How Uber Makes And Loses Money – CB Insights Research

Uber is the quintessential two-sided marketplace, but the real mechanics and drivers of its business are poorly understood. We look at where Uber makes money, where it spends it, and what profitability looks like.

As one of the fastest-growing and most controversial startups to ever come out of Silicon Valley, Uber has always upset expectations.

In an industry where keeping your cost of customer acquisition low is key to scaling your growth, Uber has been comfortable spending huge sums acquiring drivers and incentivizing users.

While most software companies stress the importance of retention, Uber has allowed its churn rate to reach nearly 13% monthly.

And despite the fact that most people know Uber first and foremost as a ride-hailing company, the fastest-growing unit at the company is Uber Eats, which generated $1.5B in revenue in 2018 — more than GrubHub.

With its much-anticipated IPO last week, Uber finally opened itself up to the scrutiny of the public markets. So far, the results have not been encouraging. The company priced shares at the the bottom of the range. Prices then fell more than 15% within the first few days of trading, reflecting concerns around profitability and a general market downturn. This was the ninth worst IPO debut in history in terms of share price drop.

To better understand how Uber makes (and loses) money, we looked at Uber’s public financial and user data, statements from senior team members at Uber, and texts like Brad Stone’s The Upstarts formed from interviews with leaders there.

We took apart the costs and revenues of running Uber, geographical effects on both, the future bets the company is making, and how all of this ties into the story Uber is telling about its long-term viability as a business.

Table of Contents

- How Uber works

- Uber’s cost centers

- Uber’s revenue centers

- Uber’s fundamentals

- Uber: forecasting the future

How Uber works

The two-sided marketplace is one of the fundamental internet business models. Take a group of buyers and a group of sellers, connect them via a technological intermediary like a website or mobile app, and collect a fee from each transaction.

Make using your platform easier, faster, or more powerful than the traditional method of connecting those buyers and sellers, and you have a business.

Ebay was the first major two-sided marketplace success — today, however, companies like Uber and Airbnb have made it more popular and powerful than ever.

Each company in this space has improved upon the experience and economics of the system that it supplanted: eBay, by making it possible to buy and sell anything to anyone on the planet; Airbnb, by making it possible to rent out or book a room to/from anyone on the planet; and Uber, by allowing taxi passengers and its drivers to find each other without relying on the luck of a curbside hail.

Bill Gurley, general partner at Benchmark and early investor in Uber, lists ten criteria to consider when evaluating two-sided marketplace businesses:

- Is it a qualitatively better customer experience?

- Does it provide an economic advantage?

- Can the technology make the marketplace more powerful?

- Is the current market highly fragmented?

- Is supplier signup currently high-friction?

- Is the market large enough?

- Can the market be expanded?

- How often will people transact on the platform?

- How do you get paid?

- Does adding to the network make the network more powerful?

For Gurley, satisfying just seven or eight of these categories could make a marketplace business a good investment with a high chance of success. His primary example for most of them, and one of the few companies that could make a claim to satisfying all of these categories, is Uber.

Today, Uber has used these criteria to expand its marketplace to six continents and over 700 cities, across which it provides about 16M trips every day. In 2018, Uber customers traveled about 26B miles in total with the company, and Uber saw $41.5B in gross bookings from its ride-hailing business, making $9.2B in related revenue.

Uber’s double-sided marketplace

The main advantage of Uber’s two-sided marketplace has been its efficiency.

The medallion cab system operates through forced scarcity — there can only ever be a certain number of cabs on the road in any given city. As a result, fares are high. Cabs never seem to be around when you need them, like late at night or in the pouring rain. And over time, these problems get worse — as the population of a city grows, the cab population often doesn’t.

Uber, on the other hand, has become more valuable the larger its network has grown. For Uber, growth means faster pickup times, more drivers on the road, and potentially lower prices for riders. It also means more revenue for Uber. It fits all the criteria of the ideal marketplace business.

The core value of that marketplace is reliability. Old-school taxis find fares either by driving around and picking them off the street (street hail), or having a dispatcher (with phoned-in customer requests) instructing them on where to go.

In other words, “supply” can meet “demand” in one of two ways: through a loosely-organized, semi-random process of discovery, or through a direct routing by a dispatcher middleman.

With medallion cabs, drivers come into contact with riders randomly or through a dispatcher-directed pickup.

For taxis, that has meant:

- Poor supply allocation for drivers. Traditional cabs only have a passenger in the car 30–50% of the time. To find a fare, they’re dependent on taxi stands, centralized dispatchers, or being hailed from the street — they have no other way to know where to go next.

- Low supply liquidity for riders. Traditional cabs congregate in urban cores and high-transit areas, leaving outer boroughs, suburbs, and “less profitable” areas under served. Riders in these areas are often unable to get a cab at all, or face long waits.

With Uber, on the other hand, users request rides directly through the app. The nearest driver is dispatched to their location, and they can be hailed again immediately after drop-off, creating:

- Better supply allocation for drivers. Uber drivers have passengers in their cars more often, meaning less time and money wasted.

- Higher supply liquidity for riders. With surge pricing moving drivers from area to area, finding a ride is more reliable.

This last point — surge or dynamic pricing creating liquidity — is one of the pillars of the Uber business model.

In the Uber model, drivers and riders can find each other more quickly and more reliably.

