Nigeria had a trade surplus of N1.2trn in 2022 as total export value increased by 41.7% y/y while import value increased by 22.7% y/y

According to the National Bureau of Statistics’ (NBS) most recent data on international trade in goods, the overall value of trade fell by -4.5% q/q to N11.7 trillion in Q4 of 22. The third straight q/q drop has been seen. On a year over year basis, it increased just 0.1%. As the import value decreased by -15.5% q/q to N5.4trn from N6.3trn, the total export value climbed by 7.2% q/q to N6.4trn from N5.9trn in Q3 ’22. In the end, there was a surplus of N996.8 billion as opposed to a deficit of -N409.4 trillion in Q3 of 22. Overall commerce as a share of nominal GDP (2022) was 5.9% in Q4 of 22 as opposed to 6.2% in Q3 of 22.

The overall amount of trade for FY2022 was N52.4 trillion, up from N39.7 trillion in FY2021. The total export value for FY2022 rose by 41.7% year over year to N26.8 trillion. Moreover, import value climbed by 22.7% y/y to N25.6 trillion in 2022 from N20.8 trillion in 2021, as reported. The overall outcome was a surplus of N1.2 trillion as opposed to a deficit of N1.9 trillion in FY2021. Overall commerce as a share of nominal GDP (2022) was 26.3% in 2022 compared to 2021’s figure of 22.9%, (using 2021 nominal GDP).

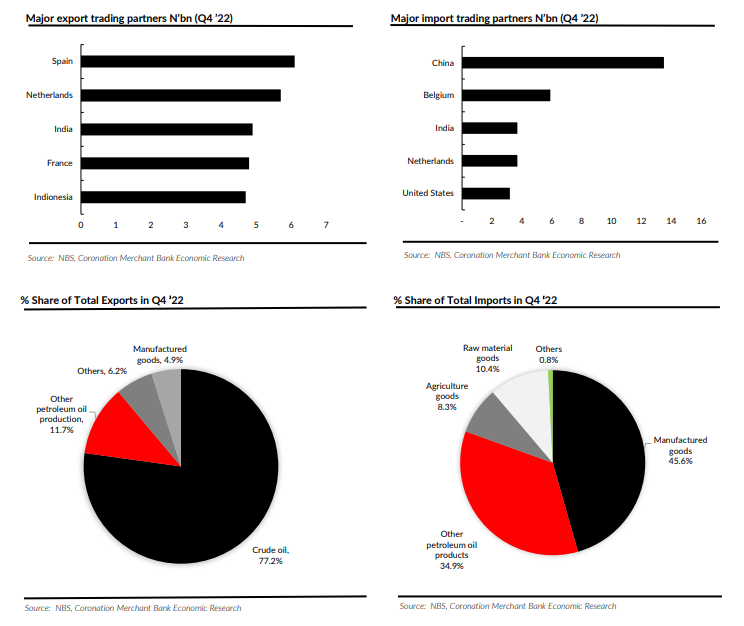

China was the source of the majority of imports in Q4 of 22 according to the NBS (N1.4trn). Belgium (N585.6 billion), India (N368.9 billion), the Netherlands (N365.3 billion), and the United States came next (N319.2bn). In Q4 ’22, imports from these five nations made up 55.8% of the total. The value of imported manufactured goods and goods connected to the oil industry fell by 14.3% and 18.2%, respectively, on a quarterly basis. Agriculture-related imports also fell by -13.3% on a quarterly basis.

In the fourth quarter of 2022, imports from the Economic Community of West African States (ECOWAS) totaled N55.4 billion, or 30.7% of all imports in the area. Spain (N617.2 billion) was Nigeria’s biggest exporting partner in Q4 of 22. It was followed by the Netherlands (N517.6 billion), India (N490.4 billion), France (N489.8 billion), and Indonesia (N489.8 billion) (N473.3bn). In all, these five nations made up 41.6% of all exports in the fourth quarter of 22.

