35.9% of adult Nigerians and 96% of MSMEs still financially excluded – Chimaobi Agwu

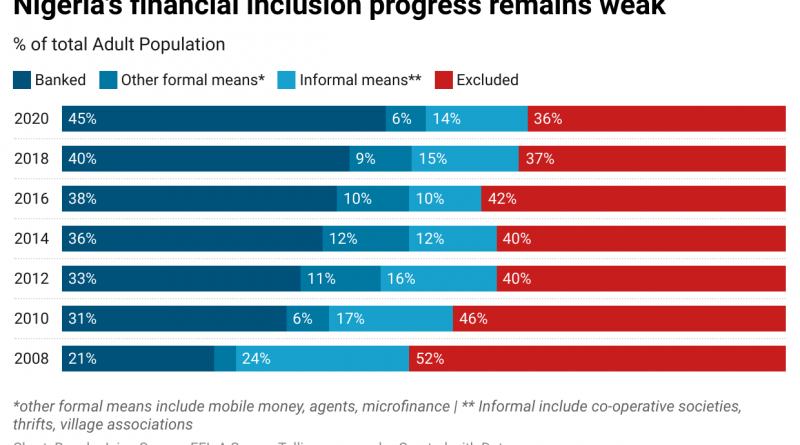

Despite several efforts and measures of Government and the Central Bank of Nigeria, 35.9% of adult Nigerian population are still financially excluded, without access to bank accounts, formal savings facilities, insurance, credit and pensions.

This was part of the presentation made by Mr. Isaiah Owolabi, the Managing Director of Efina, at the Access to Finance Dialogue organized by Mercy Corps at the Transcorp Hilton, Abuja on June 30th.

Speaking earlier, on the same subject, Dr. Ada Esenwah who represented the Director, Development Finance Department of the Central Bank, stated that as part of the Maya declaration, the Federal Government had undertaken to reduce the financial exclusion rate from 43.6% to 20%. To achieve this, the Government set up the financial inclusion Secretariat, developed the Nigerian financial inclusion strategy and launched the strategy with focus on women, youths, rural areas, the North East and MSMES. Unfortunately, while progress has been made, the target financial inclusion rate of 80% is yet to be achieved as the figures currently stands at 64.1%

The Maya Declaration is a global initiative for responsible and sustainable financial inclusion that aims to reduce poverty and ensure financial stability for the benefit of all. It is a statement of common principles regarding the development of financial inclusion policy.

Launched at the 2011 Global Policy Forum (GPF) in Mexico’s Riviera Maya, the Maya Declaration represents AFI’s core values and the first global and measurable set of commitments by developing and emerging country governments towards advancing the financial inclusion agenda. A public commitment to the Maya Declaration is a means of championing financial inclusion and contributing to a range of Sustainable Development Goals (SDGs), including goal 1 (no poverty), goal 5 (gender equality), goal 8 (decent work and economic growth) and goal 13 (climate action).

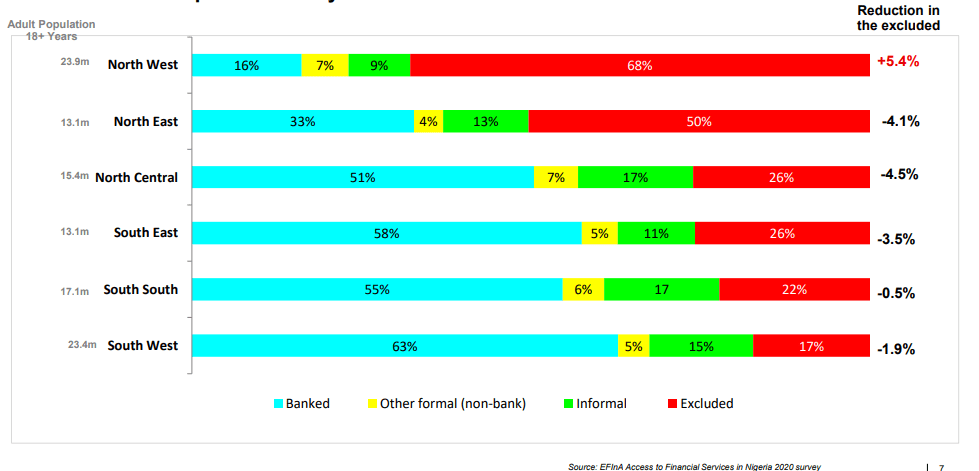

She further noted that of the six geopolitical regions, the North East has the highest rate of financial exclusion at 52%, a situation which is critically inhibiting development