Surge pricing, while sometimes a deterrent to riders, helps Uber meet fluctuating levels of demand with an optimal level of supply. By ramping up prices (and driver payouts) at times of low supply, the company makes sure that drivers are on the road and passengers are getting picked up.

In addition to increasing the supply to high-demand areas, surge pricing also helps control customer demand, as those unwilling to pay a higher price will find other means of transportation, while others will pay for the surge.

Because of surge pricing, Uber can also continue to hire contractors who work flexible hours, rather than set schedules with set pickup areas — crucial for keeping costs down, but also for constantly repopulating its high-churn employee base (see “Driver Acquisition & Retention”).

Surge pricing works by providing a financial incentive for drivers to change location. Drivers receive a text or in-app notification informing them that surge pricing has been “turned on” in a specific area.

Texts sent from Uber to encourage drivers to get on the road during surge periods.

Since then, Uber’s business model has retained the same basic dynamics. Its two biggest initiatives since UberX — Uber Pool and Uber Eats — aim to increase driver utilization even further. With Pool, it adds more passengers to the car. With Eats, drivers move around more than just people.

Everywhere, Uber is experimenting with layering more value onto the latent, global logistics network that it has built with its fleet of nearly 4M drivers.

Once the underlying technology is vetted and scaled, autonomous vehicles could transform the company’s business model further — and the company is already experimenting with this technology. Without the cost of the driver, Uber would be able to keep another 75% of every fare.

Drivers are the biggest (but not the only) cost of doing business for Uber. Below, we look at the massive expenses associated with becoming the most popular ride-hailing app.

Uber’s cost centers

Uber became a darling of Silicon Valley investors by nullifying many of the greatest costs of running a traditional taxi service.

Uber doesn’t pay its drivers as employees, it pays them as independent contractors. Uber doesn’t own cars, its contractors bring their own. Uber (as a pure ride-hailing service) has no physical assets to manage. The company just coordinates the meeting of supply and demand, and takes a cut.

That model — or more specifically, Uber’s method of going about it — wound up being quite expensive.

Uber’s losses today are the stuff of startup legend.

Uber’s operating loss in 2016 amounted to more than $3B. It increased 35% to $4.1B in 2017 and fell back to $3B in 2018, still extremely high given Uber’s maturity, low driver wages, IPO, and slowing growth.

While Uber’s basic business model is quite capital efficient, it has continued to struggle with its costs, which has been driven by a number of factors:

- Constant geographical expansion: Uber set out to conquer the world, believing that being the first mover could give the company an early advantage — but doing so meant spending hundreds of millions of dollars to start up, lobby, and often fight in unfamiliar markets.

- Commodification of ride-sharing: Because Uber has little valuable IP, and local companies and VCs have an incentive to gain a ride-sharing monopoly in their own areas, Uber has spent hundreds of millions fighting well-capitalized local competitors, attempting to drive its revenues down and costs up.

- Poor overall driver retention: While part-time work and flexibility are core to the Uber driver experience, its ~13% monthly churn rate on drivers means hefty sales, marketing, and promotional spend designed to keep people signing up and driving for the platform.

To rein in costs, Uber has been doubling down on its core markets while also expanding its offering beyond just car rides to incorporate bikes, scooters, and public transportation options into its platform.

Driver acquisition & retention

The cost of acquiring drivers has been one of the most expensive parts of running Uber since its inception. In Uber’s early years, new drivers got sign-up bonuses as high as $2,000 or $5,000 just for completing a few rides on the app.

Today, referral bonuses have been scaled down significantly, but Uber still spends billions per year marketing itself to new drivers, paying out on other incentives, and financing driver vehicles. In 2018, Uber spent more than $3.1B on sales and marketing, plus nearly $900M on excess driver incentives.

Part of the problem for Uber is driver churn. Only about 20% of drivers remain on Uber’s platform after one year, The Information has reported — equivalent to about 12.5% monthly churn.

Uber, thus far, has largely been able to counteract the deleterious effects of high churn through its high take rate and short payback period.

Between the middle of 2017 and approximately June 2018, Uber grew from approximately 2M to 3M drivers worldwide. At 12.5% monthly churn, that kind of growth would have meant consistently adding about 450,000 new drivers to the platform per month.

Over that same period, the company spent an average of about $230M per month on sales and marketing and about $110M per month on partner incentives. Uber’s acquisition spend has always been tilted towards drivers — referral bonuses for drivers coming in at $200 — $5,000 compared to $20 — $40 for riders.

If we set aside 80% of all Uber’s monthly sales & marketing spend for driver acquisition, plus partner incentives, we end up with an average driver acquisition cost of about $650.

Today, according to its S-1 filing, Uber has 3.9M drivers around the world. Each month, those drivers generate a little more than $3.4B in gross bookings. Of this, Uber makes about $900M: that works out to a revenue per driver per month of about $230.

This means Uber earns back what it spent to acquire a driver within just about three months.

At a 12.5% monthly churn rate, you lose about a third of your drivers after three months, but the impact of this is difficult to model precisely.

Uber argues that its drivers churn out by design, because Uber is less a “job” and more an “in-between” and part-time solution. Uber certainly hasn’t run out of drivers yet. But Uber’s already-low retention rate and relatively high take rate make it harder to see how Uber will cut driver acquisition costs in the future or decrease churn.

