Federal Government’s 2024 budget proposal of N26.01 trillion

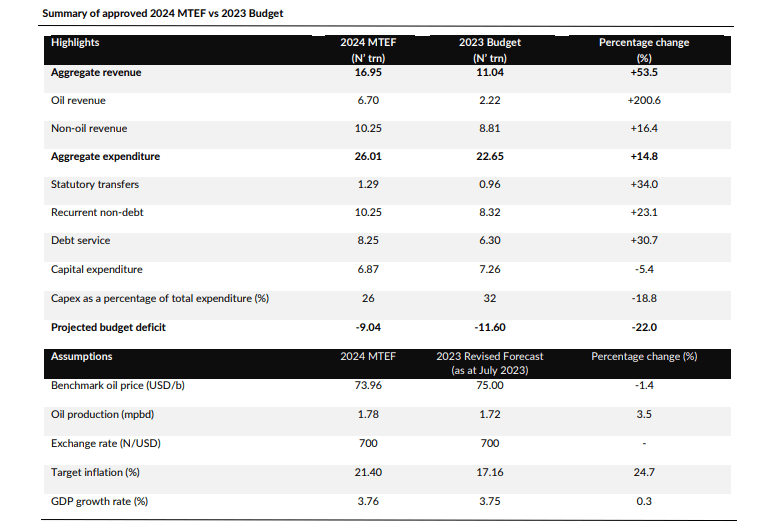

The FGN estimates that its total spending for 2024 will be N26.01 trillion, according to the newly adopted 2024–2026 Medium-Term Expenditure Framework (MTEF) and Fiscal Strategy Paper. Compared to the planned 2023 budget, this is 14.8% more. In contrast to earlier budget estimates, the proposed capital expenditure estimate is N6.8 trillion (i.e., 26% of total spending) instead of the N7.2 trillion budgeted for 2023, a decrease of -5.4%. We anticipated a marginally increased allotment for capital expenditures considering the FGN’s focus on closing the infrastructure shortfall.

The projected recurring (non-debt) expenditure, which is anticipated at N10.2 trillion compared to N8.3 trillion in the approved budget for 2023, has increased by 23.1% in tandem with the proposed capex spending decrease. This rise is attributable to the FGN’s recent wage increase, changes made to pension benefits in line with the pay increase, and the establishment of new ministries. Additionally, the projected debt servicing budget for 2023 increased by 30.7% to N8.2 trillion from N6.3 trillion.

The FGN anticipates an oil price benchmark of USD73.9/b, oil production of 1.78 million barrels per day, an exchange rate of N700/USD, an inflation rate of 21.4%, and a GDP growth rate of 3.76% year over year in 2024 (with the non-oil sector expected to account for the majority of the projected growth). These are the underlying assumptions of the MTEF.

However, the projected revenue of N16.9 trillion is 53.5% more than the N9.9 trillion allotted for 2023. This goal is rather lofty. According to the breakdown of this revenue estimate, N6.9 trillion (41%) is anticipated to come from sources related to oil, and the remaining N10 trillion (60.5%) is anticipated from sources unrelated to oil.

We observe that the MTEF’s predicted fiscal outcome indicates that higher revenue inflow is anticipated as a result of the removal of the PMS subsidy, currency depreciation as a result of the currency liberalization policy, and greater non-oil tax collection.

We think that in order to reach the projected revenue objective by 2024, concerted efforts must be made to reduce oil theft and vandalism inside the oil industry. Recent increases in oil output have been noted (i.e., 1.5 million barrels per day in September 23 compared to 1.3 million barrels per day in July 23).

Nonetheless, we project that oil output in 2024 will be between 1.4 and 1.6 million barrels per day, which is still less than the 1.72 million barrels per day objective set by OPEC.

Regarding non-oil, it is important to note that, since FY2021, actual non-oil revenue has averaged 9.4% more than FGN’s projection. We anticipate that the FGN will step up its efforts to mobilize taxes and will improve its efforts to generate and collect independent revenue, particularly from government-owned businesses (GOEs). Lower tax revenues as a result of consumers’ tight budgets, while individuals and companies continue to be negatively impacted by high inflation, is a potential risk to the projection.

The estimated budget deficit for 2024 is N9.05 trillion. Nevertheless, this is less than the N11.6 trillion allocated for FY2023 As 3.83% of the FGN’s projected GDP production, it exceeds the 2007 Fiscal Responsibility Act’s 3% requirement.

It is anticipated that fresh borrowing of N7.8 trillion (domestic: N6.04 trillion, external: N1.76 trillion) will be used to cover the deficit. We anticipate a continued reliance on local borrowing since emerging economies like Nigeria continue to find the international capital market to be prohibitively expensive.

In contrast to the 2023 domestic borrowing target, the borrowing plan included in the budget proposal indicates a -23.2% decrease in domestic borrowing. This aligns with the FGN’s projected growth in income.

Drawdowns on bilateral and international projects and programs estimated at N941.1 billion and privatization proceeds estimated at N298.4 billion are two more suggested sources of deficit financing.

The N26 trillion 2024 FGN Budget proposal

In terms of debt sustainability, the MTEF projects that the debt-service-to-revenue ratio will be 49% in 2024 as opposed to 57% in FY2023. We observe that the debt service-to-revenue ratio was 83% as of the end of March 23. As of the end of June 23rd, the debt-to-GDP ratio was 43.7%.

This exceeds the debt-to-GDP ratio goal set by the DMO for the years 2020–2023. We are aware that there is a process in motion to approve raising this ratio restriction.

According to the MTEF report, the FGN’s retained revenue was N5.1 trillion from January to July of 23. The low oil revenue performance is mostly to blame for this, which represents 81% of the prorate objective of N6.4 trillion. As of the end of July, N8.5 trillion has been spent out of the prorate objective of N13.2 trillion. In July, the budget deficit was -N3.4 trillion, which was less than the prorated objective of -N6.7 trillion. Furthermore, as of the end of July 2023, debt payments (including interest on ways and means) amounted to N3.9 trillion, or 45.8% of the total spending of N8.5 trillion as of the same date.

Nigeria’s budgetary situation is depicted in conflict in the 2024–2026 MTEF. The government’s commitment to tackling important issues like workforce compensation and infrastructure shortages is reflected in the projected rise in aggregate expenditure, but the decrease in capital expenditure allocation raises questions about how quickly infrastructure development would proceed. In addition, although though it is less than it was the year before, the anticipated budget deficit is nevertheless a cause for concern. The MTEF estimates indicate that the debt sustainability indicators, which include a relatively steady debt-to-GDP ratio and a decreased debt-service-to-revenue ratio, are showing encouraging trends. Ongoing initiatives to increase the debt-to-GDP ratio ceiling, however, emphasize how crucial it is to properly control the nation’s debt profile.