Boost to Manufacturing still required in Nigeria – Coronation Economic Notes

The importance of a vibrant manufacturing sector in emerging economies cannot be over emphasized. A functional manufacturing base attracts increased research, productivity, and exports. In addition, due to its extensive value chain, the sector is capable of boosting jobs across different economic classes. There are several factors that could support the steady expansion of a country’s manufacturing sector. These factors trigger demand and supply dynamics which are essential for a thriving manufacturing base. They include consumption patterns, money circulation, fx liquidity, infrastructure ( power, inclusive) and supply chain among others.

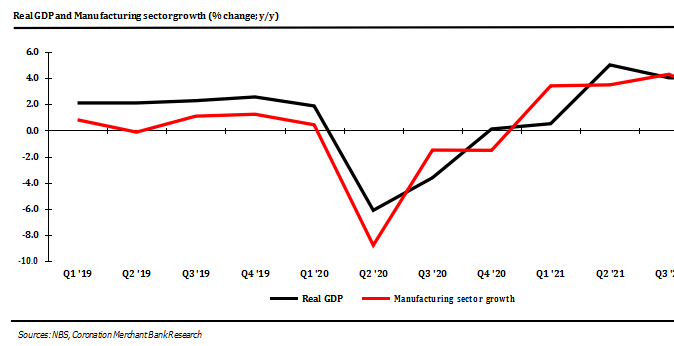

In the manufacturing sector, growth slowed to 2.3% y/y in Q4 compared with 4.3% y/y recorded in Q3. For FY ’21, the sector grew by 3.5% y/y compared with a contraction of – 2.8% y/y recorded in 2020. The food, beverages, and tobacco segment grew by 5.7% y/y while the textile, apparel, and footwear segment contracted by 1. 3% y/y respectively in 2021, compared with a growth rate of 1.5% y/y and 7.6% y/y respectively in 2020. Combined, these segments accounted for 69.1% of the total manufacturing sector in 2021. The chemical and pharmaceutical products segment grew the fastest at 8.1% y/y in 2021, but from a low base.

Following Russia’s invasion of Ukraine, oil prices have surged above USD100 per barrel to hit their highest level since 2008. Unlike premium motor spirit (PMS), diesel has been deregulated. As such, the surge in global oil price has led to an increase in diesel price. According to the Manufacturers Association of Nigeria, the situation has resulted in soaring operational costs as most businesses rely on diesel- powered generators in the absence of reliable grid electricity. The proposed take-off of the Dangote Refinery in Q4 ‘22 is expected to help improve the supply of petroleum products in Nigeria.

Russia and Ukraine are also major exporters of agricultural commodities, particularly grains. Based on data from the Food and Agriculture Organisation, both countries accounted for about c.30%, c.80%, and c.14% of global wheat, sunflower seeds, and maize exports respectively in 2020. According to the National Bureau of Statistics (NBS), Russia accounted for c.4% (N824bn) of Nigeria’s total imports in 2021. The Russia- Ukraine crisis has halted shipments from the Black Sea, which has adverse implications for global trade activity.

Typically, to meet high fx needs, manufacturers blend fx rates across markets. Therefore, forcing some manufacturers to source funds from the parallel market, which trade s at a significant premium to the I&E window (41.3% as at 31 March 2022). This also contributes to the uptick in operational costs for the manufacturing sector. We note that the CBN has released the operating guidelines for the non-oil export proceeds repatriation rebate scheme as introduced in the RT200 FX program that aims to attain a goal of USD200bn in FX repatriation from non-oil exports over the next 3-5 years.

The CBN’s Manufacturing Purchasing Managers’ Index (PMI), moderated slightly to 50.1 index points in February ‘22 from 51.4 index points in January ‘22. A reading above 50 points toward an expansion while a reading below 50 translates into a contraction.

Manufacturers face a dilemma with.regards to incurring additional costs due to rising operational costs or passing on these costs to consumers. For the latter, the current squeeze on household wallets may result in a potential loss of market share to foreign competitors due to their relative affordability. We expect the uptick in operational costs to have an impact on the headline inflation rate (currently at 15.70% y/y).

To provide some level of respite, particularly given the economic downturn experienced in 2020, the CBN created a N1trn intervention scheme to boost local manufacturing. Based on industry sources, a total of N1.08trn has been disbursed to 368 projects across various sectors in agro-allied, mining, steel production, and packaging industries.

China can be considered as a poster child.with regard to countries with budding manufacturing sectors. China’s industrial sector accounted for c.32.6% of its total GDP in 2021. China is export.oriented, however, it seems there is now a deliberate push toward s boosting domestic consumption of China.made products. We understand that there a re now steps towards significantly reducing imported items to enable the domestic distribution of locally manufactured items. In China, foreign investment has been encouraged through the creation of Special Economic Zones, which offered incentives such as reduced tax rates for foreign companies willing to set up manufacturing operations.

In Africa, Morocco is transforming itself into a manufacturing hub through investments in industrial parks, free trade zones, and supporting infrastructure such as railways, storage facilities, and ports as well as signing automotive free trade agreements with t he European Union and the United State. These combined with investments from the leading automakers in Africa are largely responsible for the growth observed in Morocco’s manufacturing sector. Nigeria may consider adopting a few of these initiatives to boost the domestic manufacturing sector.

We note that the absence of constant power supply has contributed to the slowdown o f Nigeria’s much-needed industrial take-off as self generation places pressure on operating expenses. The CBN has disbursed N1.28trn to power sector players since 2017, under the Nigeria Bulk Electricity Trading Payment Assurance Facility (NBET PAF). In addition, N232.9bn has been released to distribution companies (DISCOs) under the Nigeria Electricity Market Stabilisation Facility – Phase 2 (NEMSF- 2). These interventions are designed to improve access to capital and support the development of enabling infrastructure within the country’s power supply value chain.

The African Continental Free Trade Area (AfCFTA) agreement is expected to contribute significantly toward the development of regional value chains. To maximise the benefits of the agreement, Nigeria’s manufacturing sector needs to be strengthened through the provision of adequate infrastructure. For example, improvements in ports, transportation & power. Furthermore, there is need for significant improvement by local manufacturers in terms of product standards and service delivery. This must b e achieved if local manufacturers are to be competitive in an expanding intra-continental marketplace.

SOURCE: Coronation Merchant Bank Limited