Despite ads claiming drivers could earn $90,000 a year or on average, make $25 an hour, the average take-home pay of an Uber driver in the United States today — after expenses — is still only about $10 an hour. At 40 hours a week with a family of two, that is near or at the poverty line.

Uber’s driver acquisition process hasn’t slowed significantly, but the churn and wage problems represent one of the most significant costs involved in running the company and one of the biggest potential long-term threats.

Uber and its team are well aware — in the S-1 filing, Uber’s team reports that they “aim to reduce Driver incentives to improve our financial performance” and that they “expect Driver dissatisfaction will generally increase” as a result. While Uber “aim[s] to provide an earnings opportunity comparable to that available in retail, wholesale, or restaurant services or other similar work,” the fact remains that many drivers remain dissatisfied with that earnings opportunity, and their churn rate is a good indication of that fact.

The expensive driver acquisition machine that Uber has needed to build to circumvent that churn rate stands in stark contrast to Uber’s relatively cheap, efficient, and effective customer acquisition process.

Customer acquisition & retention

Uber’s customer acquisition, especially early on, has been driven in large part by local network effects and financial incentives for new users.

Rider churn is not a significant problem — Uber’s share of the US ride-hailing market is at 70% and climbing. Its cost of customer acquisition is relatively low — with the cutting of incentives, may be even lower than what we’ve modeled here.

Over its first few months, Uber was only used by a few dozen different riders every weekend. Six months later, it had about 3,000 active users. By the end of 2013, it was live in almost a hundred cities with roughly 80K new sign-ups per week.

In order to stimulate demand, new Uber users would receive as much as $20 just for downloading the app and taking their first ride.

Other Uber promotions have been more spur of the moment — free rides at SXSW, free barbecue delivery, cats & dogs delivered through Uber.

Today, these referrals are far fewer and further between, and Uber’s customer acquisition costs appear to have settled down.

Part of Uber’s ongoing success in maintaining its customer base has been the natural network effects of running a reliable ride-hailing business (especially one that has a majority share of the market) — 95% of its early users learned about Uber from a friend.

The most significant obstacle to Uber’s customer growth to date was the #DeleteUber campaign, and data from Second Measure shows it did have an effect on Uber’s customer base, reducing its share of the market to about 8% of the US population. By March, however, the company was back to its pre-scandal market share.

Even with about 15% of the US population between them, Uber and Lyft continue to expand, picking up more customers month-over-month.

Lyft, however, does pose a threat to Uber.

Lyft has proven it can grow in the commoditized ride-hailing space just as steadily as Uber — in 2018, it actually grew faster. At the same time, it sends a signal to investors that Uber’s moat may not be as wide as once thought.

By 2016, Lyft was only spending $5 — $10 per new user it acquired, and events like those leading up to the #DeleteUber campaign only fueled its user acquisition engine.

Lyft had 28% of the US ride-hail market to Uber’s 70% as of September 2018, a number that had increased to about 30% as of March 2019.

Still, Uber’s natural referral mechanics and incentive programs, combined with the average spend of an Uber user, have allowed the company to quickly expand its user base at relatively low cost. And even with increased competition from Lyft, there is little indication that Uber’s customer acquisition costs have gone up significantly.

Expansion costs

Uber was founded on the idea of aggressive expansion. Just months after going live in New York City and Chicago, Uber stunned employees and investors by going online in Paris. London, Mexico City, and Taiwan followed.

Uber’s geographic expansion took off in earnest in 2013. By the middle of 2014, Uber was in more than 150 cities — today, it is in more than 600.

Uber’s expansion started slow, but accelerated dramatically starting in 2013 — by 2015, the company had already brought Uber to 275 different cities.

But from Russia to southeast Asia to China, the cost of conquering global markets has been high.

Uber’s business has been commoditized. For that reason, its local competitors — often tied to the local community and supported by the state — have had to do little more than temporarily outspend Uber in order to gain their own foothold. In many of these international markets, those competitors have successfully beaten Uber back.

The London Uber Eats team decided, for example, that with the number of existing food delivery services in the area, it would have to promise delivery in 30 minutes or less if it wanted to capture users for the product.

The promotion did help grow the product. But about a year later, amid criticism of unfair competitive practices and failure to ensure its drivers’ safety, Uber lost the ability to renew its license to operate in London. However, in June 2018, Uber was granted a 15-month license to operate in the city.

Uber’s expansion into any new market comes with a variety of new, variable costs:

- Higher driver commissions

- Driver incentives

- Driver onboarding (e.g. mobile devices)

- Increased sales & marketing spend

- Insurance/other operating expenses

Where Uber’s geographic expansion has failed, it has not managed to bring those costs under control.

In 2013, Uber entered mainland China with its launch in Shanghai. In 2015, leaked documents showed that Uber was still losing a huge amount of money just in that one urban market. To attract both drivers and users, it was paying nearly 140% of its gross bookings (the top-line revenue number) to drivers in incentives.

And while net revenue margin looks bad, contribution margin looks worse.

Uber had struggled to achieve positive net revenue in markets like London, but Shanghai’s contribution margin (a measure of how profitable the region itself is for Uber) circa 2015 was at -157% to London’s 9.7% and San Francisco’s 10%.

