Nigeria’s Economic Outlook 2022 (Part 1) by Ugodre Obi-Chukwu, Nairametrics

Russia-Ukraine War

- Higher oil prices emanating from sanctions onRussia’s oil is a missed opportunity for Nigeria

- Fuel &diesel scarcity could persist due to surge in energy prices and supply challenges

- Commodity prices like wheat will face price hikes negatively affecting local manufacturing e.g., FMCGs.

- Nigeria’s wheat import is estimated at N1.9 trillion in 2021 up 71%

- Nigeria’s wheat demand is 5-6million MT but produced just 63k MT.

- Global capital flows could continue to be affected by Russian Sanctions. This could impact FDI’s into Nigeria.

- Flight risk as global airlines defer to longer routes to avoid conflict areas. This could affect business travel to East Asia.

- Risk of cybersecurity from Russian cyber attacks

More on Trade between Nigeria, Russia and Ukraine

- Russia is one of Nigeria’s top sources for its imported items, especially food items.

- Nigeria imported goods valued at N813.19 billion (over $2b annualised) between January and September 2021, representing 3.7% of Nigeria’s total import in the same period.

- Wheat is the third most widely consumed grain in Nigeria most of which is mostly imported from Russia.

- Nigeria imported durum wheat worth over N128.1 billion in the 9- month period of 2021, while it recorded a N144.14 billion durum wheat import in the previous year.

- Other imports from Russia includes different types of seafoods such as mackerel, meat, herrings, blue whiting’s, other fish, all in frozen form. Nigeria also imported vaccines for human medicine from Russia in Q4 2020.

- Ukraine has also been involved in trade with Nigeria in the past, as it imported milk preparation worth N721.45 million in Q1 2021, according to information from the NBS.

Effect on diesel prices

- According to Vitol one of the largest oil traders in the world, “Europe imports about half of its diesel from Russia and about half of its diesel from the Middle East,” adding that systemic shortfall of diesel is there as Russian imports account for roughly 15% of Europe’s diesel consumption, and crude oil from Russia processed in Europe.

- To make it worse, the shift to more diesel consumption over petrol in Europe had created shortages of the fuel.

- Diesel is also the worst affected of the oil products because Europe imports close to 1mn barrels a day of Russian diesel and the world entered the conflict with near-record low stocks of oil.

- We also understand the clampdown of illegal refining also contributed to diesel scarcity.

- The Manufacturers Association of Nigeria (MAN) warned that the high cost of diesel used by manufacturers in Nigeria is expected to lead to high cost of goods and services due to the high cost of production.

Commodity Crisis

- Oil price spikes will continue as energy crisis worsens sparking global demand for commodities.

- However, higher demand will lead to a global shortage in commodities worsening food inflation

- This will have a negative effect on raw material inputs required for local production.

- This could negatively impact local manufacturing especially those who need to import commodities

- Commodity driven inflation could trigger social unrest across emerging markets like Nigeria.

- Studies have shown that there is a correlation between food crisis and increase in conflicts and social unrest. Wheat and cereal-based foods are the most sensitive

- Favourable forex policies aimed at companies engaged in backward integration.

- CBN will aggressively implement policies like e-evaluator, e-invoice could be introduced required to facilitate imports.

- Impending planting season in Nigeria could worsen price pressures for food products.

- Bread makers are already warning of a potential increase in the price of bread by 50% in April.

But there is a silver lining

- According to Afex Russia/Ukraine war “would have an effect on energy prices and fertilizer prices and ultimately on input prices and the cost of input and production this year. I think it’s an upward trend for commodity prices.”

- They also opine that for investors “For investors, we believe this is one of the best times to come into the market. We believe the commodity market provides a safe entry for currency valuation and there is a strong correlation in that state and also commodity has a hedge against inflation as seen in the last two to three years.”

- Early reports also suggest there is a rising demand for most staple commodities, particularly sorghum which will help to boost export commodities including cocoa, sesame, ginger, and cashew.

