, the ASI’s year-to-date (YTD) return rose to 16.31%, while the market capitalisation gained ₦168.02bn w/w to close at ₦26.80trn. Analysis of today’s market activities showed trade turnover settled higher relative to the previous session, with the value of transactions up by 67.93%. A total of 193.51m shares valued at ₦4.64bn were exchanged in 3,307 deals. JAIZBANK (+1.18%) led the volume chart with 45.91m units traded, while NESTLE (+3.26%) led the value chart in deals worth ₦3.05bn. Market breadth closed positive at a 1.36-to-1 ratio, with advancing issues outnumbering declining ones. JAPAULGOLD (+9.68%) topped fourteen (14) others on the leader’s table, while VITAFOAM (-9.78%) led ten (10) others on the laggard’s log. Find below key highlights of market activities. |

SOURCE: Coronation Securities Limited