Because contribution margin accounts for all the direct costs associated with revenue in a certain region, it’s a better tool for understanding the relative costs of geographical expansion for Uber — and in this case, it’s a good tool for showing just how expensive Uber’s entrance into China was for the company.

In Shanghai, Uber appears to never have gotten close to profitability, with a worse than -150% contribution margin.

Competing in the Chinese market proved extremely challenging for Uber, which had little experience in Asia and was going up against a company, now Didi Chuxing, with the blessing of the Chinese government. All in all, Uber spent about $2B trying to overcome local regulations, find drivers, and attract users to its platform.

Didi raised billions in the early summer of 2016, hired 5,000 employees, and worked its way to 85% market share in the Chinese ride-hailing market. “Uber’s large institutional investors,” Brad Stone writes in his book The Upstarts, “were worried, and began pressing [then-CEO] Kalanick to negotiate a truce.”

In August 2016, Uber decided to exit China for strategic reasons, announcing a merger with Didi through which Uber sold its China operations to Didi in exchange for a 17.7% stake of the company.

Uber has continued to retreat from especially challenging markets since its China exit, mainly so that the company can focus on its core markets.

Uber’s expansion into Russia proceeded in a similar way. In Russia, Uber faced an already-existing and highly-profitable competitor run by Russia’s largest search engine company, Yandex. Uber never caught up.

By July 2017, Uber exited Russia, merging its operations with Yandex. At the time, Yandex.Taxi had more than 2x Uber’s rides and bookings run rate.

By the time Uber merged its Russian operations with Yandex, it was clear that local governments and entrepreneurs around the world could win the ride-hailing market regionally.

Similarly, Uber’s expansion into southeast Asia ended because Grab, the company’s largest regional competitor, raised $2B and began spending aggressively on customer and driver acquisition. Uber, in the end, couldn’t keep up.

“It’s time for Uber to swallow its pride and face a hard truth: Instead of attempting to conquer the world, it should be cutting deals with competitors and making a graceful retreat in markets too tough to dominate,” wrote Alison Griswold in Quartz.

Investors have generally agreed. After exiting southeast Asia, Uber was able to record a profit on its balance sheet for the first time — $2.5B in Q1’18 — a positive signal for investors with an IPO on the horizon.

Uber’s costs are still comparatively higher than most unicorn tech startups. The problem isn’t just one of physical expansion. The problem is that each locale Uber expands into is different — they have different regulations, different technological needs, and different cultures around ride-hailing. These differences make for an intimidating set of everyday challenges for Uber.

Regulation-based costs

While Uber doesn’t own cars or employ drivers (as employees), it still must do a lot more groundwork to expand into a new city than your average tech startup. Once it does, it must often deal (especially outside the US) with governments that have more restrictive labor laws or transport regulations.

Regulations and legal problems have been a consistent and expensive problem for Uber around the world.

Uber escaped regulation early on in the San Francisco and Washington D.C. markets primarily by appealing to its fast growth and enthusiastic user base. Its primary “defense” (known as “Travis’ Law” internally) was that people loved its service so much that any city or local government that banned the company would face a grassroots wrath. The company has not had such luck everywhere — dealing with European regulators or Asian authorities has made it difficult for Uber to get a real foothold abroad.

In Germany, Uber was forced to have each of its drivers acquire a commercial driver’s license, and it planned to pay €100 — €200 per driver to do so. 34 Uber drivers had their vehicles impounded in Cape Town, South Africa, which Uber paid to undo. In Hong Kong, Uber has paid legal bills and bail for drivers imprisoned on suspicion of working for “an illegal car-hailing service.” Regulations have in some cases directly affected the expense of bringing on new drivers.

In 2016, Uber created a chart of the cities in which driver onboarding was the most and least expensive (in both money and time). New York City, where potential Uber drivers had to pay fees of up to $3,000 to start driving and get through several weeks of classes, was by far the most expensive city in which Uber had launched.

Uber has used its significant lobbying budget to try to reduce regulations in places like New York City — it spent more than $6.6 million in NYC just in 2015 fighting a proposed vehicle cap measure, according to NY Post. Uber beat the regulation then, but in 2018, the City Council approved a new measure instituting a ride-hail cap.

In other places, it has spent large sums of money to curry favor with local communities. After a London court refused to renew Uber’s license to operate in the city, the company undertook a massive (successful) diplomatic effort to reverse the decision, part of which included rolling out new financial insurance packages to cover driver losses due to health or injury. Recently, Uber announced it would be investing $200M in Canada — where many provinces have banned Uber before — as it expands and builds out a new branch of the company in Toronto.

Uber’s revenue centers

Despite the high costs involved in running the business, Uber has been able to grow its valuation and keep investors happy because of its industry leadership in core markets, majority share of several large markets globally, and its ability to grow revenue at a fast pace.

From 2012 to 2018, Uber’s net revenue per quarter rose from $1.4M to $2.97B.

Uber grew revenue exponentially for its first 4 years, ending 2016 at $1.584 billion a quarter.

Uber has an incredibly advantaged role in its marketplace — by owning the network, it takes between 20-30% of each fare that takes place. Over time, it has been able to increase the amount of money it takes from each transaction on its platform, and it has been able to drive growth to even higher margin and value-added services.

