Earnipay Secures $4m Seed Fund to Provide On-demand Salary to Employees in Africa

Earnipay, a financial technology solution that provides flexible and on-demand salary access to income-earners, has closed a Seed round of $4million led by Canaan and with participation from XYZ Ventures, Village Global, Musha Ventures, Ventures Platform, Voltron Capital and Paystack CEO Shola Akinlade. Targeting employees across Africa, Earnipay officially launched its operations in January 2022, having been in development and beta testing since September 2021.

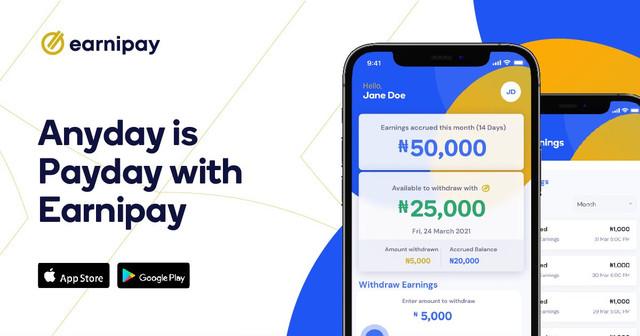

Founded by Nonso Onwuzulike to improve the financial well-being of employees, Earnipay uses its technology to offer employees the opportunity to access their earned salaries into their accounts flexibly, in real-time and interest-free. Earnipay partners with employers and seamlessly integrates with their payroll systems to offer its services to employees, who can then track and withdraw their accrued salaries via the app. Businesses are able to have complete oversight and set limits for the percentage of salaries employees can withdraw each month. Since operating in beta, Earnipay has served over 20 businesses, outsourcing firms and HR solution providers in Nigeria including Eden Life and Thrive Agric, whose employees have used the app to access their salary over 1,000 times, indicating a strong demand for the solution.

With the Seed funding, Earnipay will accelerate the development of its technology platform to serve large enterprise employers. By doing so, Earnipay will provide employees with the tools they need to make better financial decisions and improve their quality of life. The company plans to offer its on-demand salary solution to 200,000 employees by the end of 2022.

Speaking on the funding round and the recent launch of Earnipay, CEO Nonso Onwuzulike, says, “Financial worries are the leading cause of distractions in the workplace. The monthly pay cycle means employees are often unable to afford daily expenses, cover emergencies or take advantage of immediate financial opportunities. As a result, they become exposed to predatory payday loans and get stuck in unending debt cycles with unrealistic payback periods and expensive interest rates. Earnipay exists to address this problem and offer an ethical alternative to instant salary access while helping employers improve employee engagement and retention at zero cost to their business. The future of salary is on-demand, and we’re excited to be pioneering this amazing solution in Africa. I’m delighted to be collaborating with a group of highly respected investors who understand the need for a platform such as Earnipay to drive better access to salaries, and, importantly, to improve the financial well-being of income-earners in Africa.”

“We’ve seen earned wage access grow rapidly in many markets and believe it’s a natural fit in Africa,” said Brendan Dickinson, partner at Canaan. “Earnipay has quickly established itself with a product built specifically for the payroll behaviours of this region, and early employer uptake is very strong. Nonso has built one of the strongest teams that we’ve met on the entire continent, and we’re thrilled for the opportunity to partner with them.”

On-demand salary access is a huge opportunity in Africa, with over 70% of Africa’s workforce (500 million people) paid every 30 days and are living paycheck to paycheck. The 30-days pay cycle has led to 40% of the workforce living in an unending debt cycle as they struggle to match their income to their daily expenses, emergencies and opportunities. African businesses struggle to provide scalable solutions for employees to access their daily salaries as they work for it due to legacy payroll process, lack of available cash flow and internal salary advance that remains to be a tedious and manual affair.

Earnipay charges employees a small processing fee of NGN250 or NGN500 for this access. There is no payback and no interest charge because employees are accessing what they have worked for, It’s their money. With Earnipay, employers offer more financial well-being support to their employees, which in turn enables them to attract and retain top talent in an increasingly competitive employment market. In addition to on-demand salary, Earnipay provides financial education for employees to improve their financial literacy with a goal to enable them to make better financial decisions.

Onwuzulike concludes: “For five months, we have been working collaboratively with employers to deliver a workplace benefit that solves the biggest source of stress and distraction in the workplace: employee money issues. By doing so, employers are improving employee engagement and productivity, as well as positioning themselves as a better place to work. We are systematically addressing the inefficiencies in how the African workforce interacts with salaries and will continue to build products and services with both employers and employees in mind.”

Employers can sign up to Earnipay via the web platform to gain access to the employer dashboard and add their employees in a simple process. Employees will receive an invitation and have immediate access to all financial tools available on the employee mobile [via Playstore or App store] or the web app.

About Earnipay

Earnipay is a financial wellness fintech solution that integrates employers payroll and HRM systems to enable on-demand financing for employees to access their earned salary instantly without interest. Earnipay’s Flexible Salary Access helps organisations improve employee engagement and productivity by relieving financial stress caused by eliminating the need for a salary advance or predatory payday loans with interest rates. For more information, visit earnipay.com