Egypt’s first commodities exchange market to start operations in 2021

Egypt plans to start operating its first commodities exchange by January 2021 which will provide commodity markets with greater price stability by reducing risk and increasing the number of traders as well as trade volume, value, and efficiencies.

On January 22, 2020 The Egyptian Prime Minister Dr. Mostafa Madbouly, issued Decree No. 182 authorizing The Egyptian Exchange (EGX), Ministry of Supply and Internal Trade (MOSIT’s) Internal Development Agency and the General Authority for Supply Commodities (GASC) to establish a joint stock company called “The Egyptian Commodity Exchange.”

This company will be responsible for all tasks related to the management of the commodity exchange, including the facility of trading systems, quotations, pricing and control mechanisms, and risk management.

Up to $6.3 million of capital will be allocated to run the new commodity exchange.

Investors in the company include major state banks (Misr Bank, The National Bank of Egypt and The Agricultural Bank), EGX, and MOSIT.

Other stakeholders will include IC Capital, the Hermes Financial Group, the Misr Insurance Holding Company, the Misr Authority for Central Clearing, Depository and Registry, and the FEDCOC.

The company’s board will be made up of stakeholders with the Egyptian government holding 51percent of the shares and the remaining 49 percent for private entities.

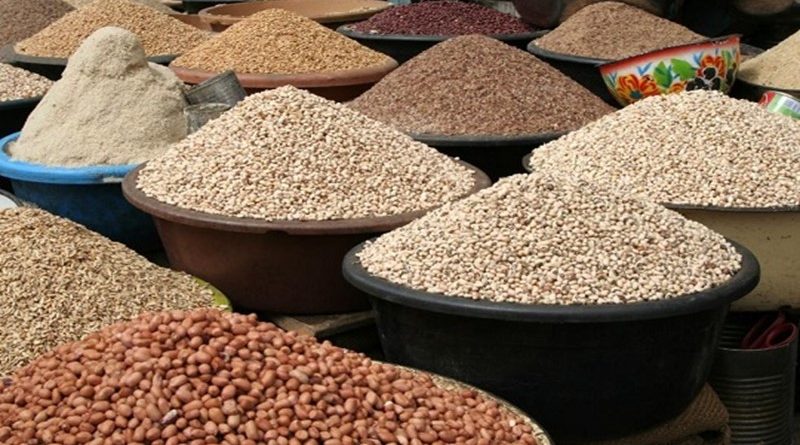

The exchange will initially offer trading of four agricultural commodities — wheat, corn, rice and sugar.

The Exchange would be for spot commodities that have large market volumes and are storable for long periods. Futures will not be offered on the exchange for the foreseeable future.

Egypt has for years long considered setting up a commodities exchange. On October 20, 2019 EGX celebrated the completion of new commodity exchange feasibility study that was developed in collaboration with MOSIT and the Federation of Egyptian Chambers of Commerce.

According to the study, the commodity exchange will be an electronic platform that is connected to logistics centers, crop collection centers, warehouses and silos to identify commodity supply and demand and ensure a more efficient value chain.

The aim of establishing a commodity stock exchange is to ensure fair, clear, and transparent trading and pricing of commodities through market mechanisms of supply and demand.

The Exchange is expected to contribute to reducing inflation resulting from fluctuating commodity prices, in addition to enhancing the marketability of smallholder production.

The Exchange is expected to provide greater stability for whenever there are commodity price fluctuations by reducing risk and increasing the number of traders, trade volume, trade value and enhance overall product quality.

This will increase trade effectiveness and promote efficiencies that will result in higher income for small scale farmers, and consumers will have access to higher quality and affordable goods.

The commodity exchange can also act as a vehicle to create new ideas and innovations across the food value chains, thus attracting new investments into the agri-food sector.