In more recent years and quarters, however, there’s been reason to fear that Uber’s growth is beginning to meaningfully slow. In 2017, Uber grew revenue by more than 100% year-over-year from $3.8B to $7.9B. In 2018, Uber made $11.3B in net revenue, 42% percent more than the year prior. From Q2’18 to Q3’18, Uber’s revenue increased 6.4%, and between Q3’18 and Q4’18, there was an increase of just 1%.

While no company of Uber’s scale is likely to be able to maintain sky-high growth forever, this slowing growth has been enough to give some investors pause about the company, especially considering its mounting losses and thin driver pay margins.

The basics of car ride/fee distribution

The average fare on Uber is a mixture of (relatively) fixed costs based on distance and time spent, and dynamic costs based on location, time of day, and your personal profile.

First, users pay a variable base rate. They pay a rate based on the distance they’re going and the time it will take to get there. They cover various local fees and taxes, and may pay a service or booking fee.

About 75 — 80% of the total fare a rider pays goes to the driver, and between 20 — 25% goes to Uber — though this can differ based on a driver’s tenure and location.

Uber uses its take to pay taxes, credit card fees, sales & marketing, insurance, and other operating expenses, and pockets the rest.

Uber’s dynamic pricing includes surge rates, city and neighborhood-based variations in price, and also personalized pricing rates based on who you are or where you’re going.

In an interview with Bloomberg, an Uber representative said a person’s “propensity to pay more to travel a certain route at a certain time of day” factors into the price of individual Uber rides.

But certain Uber services are also simply more dynamically-priced than others. When you take an UberX, you pay per-minute and per-mile. When you take an Uber Pool, you pay a dynamically generated rate based primarily on how many other passengers will join you in the car.

This kind of pricing — decoupled from the cost of providing the service — is primary in Uber’s newest (and some of its most profitable) services, and it also offers Uber the biggest opportunity to drive further revenue.

Uber Black

Uber’s premium transport service, Uber Black, was the forerunner of UberX and the original ride option within the Uber app.

By 2016, however, even though 20% of all drivers on Uber were Uber Black drivers, only 6% of all rides were.

Today, Uber Black is a marginal percentage of Uber’s overall volume and revenue. Premium, luxury transportation within Uber’s model simply does not drive higher demand, or higher margins, the way that a service like Uber Pool or UberX can.

Part of the problem is cost. In many cities, Uber Black drivers are licensed black car drivers with commercial drivers’ licenses, in comparison to the independent contractors of UberX.

The expenses involved in driving for Uber Black are also significantly higher than those of UberX drivers, since a large portion of drivers buy or lease more expensive vehicles, which often have with higher rates for insurance and maintenance.

Part of the problem is demand. After announcing the release of UberX, Uber Black demand began to die down.

As the economics of Uber dictate, falling demand means falling prices.

In New York City, the per-mile rate on an Uber Black ride was as high as $9.00 before UberX arrived. Today, it’s $3.75.

On a short, 0.8 mile ride, you end up paying just under $18:

- Base Fare: $7.00

- Time Rate: $5.85 (9 minutes x $0.65)

- Distance Rate: $3.00 (0.8 miles x $3.75)

- Base Total: $15.85

- Minimum Fee: $15.00

- NY Black Car Tax: $0.20

- Sales Tax: $1.41

- Full Total: $17.46

The anatomy of a $17.46, 9 minute, 0.8 mile Uber Black ride in Brooklyn.

Uber Black today represents an increasingly marginal percentage of Uber’s revenues, but its decline is nothing new — it started the day that Uber released its UberX service.

UberX

In late 2012, Uber announced UberX — the “low cost Uber.” Today, it is the standard transportation option within the app, with roughly 80% of all Uber rides taking place on UberX.

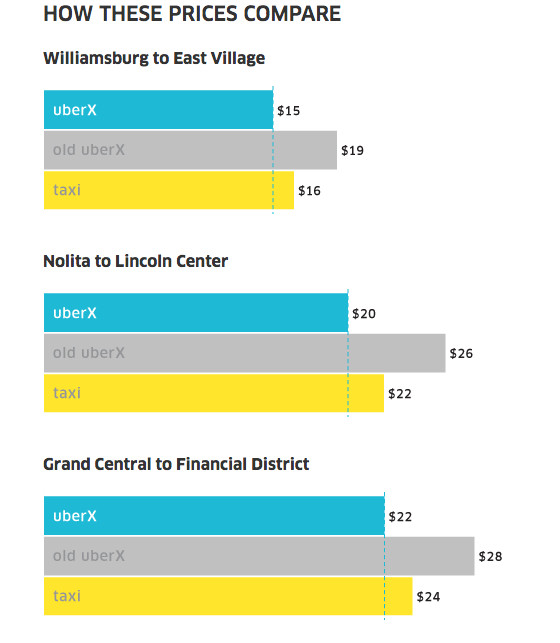

The release of UberX meant that calling an Uber finally became cheaper than calling a cab in NYC.

Undercutting the cost of a cab flipped the switch on Uber’s growth. During 2014, the number of drivers on Uber doubled each month, bringing the total number to more than 160,000 by the end of the year.

The price of an individual UberX depends on that metro area’s base rate, its per-mile and per-minute rate, any additional taxes or fees, and any dynamic pricing (such as surge pricing). If the total cost of the ride before fees falls below the minimum fare threshold for that metro area, a minimum fee charge is also incurred.

