Access Banks’ Parent Company, Access Holdings 2023 Financial Results beat Expectations

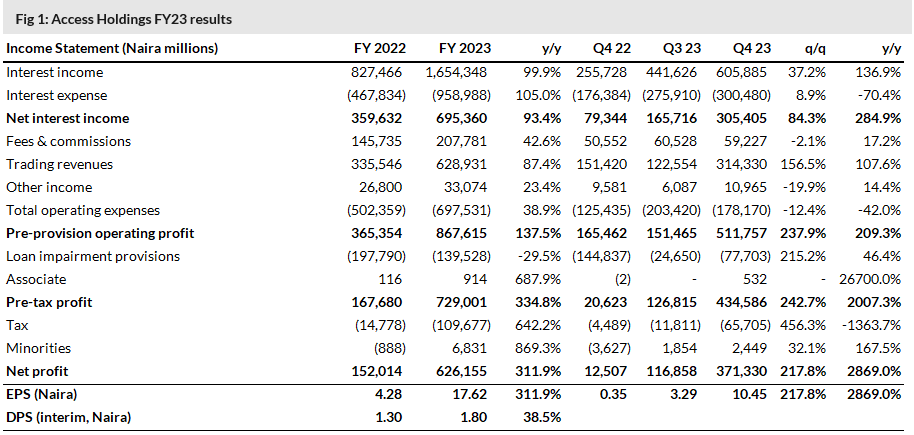

| Access Holdings (ACCESSCORP) released its FY 23 results before the trading session on Wednesday, 27 March. The group reported pre-tax and post-tax profit gains of 334.8% and 311.9%, respectively, for the period. Looking at Q4 23 performance, the group recorded a significant 2007.3% boost in pre-tax profits and 2869.0% growth in net profits. Accordingly, on the FY 23 EPS of N17.62, the group proposed a final dividend of N1.80 (versus N1.30 for FY 22), implying a final dividend yield of 7.5% on yesterday’s closing price. Stock Rating: BUY Price Target: N29.93 Price (27-Mar-2024): N24.00 Potential Upside / Downside: +24.7% Tickers: ACCESSCO NL Earnings for the period were primarily driven by expansion in non-interest income, particularly trading revenues (fair value gains on financial instruments) and fees & commissions. Owing to the above, the groups’ earnings beat our FY 23 growth forecast by 204.2%. The stock price gained 3.90% in yesterday’s trading session and is up 3.67% y-t-d. We expect the market to continue to react positively. |

|

|

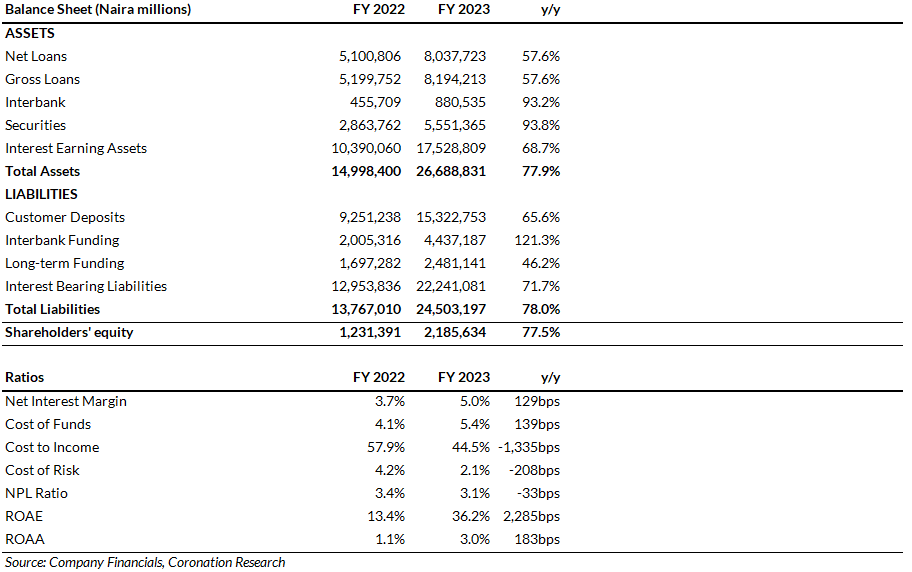

| Interest incomeInterest income advanced by 99.9% y/y for FY 23, driven by 163.4% y/y growth in interest from investment securities owing to an expansion in the investment securities portfolio by 93.5% y/y. Interest on loans to customers increased also by 62.0% y/y. The improvement in yield from advances to customers came on the back of 57.6% growth in gross loans which was much higher than our 36.1% forecast. This makes it the highest y/y growth in five years, surpassing the FY 19 growth of 49.1% y/y after the merger with Diamond Bank. Interest expense rose faster than interest income expanding by 105.0% y/y on the back of an 82.5% rise in interest paid on customers’ deposits, reflecting the rising interest rate environment, especially towards the second half of the period. The CASA mix was marginally unchanged at 62.8%, adding only 2bps from the preceding period. Interest paid on borrowed funds rose by 52.5% for the period owing to a 36.4% increase in interest-bearing liabilities. As a result, the cost of funding rose to 5.4% from 4.1% in FY22. Nevertheless, net interest income expanded by 93.4% y/y with the group’s net interest margin adding 129bps to 5.0%.Non-interest incomeNon-interest revenues (NIR) grew by 71.3% y/y as Trading revenues expanded by 87.4%. The expansion came as a result of trading gains from financial assets as well as improvements in fees and commission income (+42.6% y/y) on the back of improved income from the group’s channels and e-business income and credit-related fees and commissions. The contribution of non-interest revenues to total revenues declined to 55.6% from 58.6% in FY 22. Operating expenses grew 38.9% y/y, principally driven by IT and e-business expenses, regulatory costs, and administrative expenses. However, Q4 23 expenses alone declined by 12.4% q/q and 42.0% y/y. The cost-to-income ratio fell to 44.5% y/y from 57.9% y/y. Pre-provision operating profits expanded by 137.5% y/y. Loan loss provisions declined 29.5% y/y with the cost of risk declining to 2.1% from 4.2% in FY 22. Overall, the group’s pre-tax profit grew by 334.8% y/y, the effective tax rate increased to 15.0% (8.8% in FY 22). Asset qualityThe non-performing loan ratio declined to 3.1% for the period from 3.4% in FY22, a positive trend in asset quality over the last four years and below the 5.0% regulatory limit. The total capital adequacy ratio ended the period at 19.0%, higher than the minimum regulatory requirement of 15.0%.ConclusionOverall, the results impressed the market, beating both our view and those of other analysts. The market reacted positively to the results yesterday which in our opinion is due to the increase in dividends. As part of the firm’s growth strategy, it has announced its proposed acquisition of the National Bank of Kenya and the acquisition of an insurance company Megatech Insurance Brokers, and others. We expect that this diversification will continue to further strengthen the group. SOURCE: Coronation Asset Management Limited. |