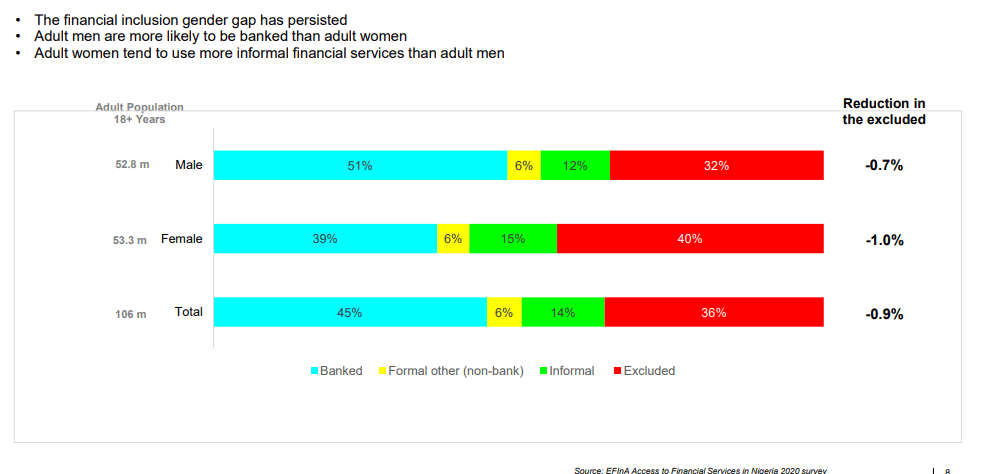

A review of the Financial Inclusion strategy in 2022 by the Federal Government revealed that financial exclusion has a gender dimension and is more acute among youths and in the rural areas. 40% of women are currently financially excluded as compared to 32% of men. As a result, current efforts are focused along these lines.

Adults in Northern Nigeria continue to be significantly more financially excluded than those in the southern zones, and rural adults are still more excluded than those in urban areas. Young adults, between the ages of 18-25, are significantly more likely than older adults to be financially excluded.

The Deputy Governor and Chair of the Financial Inclusion Technical Committee had in 2021 said that “despite progress achieved to date, critical groups remained excluded including women, rural dwellers and citizens in the northern area. To address the issue with women, CBN launched a Framework for Advancing Women’s Financial Inclusion in Nigeria in 2020 and is leading the industry to implement the framework, which we expect to lead to significant increase in women financial inclusion in Nigeria”

Also in 2021, the Deputy Governor, Financial Systems Stability (FSS), Central Bank of Nigeria (CBN), said: Financial inclusion is a strong lever for bridging income inequality, combating poverty and preserving social harmony. The CBN has accordingly been at the forefront of the efforts to drive financial inclusion in Nigeria by championing the development & implementation of Nigeria’s National Financial Inclusion Strategy led by the CBN Governor”

Access to finance serves as a buffer against vulnerabilities and makes communities much more resilient . Consequence of not having access to finance leads to disruptions, low productivity and reduced purchasing power.

For MSMEs in the country, study reveals that only 4% (i.e. 1.6 million MSMEs) of them have access to finance out of a total of 40 million MSMEs.

Mr. Ndubuisi Anyanwu, Country Director of Mercy Corps in Nigeria, observed that Financial Inclusion is key to achieving prosperity and that women, youths, displaced persons, those living with disabilities are more vulnerable to lack of access to finance. “Financial exclusion of marginalized communities and individuals becomes more critical to their survival”, he added.

Financial inclusion can benefit individuals, families, and businesses, supporting key outcomes such as GDP growth. For the first time, the EFInA Access to Financial Services in Nigeria 2020 Survey measured the financial health of Nigerian adults, finding that only 27% of Nigerian adults are considered financially healthy, while 39% are financially coping and 34% are financially vulnerable. Nigerians require a range of useful, affordable, and accessible financial services to meet all of their needs. Many Nigerian adults continue to rely on different types of providers to meet those needs; while use of banks increased in 2020, so did use of unregulated services such as savings groups and village associations.

The EFInA Access to Financial Services in Nigeria Survey highlights significant market opportunity for financial service providers to address Nigerians’ financial needs. For example, only 2% of Nigerian adults are insured, but 18 million uninsured adults say they would be interested in microinsurance. Only 7% of Nigerian adults have pension accounts, but 24 million adults without pensions are making regular savings for their retirement. While only 45% of Nigerians are banked, 35 million unbanked Nigerians own mobile phones and could be reached with mobile money.