In New York, a short 0.8 mile ride is assessed a base rate of $2.55 and a minimum fee of $8.00. In a ride comparable in time and distance to the Uber Black ride diagrammed above, you end up paying just under $9.24.

The anatomy of a $9.24, 9 minute, 0.8 mile UberX ride in Brooklyn.

Base rates and minimum fares tend to be higher in cities with more traffic, higher driver onboarding costs, and higher median income.

In Milwaukee, the base fare is $1.25, and in Nashville, it’s only $1.00.

In Boston, on the other hand, UberX’s base fare is $2.10. In New York, where driver onboarding costs are the highest (as discussed earlier), the base fare is $2.55.

UberX was powerful for Uber as a business. Making the service competitive with cabs unlocked growth into a completely different market of users who could now summon a ride versus hail a taxi. On Uber’s side, it allowed the company to offer lower fares to riders and lower payouts to drivers.

Not long after UberX launched, Uber secured itself virtually unlimited access to capital — and both the ability and mandate to use the network to drive newer, higher-margin value.

Uber Pool

Uber Pool is Uber’s newest ride option. Essentially a carpooled Uber, Uber Pool gives riders discounted rides by bundling multiple fares into a single car.

It’s not the first instance of this kind of app-enabled service. John Zimmer, the founder of Lyft, launched an app to help university students share rides with each other in 2006. And Lyft launched its own carpool option, Lyft Line, a month before Uber opened Pool up to users in San Francisco.

The carpool model, while cheaper for riders, is powerful because it theoretically should allow Uber to collect as much as 2 — 4x more revenue on each trip.

A rider calls an Uber Pool to get from point A to point F. At point B, another rider requests a ride to point F — the Uber Pool stops, picks them up, and continues on their way. At point C, a rider requests a ride to point G. Point F is on the way, so the Uber Pool picks them up too.

Uber collects a fare on three separate trips: the point A to point F trip, the point B to point F trip, and the point C to point G trip. The driver only gets one fare — for driving from point A to point G — but they get the added benefit of always being on the road, making money. They’re idle for less time, which works out both for them and for Uber.

Going from Lower Manhattan to JFK you might pay upwards of $70 on UberX. Of that $70, Uber gets about $15 — $17 and the driver gets $53 — $55.

An Uber Pool vs. UberX pricing for a ride from the West Side of Manhattan to JFK Airport.

On Uber Pool, given similar traffic conditions, you would pay around $50. But then you pick up a few passengers headed to JFK along the way in Brooklyn or Queens. They each have to pay $20 or $30 each to join your already-existing route to JFK — a route your driver would be driving with or without them. Now the total revenue on that ride is up to $100. The driver still takes home $53 — $55, plus the fare associated with the time/mileage to pick up additional passengers — but Uber can now take $45 — $47 instead of $15 — $17.

In 2016, Uber’s David Plouffe announced that 20% of all Uber rides around the world were taking place on Uber Pool, though in some markets, it appears that these rides are not yet generating net revenue for the company.

A study from The RideShareGuy showed that on 49 Uber Pool trips in New York, Uber mostly lost money.

In practice, many Uber Pool rides taken do not involve multiple passengers hopping onto the route, maximizing revenue and driver utilization. In these instances, riders effectively halve Uber’s take.

The potential for Uber Pool is significant, but in order for it to pay off, Uber needs a lot more people opting for pooled rides.

If someone chooses Uber Pool but then no other fares join the ride, the company is on the hook for a lower price. It made a gamble and lost. But overall, cheaper prices do seem to drive the total number of trips up. If Uber Pool can lower price points enough to get people to choose a car over another type of transport like buses or the subway, then Uber is in a better position to guarantee it will have multiple riders on every route — and make additional revenue off Uber Pool.

This is why while Uber Pool may not be the most revenue-generating business inside Uber, it is likely one of the most forward-thinking. It is about increasing value to users and increasing revenue to Uber through higher utilization.

Higher utilization is also the cornerstone of the success of Uber Eats, which has used the same mechanics to quickly become one of the most successful businesses at Uber.

Uber Eats

Uber Eats, Uber’s food delivery app, is the fastest-growing and most profitable unit within Uber.

Uber Eats has succeeded because it uses the existing global network of drivers within Uber to provide a higher-margin, value-add service to its customers — food delivery.

Uber Eats allows users to order food delivery from more than 220,000 restaurants in 500+ cities. Food is delivered by local Uber drivers, who receive Uber Eats requests within the standard Uber drivers’ app.

In 2018, Uber Eats generated $7.9B in gross bookings, leading the Uber team to claim that it is the largest meal delivery service anywhere outside China. With $1.5B in revenue in 2018, Uber Eats now represents 13% of Uber’s total revenue. In the last quarter of 2018, more than 16% of Uber’s 91M actively installed users received a food delivery using Uber Eats.

Uber Eats generates revenue in three ways: a sliding scale delivery fee from each customer, a percentage of each driver’s gross fare, and a 30% fee from the restaurant on each order.

Each order pays a booking fee that is determined, like Uber Pool, by both distance and matching. In the first example below, an order from a McDonald’s 1.5 miles away pays a $3.49 booking fee. In the second example, a restaurant that is 2.6 miles away is only given a $1.49 booking fee.

Despite the distance difference, another Uber Eats customer — somewhere between the origin point of the request and the restaurant — has also ordered from that same restaurant. Since the driver is already coming that way with an order from that restaurant, the Uber Eats app uses the lower booking fee to incentivize you to help create a “batched” order.

