Total value of Nigeria’s trade increased by +5.8% q/q to N12.7trn in Q2 ’23

The National Bureau of Statistics (NBS) most recent report in its series on international commerce indicates that the overall value of trade climbed by +5.8% q/q to N12.7 trillion in Q2 ’23. On a year-over-year basis, it showed a loss of -7.3%. Overall, N1.3 trillion was surplus compared to N927.2 billion in Q1 of 23. The total value of exports climbed by +7.7% q/q to N7 trillion from N6.5 trillion in the previous quarter, and the value of imports increased by +3.6% q/q to N5.7 trillion from N5.5 trillion. As a proportion of nominal GDP (2022), overall trade increased from 16% in Q1 to 17% in Q2 of 23.

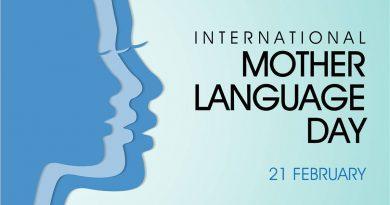

According to NBS data, China accounted for the majority of imports in Q2 of 23 (N1.3 trillion). The United States (N921.4 billion), Belgium (N460.4 billion), India (N417.7 billion), and the Netherlands (N369.7 billion) are next in line. In Q2 of 23, imports from these nations made about 60% of the total.

In Q2 of 23 there were N52 billion worth of imports from the Economic Community of West African States (ECOWAS), which made up 21.9% of all imports in the area.

The top five countries for exports were the Netherlands ($788.9 billion), the United States ($583.2 billion), Indonesia ($550.2 billion), France ($540.7 billion), and Spain ($504.4 billion). In Q2 ’23, exports to these nations made up 44.2% of the total.

Crude oil continued to make up the greatest portion of exports in Q2 ’23, accounting for 79.6% of all exports and expanding by 8.5% q/q. The NBS reports that in Q2 ’23, average crude oil production decreased from 1.5 million barrels per day in Q1 ’23 to 1.22 million in Q2 ’23.

In terms of non-oil exports, agricultural products dominated the list in Q2 of 23. Shelled cashew nuts, sesame seeds, premium cocoa beans, flours, and soy bean meals are a few of these products. Nigeria exported commodities at N425.7 billion to other ECOWAS members, up from N399.2 billion in the first quarter of 23. This accounted for 57% of all exports to the continent.

Nigeria might become a dominant force in intra-African commerce if it uses the AfCFTA to its advantage. It’s important to note that over the following three years, Afreximbank plans to increase its financing support for intra-African trade by USD40 billion (from an initial USD20 billion). The organization is actively working with the African Union (AU) to implement the AfCFTA, particularly through the Pan African Payments and Settlements System (PAPPS), which was created to simplify trade payments and transactions carried out in local currencies.

When it comes to seaports, Apapa remained the busiest port during that time. Through this port, goods worth N6.6 trillion left the country, making up 93.7% of all exports. Tin Can Island (N213.8 billion) and Port Harcourt (N153.2 billion) were two other ports used during the time period under examination.

