Capital imports in Q2 Nigeria declined by -2.4% q/q

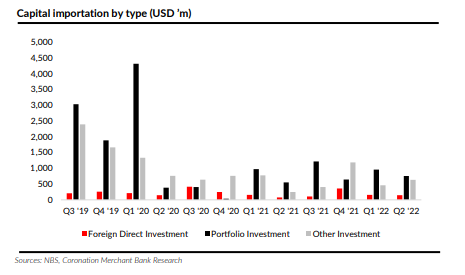

The National Bureau of Statistics (NBS) released its latest report on capital importation for Q2 ’22. The data was obtained from the CBN and compiled using information on banking transactions from all registered financial institutions in Nigeria. The total value of capital imported in Q2 was estimated at USD1.5bn, representing a decline of -2.4% q/q. The slowdown can be partly attributed to foreign investors’ apathy towards the country due to the choppy macroeconomic environment. Meanwhile, on a y/y basis, it increased by 75.3%. The y/y growth reflects positive base effects given the relatively low base in the corresponding period in 2021. The capital importation data is gross, and not adjusted for capital exports.

The category referred to as portfolio investment accounted for the largest share (49.3%) of total capital importation in Q2 ’22. On a q/q basis, portfolio investment decreased by 21%. Bonds accounted for 43% of total portfolio investments, increasing by 4% q/q. In Q2, the average yield for FGN bonds in the secondary market increased by 46bps to 11.2% q/q. Given upticks in headline inflation (19.64%, as at July ’22), real yields become somewhat attractive on the back of rising yields in select fixed income instruments. Money market instruments accounted for 56% of total portfolio investments and decreased by 31% q/q.

Demand for equities was relatively low in Q2 ‘22. Equities accounted for 2% (USD12.7bn) of total portfolio investments in Q2, this is the lowest since 2013. From the recently released earnings reports, we see that there was muted performance of corporates in Q2. However, NGX-ASI posted a positive return of 16% in Q2 ’22. Data from NGX show the ratio of local to foreign investment participation at 71:29 in Q2.

In the quarter under review, foreign direct investment inflow declined by -5% q/q to USD147m. On a y/y basis, it in

Marginal q/q dip in capital imports Singapore is one of the largest recipients of FDI inflows in the world. Factors such as a simple regulatory system, tax incentives, and relatively political stability make Singapore an attractive investment destination. Additionally, China has been able to boost their FDI through strong investments in services and high-tech sectors. Therefore, there is a need for forward steps in creating a conducive business environment and appropriate fiscal incentives to match the aforementioned favoured destinations for foreign investments.

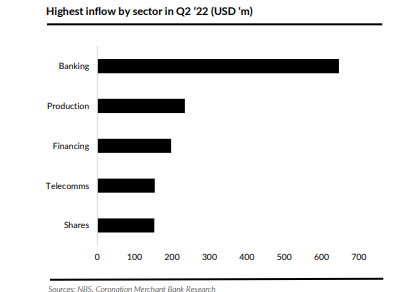

From a sector perspective, the banking sector received the highest inflow (USD646m) in Q2, accounting for 42% of total capital importation. The second largest recipient was production (USD234m), which we are assuming falls under the manufacturing sector.

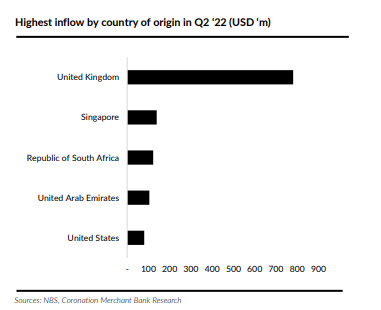

Capital importation by country of origin show that the United Kingdom was the top source of capital imported in Q2 with a value of USD781m, accounting for 51% of total capital inflow during the period. This was followed by Singapore (USD139m) and South Africa (USD122m). It is worth highlighting that only four states (Anambra, Ekiti, Kogi and Lagos) and the FCT, recorded capital importation in Q2. There is need for strategic capital projects to improve infrastructure quality. This could attract foreign investments across states. The inability of the 32 other states to attract inflow is likely to continue to hinder an inclusive investment approach.

YTD, the CBN has raised the monetary policy rate by 250bps (MPR currently at 14%). This could support investments into the domestic fixed income market in the near term. However, given the current stance (i.e. tightening) of select central banks in advanced economies, a slower pace with capital inflow in emerging markets (Nigeria, inclusive) is expected. FX repatriation issues adversely impact foreign investment activity. We note that in August, Emirates announced plans to suspend flight operations in Nigeria following difficulty to repatriate funds. This was rescinded after the CBN released USD265m to settle foreign airline outstanding ticket sales.

Based on trading activities to date this quarter, we expect the Q3 report when published to show muted inflows from portfolio investments. Overall, capital importation in Q3 is likely to remain below pre-pandemic levels. The projected underperformance can be partly linked to relatively weak macroeconomic environment, flight to safety following interest rate hikes across advanced economies, concerns around upcoming elections and the lingering conflict between Russia and Ukraine.

SOURCE: Coronation Economic Notes by Coronation Merchant Bank