Using Uber Eats, you save money on certain restaurants that already have orders pending with Uber Eats — if you’re in the same area as the other order, drivers can batch deliveries and save time.

The customer perceives this as a discount, though like Pool, it is ultimately a larger victory for Uber. It generates another order (and get a 30% cut from the restaurant) while the increase to its cost in payout to the driver consists only of whatever minimal diversion they make from their already-existing route.

Uber Eats already saves a significant amount on costs because it utilizes existing Uber drivers to do pickups and delivery. And its global network of drivers has also allowed it to easily expand into many new markets.

It also benefits from the fact that the majority of restaurants cannot afford to hire their own delivery drivers. They work with Uber Eats to supplement their revenue with delivery orders, even if they have to pay out a cut to Uber.

With razor-thin restaurant margins, you need a high volume of orders to break even with a service like Uber Eats. Many restaurants have opted out:

Not all restaurateurs are convinced that working with Uber Eats is worth it given the gross 30% cut it takes out of each order.

In parts of the world without well established on-demand food delivery options, Uber has the massive competitive advantage of already owning a fleet of delivery drivers. Once the company makes the connection with a restaurant, it has to just flip a switch to turn delivery on. Potential customers can use all their existing information stored in their Uber app to start ordering.

In markets like NYC where other food delivery options like Seamless are well entrenched, Uber Eats growth has been slower.

Uber Eats’ ultimate value to Uber is not just as a potentially huge profit center for the company, however. It is as a stepping stone to even more revenue-generating “side apps” that demonstrate the potential for Uber to become more than a ride-hailing company.

Revenue bets

Today, Uber’s two major bets for the future are in alternative forms of transportation, like scooters, and in autonomous vehicles.

Scooters fit into a vision of Uber less as an app for getting a ride and more as an app for getting anywhere.

As part of Uber’s efforts to expand into the electric scooter space, Uber acquired the dockless bike startup Jump in April 2018 for a reported $200M.

Explaining the acquisition, Uber CEO Dara Khosrowshahi reported that the average length of a trip on Jump is 2.6 miles — the same length as 30 — 40% of all trips Uber serves in San Francisco. In Uber’s S-1, the company reported that trips of “less than three miles” made up as much as 46% of all trips taken through Uber in the year 2017.

Getting on the leading edge of the micromobility movement, whether through scooters or electric bikes, could be a crucial way for Uber to offer that large subset of its customers a less expensive alternative to getting a car.

For now, Uber’s experimentation with what it calls the “New Mobility” has not been meaningful for Uber’s bottom line. The company’s S-1 states that the business line represents “new or emerging offerings beyond its Core Platform,” and that “New Mobility revenues were not material in 2018.”

In the long run, expanding out into alternative forms of transportation like bikes and scooters could be a way for Uber to not just maintain its users and their engagement with the product but generate more efficient revenue. As long as people are getting from A to B through Uber, they’re also ordering food through Uber Eats, and getting an UberX when it’s raining, and so on. And there’s also good reason to think that Uber might prefer the profit margins on bikes and scooters, where they can own the capital, versus cars, where they have to pay the drivers.

Autonomous cars are the other key part of Uber’s future story for investors because these not only strengthen Uber’s value as a provider of rides from point A to point B — they offer a constantly moving fleet of vehicles without the cost of drivers that can solve a lot of very valuable last-mile problems.

The last-mile accounts for more than half the delivery cost of all goods in general — and Uber, with its massive fleet, could play a role in lowering that. Uber has already experimented with package delivery with its Uber Rush service, which also allowed users to buy a variety of preset goods. With Uber Eats, Uber has started doing this for the meal delivery space.

Uber’s fleet, in other words, could serve as a latent, global delivery network. And, with autonomous vehicles, Uber stands to cut out the #1 cost of running its business — the human drivers.

A UBS research note claimed autonomous vehicles could lower passenger fares by as much as 80%: imagine taking an Uber Pool from SFO to Palo Alto in rush hour traffic for $7 instead of $37, or a $5 ride from the Lower East Side to JFK rather than a $27 one.

The advantages go beyond lower fares for riders and a higher take of the profits. With autonomous cars, Uber would be able to ensure its cars are producing value even when they’re empty of passengers — or it could simply idle them, turn them off, or cycle them in to maintenance/storage if not needed at the time. Uber wouldn’t have to rely on financial incentives to make sure drivers get out on the roads during busy times — it could simply spin up the right number of cars, optimized perfectly for demand.

Autonomous cars also mean Uber’s business model will have to change in other ways. Owning a fleet of autonomous vehicles rather than renting the time of vehicle-owners as it does now means Uber has to pay the attendant costs on those vehicles — maintenance, insurance, and depreciation. That’s in addition to manufacturing the vehicles or buying them through a partner.

Autonomous driving, and its attendant opportunities, are still very much in development. Furthermore, Uber’s self-driving tests were halted after the death of a pedestrian, but began ramping up again in July 2018. While the autonomous play sounds promising, the goal of eliminating drivers and lowering costs 80% is likely still far off.

Uber has ostensibly been working on autonomous driving technology since 2015, when the company started up its Advanced Technologies Group.

