AFEX Indexes outperforms other markets in the Nigerian capital market

The Afex Exchange Index (AEI) and Afex Commodities Index (ACI) maintained a bullish run into the second month of the new trading season which started in December 2020. The ACI which measures the performance of a basket of grain commodities recorded a YtD performance of 17% while the AEI which measures the performance of a basket of export commodities gained 12% in the corresponding period, respectively. AFEX indexes also outperformed the Nigerian All Share Index (ASI) which gained 7% in January 2020.

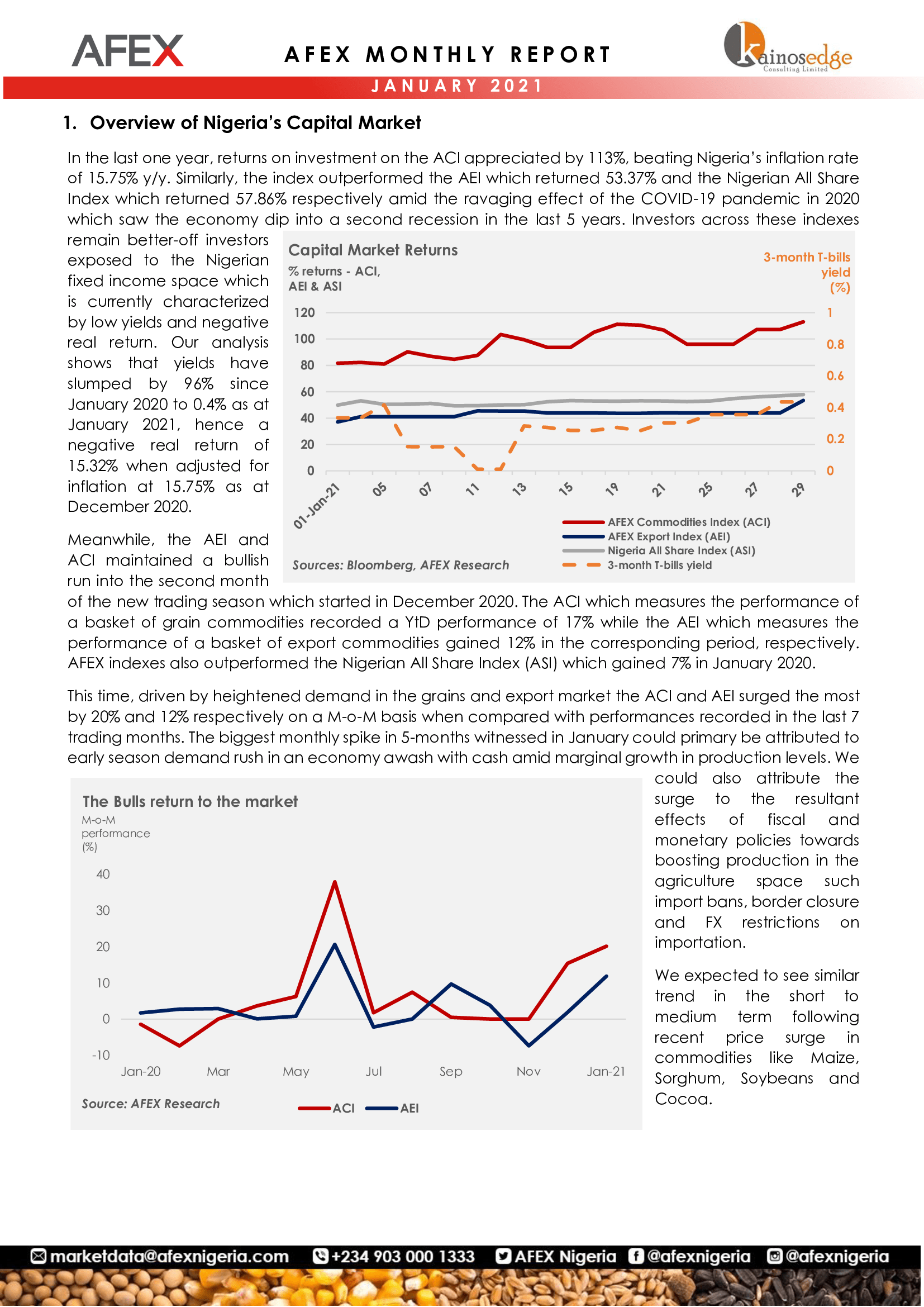

This time, driven by heightened demand in the grains and export market the ACI and AEI surged the most by 20% and 12% respectively on a M-o-M basis when compared with performances recorded in the last 7 trading months. The biggest monthly spike in 5-months witnessed in January could primary be attributed to early season demand rush in an economy awash with cash amid marginal growth in production levels. We could also attribute the surge to the resultant effects of fiscal and monetary policies towards boosting production in the agriculture space such import bans, border closure and FX restrictions on importation.

We expected to see similar trend in the short to medium term following recent price surge in commodities like Maize, Sorghum, Soybeans and Cocoa.