Americans lose millions of dollars to wire transfer fraud scams

Millions of dollars are being lost by Americans each year due to criminals who engage in fraudulent wire transfers (wire transfer scams or money transfer scams) to steal money from their bank accounts. In response to this alarming issue, certain U.S. senators are now urging major banks to provide explanations regarding their efforts to combat these scammers.

The Senate Banking Committee, as reported by CBS News, recently sent a letter to JP Morgan Chase, Citibank, Bank of America, and Wells Fargo. In this letter, the committee emphasized that banks should take responsibility for unauthorized transactions, including those that involve fraudulently induced wire transfers. They specifically highlighted cases where consumers were deceived or manipulated into initiating such transfers.

Several Chase bank customers, who were interviewed by CBS News, shared their personal experiences of falling victim to these scams. Jennifer Davis, a resident of New York City, recounted losing $25,000 to a wire fraud scheme. She expressed her shock and devastation, emphasizing that this was a crime committed against her.

Andrew Semesjuk from Connecticut also suffered a loss of $15,000. He questioned the purpose of entrusting his investments to a bank if they fail to protect them adequately.

Nikki Kelly, a resident of Florida, shared her distressing ordeal of losing $48,000 from her business account. She described the impact on her life as nothing short of destruction.

Karen Roe, another Florida resident, had a similar experience. While she was in the hospital for a medical procedure, she received a call from someone claiming to be from Chase Bank. The caller ID displayed the bank’s name, further deceiving her. The person on the line informed her about a transaction that had supposedly taken place on her account, amounting to $71 at a Walmart in New Mexico. Roe vehemently denied any involvement, stating that she was in Orlando and had never been to New Mexico.

These accounts highlight the urgency of addressing this issue and ensuring that banks take appropriate measures to protect their customers from fraudulent wire transfers.

Following that, the man alleged that someone was attempting to wire-transfer funds out of her account and requested her to verify her identity over the phone before he could stop the transaction.

“He mentioned that he would send an authentication code to ensure that it is indeed me on the other end of the line,” Roe stated.

She provided him with the code, only to later discover that it was not a step taken to verify her identity. Instead, the scammers utilized the code to authorize a wire transfer from her account to their own.

Roe mentioned that they managed to steal $27,000, which she had earned from her countertop installation business. The money vanished within seconds, leaving her in a state of shock.

“It completely upended my life,” Roe expressed.

Furthermore, the criminals also stole an additional $19,000 from an account she managed for a nonprofit industry group. This left her facing inquiries from the group members regarding how the theft had occurred.

“That money didn’t even belong to me. It belonged to the members,” Roe lamented. “And I was just devastated, sick to my stomach.”

Chase conducted an investigation into the theft and acknowledged in a letter to Roe that she was “the victim of a scam.” However, the bank argued that the wire transfers were “authorized” and claimed to have “received calls verifying the wires as valid,” with someone providing her debit card number and PIN. They further stated, “we processed it as you instructed.”

Roe expressed her belief that she is being unfairly blamed.

“They’re not taking responsibility for what their customers are going through,” she asserted.

When approached by CBS News, Chase stated that it does reimburse customers for “unauthorized transactions” if it determines that the customer had no involvement in the transaction.

However, in Roe’s case and those of the other victims interviewed by CBS News, Chase refused to reimburse their money, as they had deemed the transactions “authorized” despite the victims reporting the scam to law enforcement.

Davis expressed his frustration, stating, “They abandoned me without any support. I am unable to comprehend the situation.” According to consumer experts, the issue lies in the federal law that safeguards consumers in various banking transactions, known as the Electronic Funds Transfer Act (EFTA). Unfortunately, wire transfers are generally exempt from this protection, allowing banks to avoid reimbursing losses incurred by consumers.

The National Consumer Law Center argues that this regulatory loophole should be closed in order to incentivize banks to enhance their security measures. Carla Sanchez-Adams, a senior attorney at NCLC, believes that if banks were aware of their responsibility to reimburse consumers, they would implement stronger security procedures. Senator Sherrod Brown, the chairman of the Senate Committee on Banking, Housing, and Urban Affairs, emphasized the need for better protection for consumers, placing the responsibility on companies to ensure the safety of people’s money.