- A depreciating naira will also favour players in this sector. We have seen players like Okomu, Presco report impressive results in the last two years

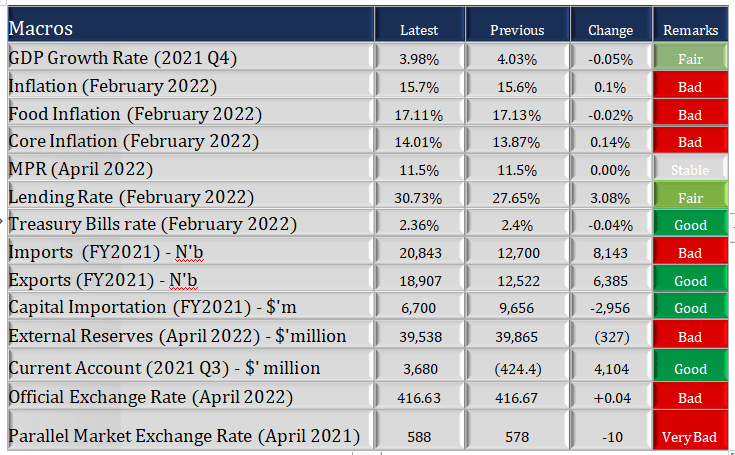

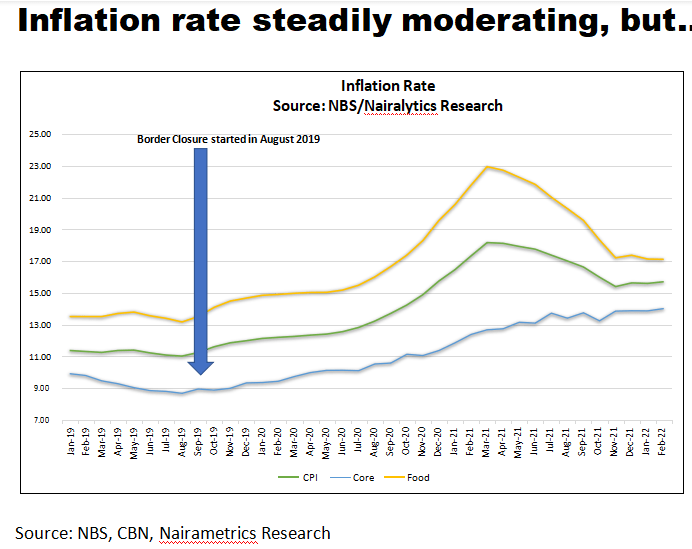

Hyper Inflation

- Hyper Inflation is expected to remain sticky throughout 2022

- This is worsened by higher diesel prices, fuel scarcity, removal of electricity subsidy.

- Imported inflation will add to rising cost of goods and services.

- Businesses will seek to mitigate elasticity of demand for their products.

- Consumer Goods businesses will look to shrinkflation, Sachetization to manage cost and boost revenue.

- General price increases by retailers to cushion rising operating cost is how businesses will survive.

- Focus will be on good customer service, relationship management to strike competitive advantage.

- Pressure on luxury good businesses to scale amidst widespread poverty

- Higher taxes per the finance act could trigger price increases for beverages, online transactions etc

Hyper Inflation – How will economic actors respond?

This high cost of economic activities will impact the spectrum of participants in a variety of ways

Individuals

- Purchasing power erosion,

- Risk of aggregate demand contraction,

- seek for more income…multiple jobs, productivity decline,

- Desperation / survival modes …susceptibility to rich quick schemes, cybersecurity threats

- Thus, overall worsening consumer risk profile re NPL as well as, savings rates declines.

- Proliferation of street begging, hawking and street trading

- Pressure on rich relatives and breadwinners

- Pilfering, Petty Stealing, Conmen

Corporations

- Seek to mitigate elasticity of demand for their products

- Shrinkflation through adjustments through repackaging & content adjustments

- Hoarding to create artificial scarcity

- Input costs inflation (labor, energy, commodities)

- Inventory pileup for luxury items

- No room for less competitive companies.

- Oligopolies, monopolies and cartels will grow stronger

Government

- Irrational Consumer Protection

- Price Controls?

- Government Palliatives and handouts

- CBN Interventions in specified sectors

- Tackle logistic bottlenecks

- Port reforms

- Infrastructure spending to help address supply side challenges

- Strike trade deals

- Fines, penalties, harassments

SOURCE: Nairametrics. By Ugodre Obi-Chukwu