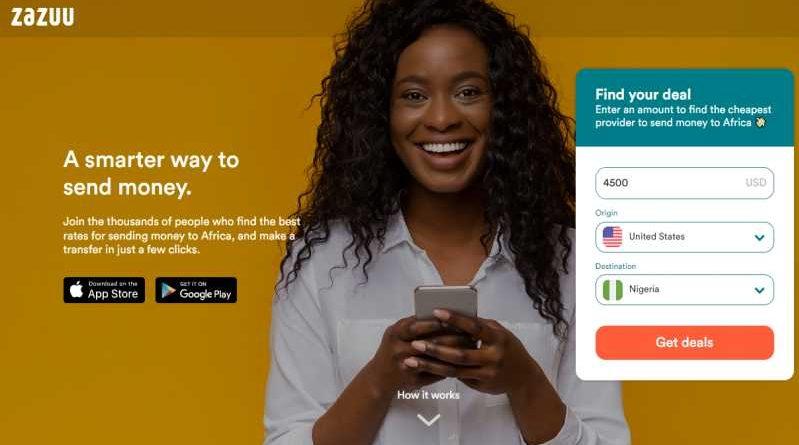

Nigerians’ led Zazuu FinTech raises $2M to scale its African Remittance Platform

The startup will use the money to scale its platform and improve its product, adding “new features that ensure everyone sending money to Africa gets the best money transfer experience,” said Zazuu Chief Operating Officer Korede Fanilola in the report.

Zazuu has evolved from a chatbot informing users of the daily rates in Facebook and Telegram groups to a Financial Conduct Authority (FCA)-licensed organization in the United Kingdom with users in eight countries across North America and Europe. Almost 100,000 people have used the current version of Zazuu’s Search and Compare service to secure the best rates for their money movement activities, according to the report.

“In 2018, I sent about $3,000 back home to Nigeria,” Fanilola said, per the report. “I thought I got the best deal on that transaction until about two weeks later when someone informed me I could have saved up to $30 in fees on that transaction if I had used a different provider. I was livid. We all have experiences like this where we only discovered in hindsight that we had lost more than we should on transactions back home simply by choosing the right provider.”

The global cost of moving money across borders averages around 6.09% of the value of the transaction and can be as high as 22% for money sent to African countries, the report stated, citing the World Bank. Lack of transparency among remittance providers is the leading challenge.

The company’s goal is to help customers by providing “better access to financial instruments like credit both home and abroad in the future,” said Zazuu CEO Kay Akinwunmi in the report. “The aim is to build a completely non-biased financial wellbeing for African immigrants across the world.”

Zazuu’s funding round saw participation from Launch Africa, Founders Factory Africa, Hoaq Club, Tinie Tempah, Jason Njoku, CEO IrokoTV, Babs Ogundeyi, CEO Kuda Bank and other angel investors, according to the report.

Meanwhile, Nigeria-based FinTech Moni is trying to fill the funding gap for small business owners in Africa with a community-based lending solution.