The largest portion of all exports in Q4 22 (77.8%) was crude oil, which saw a q/q increase of 5.4% to N4.9 trillion after falling by 21.2% in the previous quarter. The FGN’s recent initiatives to combat crude oil theft and vandalism can be partially blamed for the q/q increase in the value of total crude exports. These initiatives have enhanced oil production.

According to NBS data, average crude oil output (condensates included) in Q4 was 1.34 mbpd as compared to 1.20 mbpd in Q4 of last year and 1.50 mbpd in Q4 of this year. This is less than both the FGN’s output baseline of 1.7 mbpd and the 1.8 mbpd OPEC production limit for Nigeria. For non-oil exports, the top export commodities in Q4 of 22 included superior quality cocoa beans, sesame seeds, shelled cashew nuts, other frozen shrimp and prawns, shelled cashew nuts, crude palm kernel oil, natural coca butter, ginger, and soy beans. Nigeria exported commodities worth N553.7 billion to other ECOWAS members in Q4 of 22 as opposed to N507 billion in Q3 of 22. This accounted for 58.7% of all exports to Africa.

The Apapa Port was the busiest port at the time. At this port, N5.8 trillion worth of goods were exported, making up 91% of all exports. Other heavily utilized ports are Tin Can Island and Port Harcourt (N341.9 billion) (N159.3bn).

Regarding China, its exports of goods to other nations climbed 6.6% quarterly to USD 970.6 billion in Q3 ’22 from USD 910.4 billion in Q2 ’22. We observe that the zero-covid policy has been phased away and the economy has been reopened by the Chinese government. The reopening is anticipated to boost economic activities and reduce production disruptions in the manufacturing sector, as indicated by the growth seen in China’s PMI (52.6 as of February ’23 vs. 50.1 reported in January ’23).

Regarding China, its exports of goods to other nations climbed 6.6% quarterly to USD 970.6 billion in Q3 ’22 from USD 910.4 billion in Q2 ’22. We observe that the zero-covid policy has been phased away and the economy has been reopened by the Chinese government. The reopening is anticipated to boost economic activities and reduce production disruptions in the manufacturing sector, as indicated by the growth seen in China’s PMI (52.6 as of February ’23 vs. 50.1 reported in January ’23).

Regarding China, its exports of goods to other nations climbed 6.6% quarterly to USD 970.6 billion in Q3 ’22 from USD 910.4 billion in Q2 ’22. We observe that the zero-covid policy has been phased away and the economy has been reopened by the Chinese government. The reopening is anticipated to boost economic activities and reduce production disruptions in the manufacturing sector, as indicated by the growth seen in China’s PMI (52.6 as of February ’23 vs. 50.1 reported in January ’23).

Global/Regional in focus

The World Trade Organization (WTO) reports that global merchandise trade climbed 13.4% year over year, or USD1.5 trillion, to USD12.8 trillion in Q3 ’22 from USD11.2 trillion in the same period of 2021. In the meantime, on a quarter-to-quarter basis, total merchandise trade fell slightly by -0.9% due to supply chain disruptions brought on by the ongoing Russian-Ukrainian crisis and a slowdown in economic activity brought on by concerns about a global recession brought on by rising inflation and the tightening of monetary policy in both advanced and emerging economies.

According to what we hear, Russia has consented to extending the Black Sea Grain Agreement for an extra 60 days (two months) as concerns about the initiative’s future grew as the initial expiration date of March 18, 23, came near. Approximately 24.1 million tonnes of grains (including corn, wheat, barley, and sunflower oil) have been exported through 1600 vessels to both advanced and emerging economies, showing the crucial role that the Black Sea Initiative has played in promoting global food security, according to data from the United Nations.

Regarding China, its exports of goods to other nations climbed 6.6% quarterly to USD 970.6 billion in Q3 ’22 from USD 910.4 billion in Q2 ’22. We observe that the zero-covid policy has been phased away and the economy has been reopened by the Chinese government. The reopening is anticipated to boost economic activities and reduce production disruptions in the manufacturing sector, as indicated by the growth seen in China’s PMI (52.6 as of February ’23 vs. 50.1 reported in January ’23). SOURCE: Coronation Merchant Bank