World Economic Outlook further tilts to the downside – Coronation Economic Note

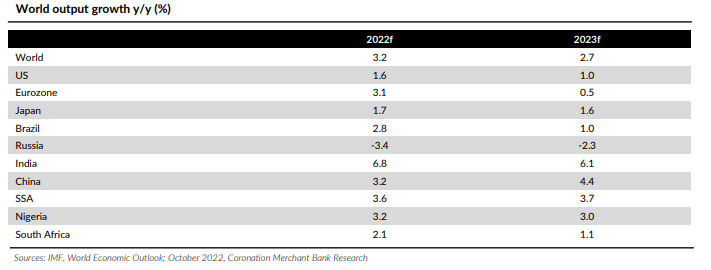

The IMF’s latest World Economic Outlook (WEO) has left its global forecast for 2022 unchanged at 3.2% y/y and has trimmed its projection for next year from 2.9% y/y to 2.7% y/y. The outlook projects contractions for one-third of the global economy in the near-term. We note that there were significant reductions in the 2022 forecasts for two of the largest economies, US and China. According to the WEO, the trickledown effects from Russian invasion of Ukraine, a cost-of-living crisis triggered by persistent inflationary pressure and the slowdown in China continue to negatively impact global growth.

The US global growth was revised downwards from 2.3% y/y to 1.6% y/y in 2022, reflecting the unexpected GDP contraction registered in Q2 ’22. In addition to weakening disposable income which is affecting consumer demand as well as upticks in interest rates that are straining spending capacities, especially on residential investments.

China’s global growth was revised downwards from 3.3% to 3.2% in 2022. The projection took into consideration, a sharper slowdown in China due to extended lockdowns and the worsening property market crisis as well as spillover effects from the Russia- Ukraine crisis.

YTD avg. crude oil prices have increased by 28.1%. The movement in oil prices reflects concerns around oil export disruptions during tight supply-demand balances, as well as a muted response by OPEC and other oil producers following prior divestments in the fossil fuel sector. It is also worth highlighting that strategic oil reserve releases by members of the International Energy Agency and slower demand amid COVID-19 lockdowns in China resulted in oil prices declining to below USD100 per barrel in Q2 ‘22. Since April, rising interest rates and recession concerns have impacted oil prices.

We note that refined-product prices peaked multi-year highs as European refineries encountered capacity constraints. We note that the futures markets suggest that oil prices will rise by 41.4% to an average of USD98.2/b in 2022 but will decline to USD76.3/b by 2025.

The steady upticks in inflation recorded across economies have resulted in rapid and synchronized monetary policy tightening, particularly among advanced economies. Based on the IMF’s outlook, avg. global inflation is expected to peak to 8.8% towards end-2022 and remain elevated at 6.5% in 2023, before declining to 4.1% by 2024.

Our inflation forecast took into consideration expected base effects, insecurity, persistent supply shocks on the back of the on-going Russia-Ukraine crisis, depreciation of the naira in the parallel market, and upticks in the price of PMS (on the back the planned fuel subsidy removal in 2023).

The Fund revised its forecast for sub-Saharan Africa to 3.6% (from 3.8%) in 2022. The slightly weaker outlook reflects lower trading partner growth, tighter financial and monetary conditions, and a negative shift in the commodity terms of trade. For Nigeria, the IMF trimmed its GDP growth projection in 2022 from 3.4% y/y to 3.2% y/y. The IMF’s inflation projection for Nigeria is 18. 9% y/y at end-2022 and 17.3% y/y by end-2023. In our view, wee inflation at 22.65% y/y at end-2022 and moderating to 18.3% y/y by end2023. Source: Coronation Merchant Bank