Which country has the Most Startup Ecosystems in 2021?

The United States of America has the highest number of Startup Ecosystems for 2021 in the Global Startup Ecosystem Index published by StartupBlink. The US which has a total of 267 Startup ecosystems to occupy the number one spot is followed by the United Kingdom, Israel, Canada, Germany, Sweden, China, Switzerland, Australia and Singapore in that order.

There is an ongoing battle over global economic dominance between the United States and China, but when it comes to startup ecosystems US superiority remains unthreatened. Regarding startup ecosystems, the US is still the land of opportunity, representing the world’s most vibrant source of free and disruptive technological creativity. The US version of the internet is global and open, in contrast to more closed systems forming in other parts of the world. US startup ecosystems are leveraged by global cultural influence across all sectors, and by the fact that English is a globally dominant language, allowing US startups immediate access to global markets.

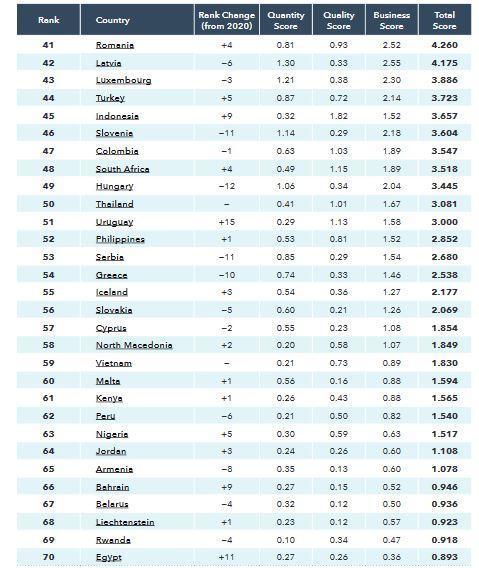

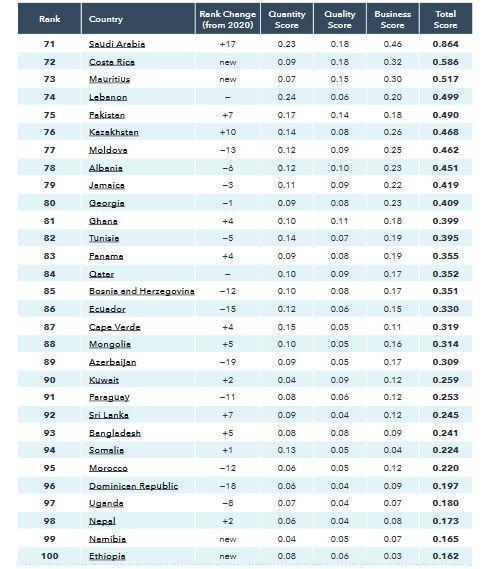

In all there are 14 African Countries on the top 100 list of the Global Startup Ecosystem for 2021. These countries are South Africa (Number 48), Kenya (Number 61), Nigeria (Number 63), Rwanda (Number 69), Egypt (Number 70), Mauritius (Number 73), Ghana (Number 81), Tunisia (Number 82), Cape Verde (Number 87), Somalia (Number 94), Morocco (Number 95), Uganda (Number 97) , Namibia (Number 99) , and Ethiopia at (Number 100)

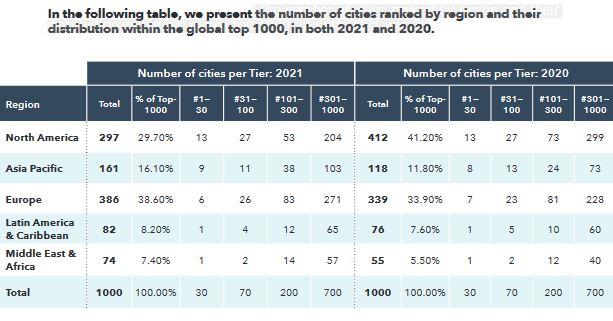

We start with the momentum of North America, a region which dominated 41.2% of the cities last year, and has decreased to 29.7% of cities this year.

The main reason for this decrease is a bit technical. In 2021, dozens of startup ecosystems were clustered together in the United States as part of the new ranking process. This clustering should have resulted in a decreased number of ranked cities in North America, but also an increase in the output of top tier cities, which receive an extra boost from cities in their cluster. The total number of ranked cities in North America has decreased as expected, yet the number of North America cities in the global top 100 stayed exactly the same at 40. More precisely, two Canadian cities dropped from the global top 100, while the US gained two cities.

The conclusion is that the North American region as a whole has lost both strength and momentum in comparison to other regions around the world this year. It should be noted however, that although the North America region no longer produces the highest number of ranked ecosystems globally, it is still leading in both the number of cities ranked between 1-30, where it holds 13 cities (43%), and cities ranked 31-100, where it holds 27 cities, or 39%, dominating the top tier. By comparison, Europe has 6 cities in the top 30, and 26 cities ranked 31-100. Similarly, North America clearly dominantes all ranked startup industries, presented later in the report. The city of San Francisco is the undisputed leader in all ranked industries, with the exception of one industry where New York ranks higher, demonstrating that North American – and particularly the US – cities are dominant hubs of global innovation.

The European region has the most cities in the global top 1000, with 386 cities now (or 38.6%), compared to 339 cities (or 33,9%) in 2020. This reveals the massive diversity of technological hubs in Europe. And yet, Europe’s momentum is not entirely positive. While Europe’s presence in the top 1000 improved, only 11 of 44 ranked European countries improved their rankings this year, and 25 of them dropped

. It is inherent to any ranking system that when one area decreases, another must increase. The Asia-Pacific region shows the opposite trend of Europe: only one of the 19 ranked countries in this region decreased in ranking (Australia), and two countries entered the elite global top 10: China and Singapore. Interestingly, this appears to be a power shift between Europe and the Asia Pacific, because China and Singapore replaced two European countries in the global top 10: The Netherlands and Spain. The Asia Pacific’s positive growth momentum is also well established by the number of regional cities in the global top 1000, which increased from 118 last year to 161 this year. This growth, however, does not yet translate into top tier presence among the global top 100 cities, where the Asia Pacific representation declined from 21 last year to 20 this year.

Similarly, in the top 30, much has remained the same as 2020, with Europe losing one city (Barcelona, Spain) to be replaced by a new Asia Pacific entry to the top 30 (Shenzhen, China). Having only one new Asian city entering the top 30 club is by itself an interesting observation, given the entry of China and Singapore into the global top 10 this year. While Singapore depends solely on its capital ecosystem, Singapore City, China’s rise to the top can be attributed to steep growth in many Chinese ecosystems in 2021; yet only one additional Chinese city entered the global top 30.

The Latin American and Caribbean region did not experience the same momentum as Asia Pacific. The number of Latin America countries represented in the global top 100 this year decreased from 15 to 13, and the number of cities in the global top 100 decreased from 6 to 5. Still, this region did see an overall increase in presence, from 76 ranked cities in the global top 1000 to 82 this year.

Finally, the Middle East & Africa region saw solid gains in the rankings this year, establishing very positive momentum. The region is represented by 22 ranked countries, compared to 20 last year, and showed a fantastic increase in the number of ranked cities, from 55 last year to 74 this year. Although the number of cities ranked in the global top 100 remained stable this year, the region’s representation among cities ranked 101-200 increased from 6 last year to 8 this year, showing that ecosystems in this region are continuing to develop