Nigeria’s GDP Report for quarter 4 of 2022: GDP marginally ahead of expectations

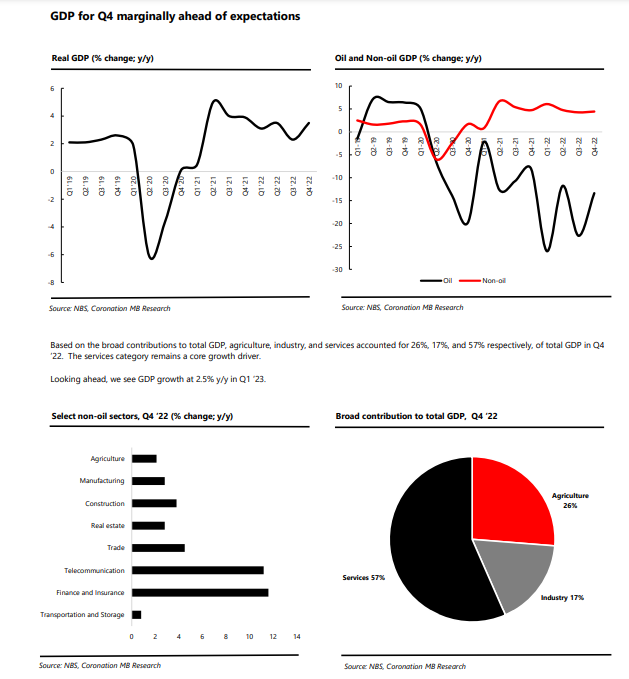

According to the National Bureau of Statistics’ (NBS) most recent national accounts, GDP increased by 3.5% y/y in Q4 of 22 as opposed to 2.3% y/y in Q3 of 22. GDP increased by 3.1% y/y in FY ’22 as opposed to 3.9% y/y in FY 2021. The oil’s quarterly performance

While the non-oil economy expanded by 4.4% y/y in Q4 ’22, the overall economy shrank by -13.4% y/y.

For FY2022, the oil sector experienced a decline of -19.2% y/y versus -8.3% y/y, mostly due to the effects of oil theft, vandalism, IOC divestments from onshore oil development, and infrastructural shortages. Oil prices have fallen by an average of -13.4% year over year over the last eight quarters. Bonny Light’s quarterly performance decreased by 7.1% to USD81.9/b at the end of Q4.

According to NBS data, average crude oil output in Q4 of 22 was 1.34 mbpd, up from 1.20 mbpd in the prior quarter (condensates included). This is less than both the FGN’s oil production and Nigeria’s 1.8 mpbd OPEC production limit.

standard of 1.7 mbpd. According to industry sources, select ports saw an uptick in oil output in Q4. Bonny, Brass, Forcados, and Escavros are some of them.

In contrast, Qua-production Iboe’s was noticeably lower during the same period.

Regarding the non-oil sector of the economy, agriculture expanded by 2.1% y/y versus 1.3% y/y in the previous quarter. In Q4 of ’22, the sector made for 26.5% of the overall GDP. Agriculture expanded by 2.1y/y in FY2022. Crop production, which accounts for 91% of agriculture’s GDP and increased by 2.4% y/y in Q4 ’22, continued to be the sector’s key driver. The forestry sector, meanwhile, expanded 1.6% year over year. Nonetheless, the livestock and fishing industries also had declines of 1.6% and 3.0% y/y, respectively. As of October 22, the CBN had distributed N745 billion for large-scale agricultural projects via the Commercial Agricultural Credit Programme, one of the CBN’s financial interventions aimed at the agriculture sector (CACS)

After experiencing a contraction of -1.9% y/y in the previous quarter, the manufacturing sector experienced growth of 2.8% y/y in Q4 of 22. The CBN’s current demonetization strategy, including resulting in cash shortages, which is hurting manufacturing. We know that manufacturers are producing at reduced rates because consumer spending has slowed down; the Q1 national accounts would reflect this. A closer look at the manufacturing industry reveals that in Q4, the food and beverage and cement industries experienced growth of 4.9% year over year and 3.9% year over year, respectively. The textile, garment, and footwear category, meanwhile, experienced a -1.2% y/y decline.

One of the sectors with the fastest growth rate was telecommunications. It had growth of 11.2% year over year and made up 13.5% of GDP in the fourth quarter. According to information from the Nigerian Communications Commission (NCC), the number of internet subscribers rose 9.1% year over year in Q4 22.

Compared to the 5.1% y/y figure achieved in Q3 ’22, trade slowed to 4.5% y/y. In Q4 of ’22, the sector made up 15.8% of the overall GDP. Due to the recent cash shortage brought on by the naira redesign strategy, domestic trade, which depends primarily on cash transactions, continues to experience problems. Given that people have a relatively low tolerance for errors in computerized transactions, cash is still the preferred method of payment. SOURCE: Coronation Merchant Bank