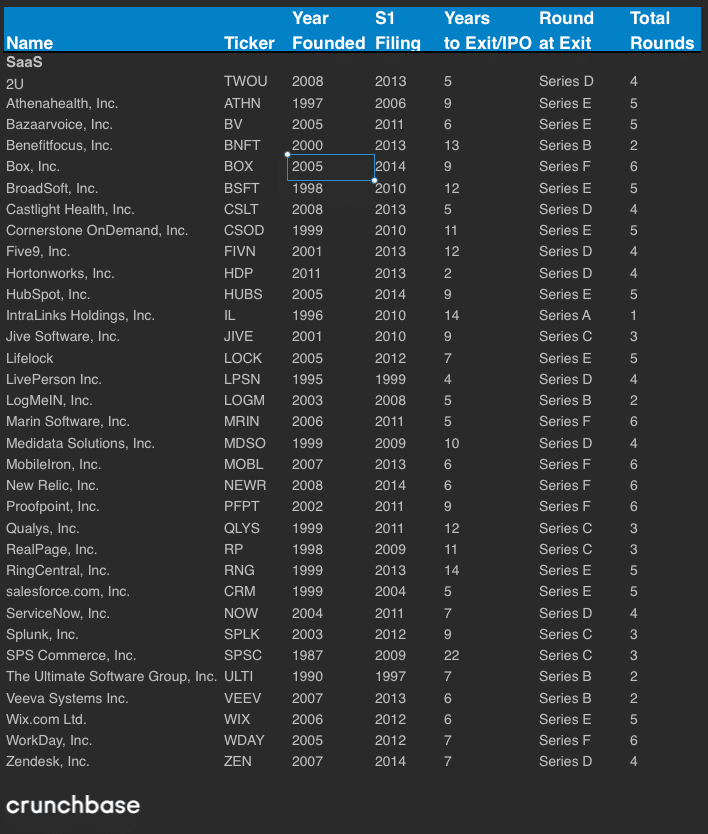

How Many Rounds of Funding Do Companies Raise Before Exiting?

How many rounds of funding has it historically taken tech companies to exit? We looked at data from 124 IPOs. After some thorough analysis, it looks like the number of funding rounds it takes for a company to exit varies depending on the industry.

Social media companies took six rounds to exit

Social media companies on median didn’t exit until after their Series F funding round. LinkedIn was the quickest of the group going only raising a Series D.

It’s interesting to see that social media companies made it to the promised land faster. On median social media companies took seven years since founding to IPO whereas software took nine years.

Marketplaces took five rounds before going public

Marketplaces and transactional models needed five rounds through the Series E. They took seven years to exit.

Notice though that Eventbrite and Redfin which exited in 2018 and 2016 respectively, took 13 years and seven rounds to exit on average. Again, this supports the view that companies are staying private longer.

Ad-based businesses went through four funding rounds before their IPO

They took seven years to exit on the median. Netscape which was founded and ultimately went public in 1994, is a great reminder of how crazy the dot com boom was.

Subscription and E-commerce exited after the Series C

Subscription service companies took seven years to exit on median and e-commerce took 5. Even more recent exits like Blue Apron and StitchFix needed only four and six years respectively.

Hardware, payments, and gaming are also presented in the data. Note this data does not show whether there were multiple occurrences of the same round (for instance B, B1, B2) or bridge rounds — both are unlikely since these companies all were successful enough to go public.

The data does seem to show that some of the more recent exits in the tech space took much longer to exit and many more rounds as companies are staying private longer. Also notice businesses that are B2C focused scale much faster than those that are B2B or enterprise focused, so they exit sooner.

Sammy is a co-founder of Blossom Street Ventures. They invest in companies with run rate revenue of $2mm+ and year over year growth of 50%+. We can commit in 3 weeks and our check is $1mm. Email Sammy directly at [email protected].

CRUNCHBASE