Machines and Markets: Insight into Nigeria’s Manufacturing Landscape by Coronation Merchant Bank

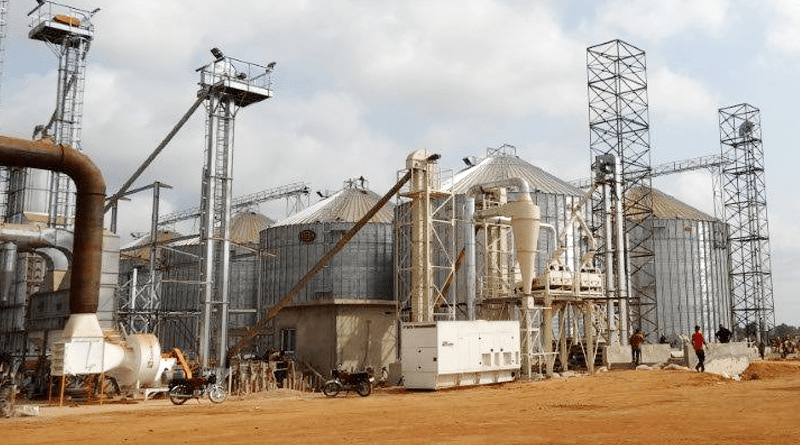

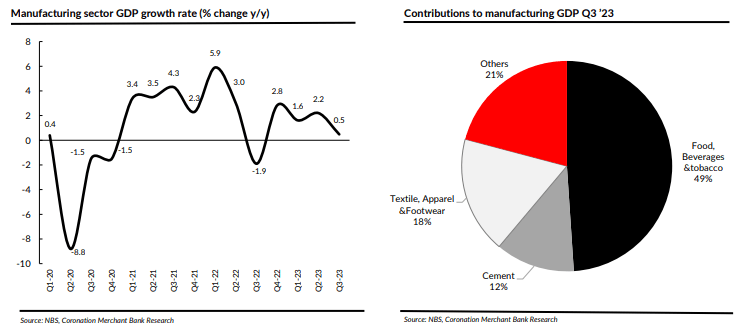

Over the last seven years, Nigeria’s manufacturing sector has grown at an uneven rate, averaging a meek 0.46% y/y and adding an average of 9.1% y/y to the country’s GDP over that time. The current trajectory of the industry has been influenced by several things. Global economic conditions, supply chain disruption, forex volatility, and infrastructure shortages are a few of them.

The industry rose by 0.4% year over year in Q3 ’23, making for 8.4% of the GDP. Due to rising fuel prices in the middle of 2023, the manufacturing sector—which is mostly dependent on gasoline-powered generators and automobiles—saw a rise in operational costs. In addition, high borrowing prices and restrictions on foreign exchange liquidity have increased operating costs, which has affected competitiveness.

A more thorough examination of the Q3 ’23 national accounts reveals that the food and beverage segment of the manufacturing sector rose by 0.9% year over year and accounted for 49% of the manufacturing GDP overall. Nonetheless, it is noteworthy that the majority of consumer goods companies experienced remarkable revenue growth, primarily due to the adoption of corresponding product price hikes. The inelastic nature of product demand made it easier for producers of basic staples to execute price increases. Conversely, exchange rate losses (post-fx liberalization) had a significant negative influence on their net revenue, which represents their profitability.

The textile, apparel, and footwear category, on the other hand, saw a y/y contraction of -2.7% due to production capacity issues and low purchasing power experienced by textile manufacturers, which has resulted in relatively weak patronage.

Perhaps government actions to combat smuggling and counterfeiting, tax breaks for manufacturers, and tariff reductions on machinery will increase output from this manufacturing sector. These policies also benefit the textile and garment industries.

According to the most recent data, the Manufacturing Purchasing Managers’ Index (PMI) of the CBN increased from 51.6 points to 53.6 points in May 23. Keep in mind that a number above 50 indicates expansion and a reading below 50 indicates contraction. When they are issued, we anticipate that the next readings will accurately represent the state of the market, which includes significant operating costs. Two nations that could make excellent case studies for Nigeria’s industrial industry are China and South Korea. Both countries’ manufacturing sectors have experienced rapid expansion over the last ten years; in 2022, they accounted for 25.6% and 27.7%, respectively, of the total GDP.

Strategic government policies, technological developments, export-oriented industrialization, education, and skill development have all played major roles in growth. China has been the preferred location for businesses looking for effective and economical production due to its capacity to provide cost-effective manufacturing solutions. Massive conglomerates, or “chaebols,” like Samsung and Hyundai, have been instrumental in South Korea’s industrialization and growth of ancillary economic sectors.

In light of the prevailing macroeconomic conditions, manufacturing firms need to employ a variety of tactics to sustain their operations or pursue growth. From our perspective point, manufacturing companies should think about investigating currency hedging techniques to reduce foreign exchange risks and putting strict cost control measures in place to lessen the impact of increased import costs. Additionally, spending money on backward integration and import substitution strategies had to be taken into account, as doing so would lessen the effect of currency depreciation on manufacturing expenses.

To lower the risks related to changes in energy prices, perhaps step up your efforts to invest in sustainable energy sources. Value brands that have managed to maintain consumer interest should receive intentional attention, especially in light of the comparatively weaker purchasing habits. Finally, as rising inflation is a major danger to consumer spending, optimizing changes in consumption patterns should be taken into account. Customer segmentation is therefore vital in order to profile customers and stay at the top of their lists of priorities for spending.

It’s just been six months since the current administration took power.

The FGN intends to encourage manufacturers through strategic partnerships to accelerate the growth of specific sectors and segments, including light electronics assembly, apparel, fertilizer, refined sugar, oil palm, and automotive, according to the policy advisory council report that was published in June 2023. The FGN anticipates that these sectors will produce c.USD50 billion annually. Plans call for the domestication of at least 50% (or USD 17 billion) of the value chains in the three manufacturing subsectors that contribute the most to GDP: food and beverage, chemicals and petrochemicals, and textile, apparel, and footwear.

By 2031, at least 70% of Nigeria’s vaccination and pharmaceutical needs will be satisfied by locally produced goods. We can observe that in Q3 ’23, the manufacturing GDP was contributed by 3.4% by the chemical and pharmaceutical sector. The last eight quarters have shown an average rise of 7.5% y/y for this segment. It is encouraging that the government is committed to attaining self-sufficiency in the chemical and pharmaceutical industries. On the other hand, negative risks include increased inflation and more currency devaluation. The segment’s long-term viability is further threatened by the slow uptake of health insurance plans, the lack of significant patent regulation, and the absence of systems for pricing and payment.

It is anticipated that the agreement establishing the African Continental Free Trade Area (AfCFTA) will have a major impact on the growth of regional value chains.

But intra-African commerce has remained weak since the deal was signed in 2019, and Nigeria has not been able to fully utilize the accord’s potential. One of the main things preventing manufacturers from participating is the lack of information available to them, together with administrative obstacles. In order to optimize the advantages of the agreement, it is imperative to enhance the logistics and transportation infrastructure, streamline customs procedures, and minimize bureaucratic obstacles. If local manufacturers want to remain competitive, they must also prioritize service delivery and product quality. Separately, we know that Somalia’s cabinet has approved the AfCFTA Agreement, which is now awaiting ratification by the lawmakers. SOURCE: Coronation Merchant Bank. Read the full article here