The committee has requested the four banks to provide information spanning five years, including the number of reported victims and the total amount of money lost.

A CBS News analysis revealed a significant increase in consumer complaints regarding domestic wire fraud at JP Morgan Chase, with the number of complaints more than quadrupling from 88 in 2020 to 355 in 2023. When approached for comment, all four banks declined to respond to the Senate Banking Committee’s letter.

Chase, however, stated that it continues to invest significantly in protecting customers from fraud and educating them about tactics employed by criminals. In a previous Senate hearing, Chase CEO Jamie Dimon argued that it was unreasonable to expect banks to financially support criminal activities and called for increased efforts from the government and law enforcement to prevent and prosecute wire transfer fraud scams. Chase provided CBS News with a statement and offered tips for consumers to protect themselves.

Consumers must always exercise caution when approached by individuals requesting passcodes, access to their device, or money in order to prevent fraud. It is important to note that legitimate banks will not make such requests or ask you to transfer money to yourself, as this is a common tactic used by scammers.

Scam prevention advice:

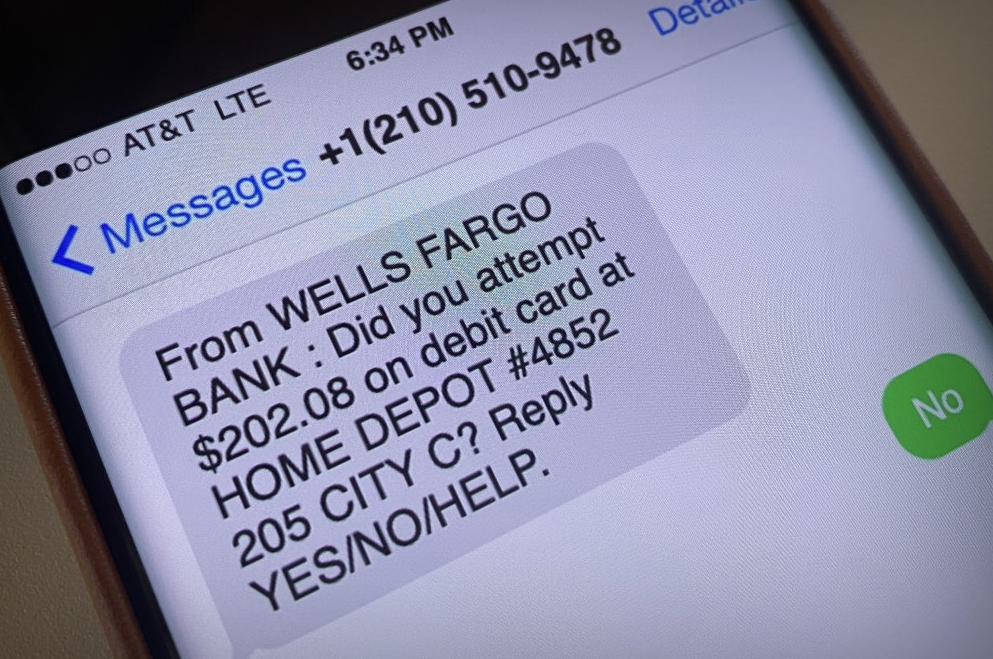

Scammers have the ability to manipulate phone numbers, making it appear as though the call or text is coming from your bank when it is not. This is done to deceive individuals into disclosing personal or financial information, or to convince them to send money.

It is crucial to remember that even if the caller ID displays a call or text from Chase, it could still be a scam. If you are unsure, it is best to end the call and contact us directly.

To ensure that you are speaking with a legitimate representative of your bank, call the number on the back of your card or visit a branch in person. Consumers should safeguard their personal account details, passwords, and one-time passcodes.

Banks will never reach out via phone, text, or email to request that you transfer money to yourself or anyone else as a means of preventing fraud. Always verify the recipient before sending money, as once the transfer is made, it may be irreversible. For more information on common scams and tips to protect yourself, please visit: www.chase.com/security. SOURCE: CBSNews. Story by By Anna Werner. –Nicole Busch contributed reporting.