Debt Management Office (DMO) successful auctions N225bn (USD503.7m) bond – Coronation Merchant Bank

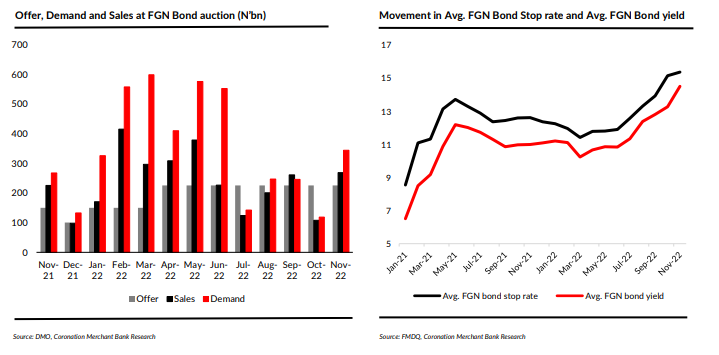

The DMO held its monthly auction of FGN bonds on Monday (14 November ’22). It offered N225bn (USD503.7m) but raised N269.1bn (USD602.4m), through re-openings of the 14.55% FGN APR 2029, 12.50% FGN APR 2032 and 16.24% 2037 FGN bonds. The participation level (demand) at this auction improved on a month-on-month basis, as the DMO secured a total bid of N344.0bn (USD770.1m) compared with a total bid of N119.2bn (USD270.1m) at last month’s auction.

The bids for the 7, 10, and 15-year benchmarks were allotted at the marginal rates of 14.75% (previously: 14.5%), 15.2% (previously; 15.0%), and 16.2% (previously; 16.0%) respectively. Bid-to-cover stood at 1.27x, compared with 1.10x in October. The demand at this auction primarily reflects improved system liquidity and end-year rebalancing/portfolio build-up by fund managers. The improved system liquidity can be attributed to inflows of N105bn and N193bn on the back of recent maturities from OMO and NTB instruments. The improved system liquidity was also reflected in money market rates (call, overnight and repo) which closed within a range of 7% – 13% on Friday 11 November.

In addition, the upticks recorded in FGN bond yields since the last auction in October combined with the three consecutive m/m declines recorded in headline inflation (currently 1.24% vs 1.82% in July) have encouraged fund managers to proceed with end-year rebalancing activities or portfolio build-up. The latest monthly report by National Pension Commission (PENCOM) show that as at endSeptember ’22, FGN bonds held by pension fund administrators had increased by 12.3% y/y to N8.8trn. The PENCOM report shows that FGN bonds accounted for 61% of total assets under management, compared with 60.2% recorded in the corresponding period of 2021.

According to the DMO’s bond issuance calendar, it had set out to raise a maximum of N2.47trn through FGN bonds to meet a domestic borrowing target of N3.53trn. However, year-to-date, it has raised N2.75trn, exceeding the target by c. N284.4bn. Recently, Moody’s Investors Services downgraded Nigeria’s local currency and foreign currency long term issuer ratings from ‘B2’ to ‘B3’. This was followed by Fitch Ratings, which downgraded Nigeria’s long-term foreign currency issuer default rating from ‘B’ to ‘B-’.

According to the ratings agencies, justification for the downgrades include significant deterioration in FGN’s finances and its external position despite higher oil price in 2022, high debt service costs, high cost of fuel subsidy, stagnant oil production and fx liquidity pressures. We note that the average yield for FGN Eurobonds remained largely unchanged after the ratings action, as investors had already priced in the reasons behind the downgrades.

We maintain our view that there is likely to be increased borrowings in the domestic debt market as the Eurobond market remains expensive for emerging economies like Nigeria. We currently see mid-curve FGN bond yields in the secondary market around 14.9%-15.4% and yields at the longer-end of the curve between 15.4% – 16.4% over the next one month. However, the level of system liquidity (impacted by items such as auctions, CRR debits/refunds, bond/NTB maturities, coupon payments and FAAC allocation) would also influence movement in yields.

Based on the proposed 2023 FGN budget, the projected deficit is estimated at N10.8trn. This represents 4.8% of the estimated 2023 nominal GDP. This is above the 3% threshold set by the Fiscal Responsibility Act 2007. The deficit would be financed mainly by new borrowings totalling N8.8trn. The balance is expected to come from privatization proceeds and drawdowns on bilateral/multilateral loans secured for specific development projects/programmes.

SOURCE: Coronation Merchant Bank