Global perspective

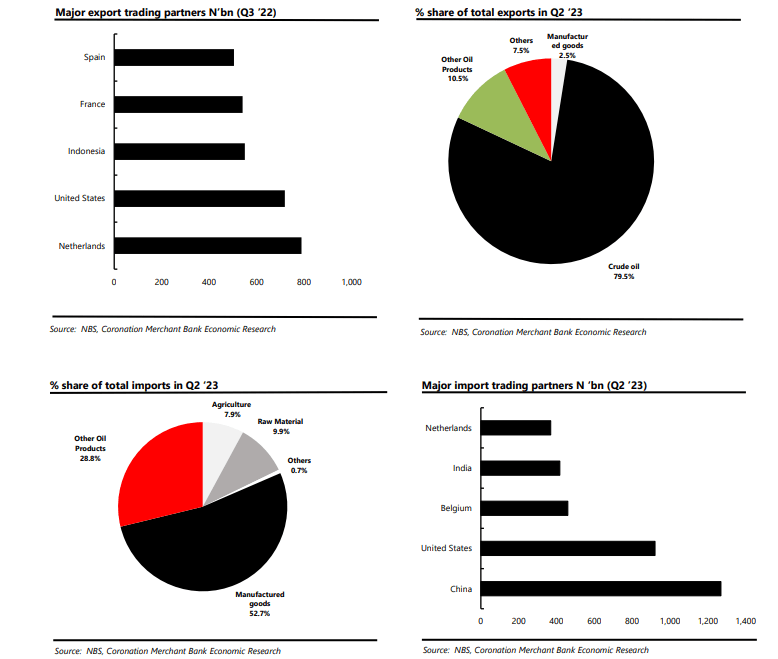

The World Trade Organization (WTO) reports that in Q1 ’23, merchandise trade exports decreased slightly by -1.6% y/y or USD94 billion to USD5.8 trillion compared to USD5.9 trillion recorded in the same quarter of 2022. The total merchandise trade exports, nevertheless, experienced a little q/q fall of -3.5%. Weakened global demand brought on by rising prices and advanced economies’ tightening of monetary policy can be partly blamed for the fall.

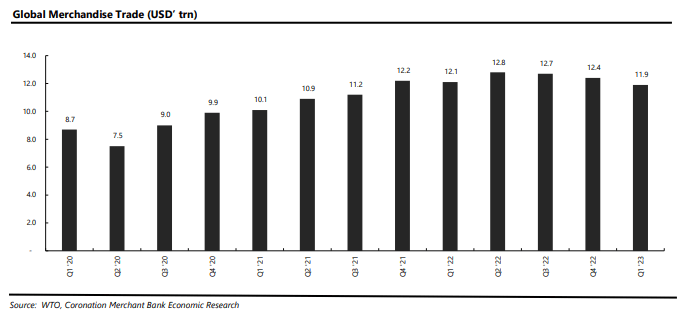

The Black Sea grain agreement was canceled by Russia in July of that year. According to our channel checks, the UN has suggested increasing Russia’s exports of grains and fertilizer in an effort to persuade it to rejoin the Black Sea grain agreement.

We point out that the Black Sea Grain deal’s termination might result in higher food costs and increased headline inflation. The impact of the suspension of the grains deal is being mitigated by better harvest circumstances from nations like Brazil and Argentina, thus select grain prices have continued to moderate.

Furthermore, after the grains agreement was terminated, there had been an increase in attacks on Ukrainian ports. Grain warehouses and oil storage tanks were destroyed as a result of recent accidents at the ports of Renzi and Izmail. Given the conflict between Russia and Ukraine, there is now little chance of reviving the grain agreement.

Wheat prices at the end of August in 23 decreased by -8.6% m/m to conclude at USD315.8/MT. As a result of increased production levels and ideal weather, wheat prices have remained stable. In addition, maize prices dropped -14.3% month over month to settle at USD207.6/MT. In the meantime, cocoa prices climbed by 1.3% m/m as of the end of August 23, primarily as a result of the occurrence of cocoa pod illnesses and poor weather in cocoa-producing countries.

According to trade statistics, China’s overall exports decreased by 4.3% year over year to USD 864.2 billion in Q2 23 from USD 902.9 billion in the same period of 2022. The comparatively lax consumption habits are a major factor in the reduction in demand for China’s exports. In terms of imports, China too saw a drop of -6.4% y/y to USD681 billion in Q2 ’23 from USD637.5 billion in Q2 ’22.

With Nigeria as its center, there are several chances for global economic growth and development. Stakeholders must lower trade barriers and encourage the use of innovation and technology in trade processes in order to accomplish this. Nigeria may be a key player in advancing regional and global trade due to its wealth of resources and advantageous location.

SOURCE: Coronation economic note from Coronation Merchant Bank