The project is, however, a drain on profits. Uber’s self-driving unit loses between $125M and $200M a quarter and the company has spent a total of $2B on the project overall, according to The Information. Waymo, the Alphabet unit that is the furthest along at developing an autonomous car and the best positioned competitively, has already become the first company in America to charge for self-driving car rides.

Geography of Uber’s revenue

Uber’s long-term goal, after its first round of investment, quickly turned to expanding around the world. Due to the potential for commoditization, ride-hailing at the time was seen as a winner-take-all market, so becoming the first and biggest player in a new city was the route to success.

But, as discussed, not every country and city has been equivalent when it comes to generating revenue for Uber. In addition, while many observers have seen Uber as an urban phenomenon, much of its market is rural and suburban — outside the traditional bounds of a cab service.

In 2015, a set of leaked documents revealed the markets where Uber was the most profitable by contribution margin.

A company is contribution margin profitable when it has more revenues than variable costs with a market or a product — a good measure of future profitability for a company like Uber with fixed costs that should grow more slowly over time and at scale.

Near the top of the list were cities like San Francisco and New York, Uber’s two most mature markets, and therefore the most developed in terms of customer & driver acquisition and volume.

But a couple of notable cities actually had even greater contribution margins — Stockholm and Johannesburg. A city like Johannesburg possesses demographic characteristics that make it an attractive target for Uber:

- High unemployment: With nearly 30% unemployment, there’s a large pool for potential labor for Uber

- Poor public transport: Unreliable or erratic services like the minibuses of Johannesburg create a need for an Uber-like service

- High degree of urban sprawl: Johannesburg’s decentralization means a high number of car trips (3M a day according to the Financial Times) and higher saturation of Uber cars

Today, Uber’s most profitable areas are primarily concentrated in North America and Europe, where it has the least concerns about future expansion and the most brand power already built up. North America and Europe also tend to be wealthier, have a larger middle class with more disposable income, and have more areas of urban sprawl. While the company has faced localized issues in these areas — an Uber ban in Austin, Texas or a rideshare cap imposed in New York City — they are not existential threats like the ones faced in China.

Uber’s foothold in American cities has also allowed the company to expand out into the suburbs and the rural areas outside those cities. In Uber’s early days, a common criticism of the company was that the model it was pursuing only made sense in dense, urban areas. This chart of trips taken from 2013 through 2017 in California illustrates how Uber has slowly spread outwards from those urban cores:

An early criticism of Uber was that its model would only work in and benefit urban areas. This graphic shows that over time, Uber has expanded out into the suburban and rural areas outside cities.

Traditional cab services struggle to bring service outside cities because their method of connecting drivers with riders is ad hoc and slow, while Uber routes drivers exactly where they need to go.

In New York, for example, looking at overall growth in rides (both cab and Uber), most is taking place not in the downtown core, but in the outer boroughs.

Before Uber, for-hire rides in the outer boroughs of New York City were a marginal proportion of all rides taken in the New York City area. After Uber was introduced, they became approximately 30%.

By bringing the option of ride-hailing to these areas, Uber is expanding its market in outer boroughs, neighborhoods, and rural & suburban areas — and expanding the ideal zone of the car-for-hire market beyond its traditional boundaries in cities.

Uber’s fundamentals

The story of Uber is of two competing narratives that both hinge on costs and revenues.

One story is that Uber is a company that can’t stop burning through money in pursuit of dominance in a crowded, commoditized marketplace.

The other is that Uber is building a network that, in the future, will be worth a magnitude more than it is worth today.

Understanding why Uber might be valuable despite its tremendous losses requires looking at what Uber means when it talks about profitability, whether or not it lives up to that definition, and how it is positioned against its biggest competitors.

Contribution margin

Uber has a reputation for burning through money, and it’s often been criticized by investors and analysts for failing to turn that spend into profitability.

Uber is, however, “contribution margin profitable.” In its 2018 S-1 filing, Uber announced a 9% “core platform contribution margin.” A year prior, its core platform margin was 0% — the year prior to that, it had been -23%.

Contribution margin is a measure of revenue vs. variable costs. It’s used by some startups to argue for profitability because fixed costs, things like administrative expenses and R&D, tend to rise more slowly than revenue. By eliminating fixed costs from the metric, it allows investors to focus on whether the core unit economics of a model makes sense, and whether continued growth will one day generate real profitability.

This is Uber’s basic argument for using its version of the metric in its S-1 as well. “Core Platform Contribution Margin demonstrates the margin that we generate after direct expenses,” the S-1 reads, “We believe that Core Platform Contribution Margin is a useful indicator of the economics of our Core Platform, as it does not include indirect unallocated research and development and general and administrative expenses.”

Uber’s contribution margin has always differed based on the market.

In its more mature and profitable cities — New York, DC, Boston, Paris — Uber is contribution margin profitable to the tune of 8 — 9%. That means when ignoring fixed costs, 8 — 9% of its top-line revenue in those cities turns into profit.

When Uber entered Shanghai, as mentioned above, its contribution margin there was nearly -160%: it lost significantly more it made.

At a Financial Times event, Dara Khosrowshahi claimed that Uber’s contribution margins across Europe and America were continuing to improve as of October 2018, and that in “in three to five years,” that margin would be enough to cover fixed expenses as well.

One of the key reasons that Uber’s growth in mature markets has led to contribution margin profitability is that the service’s basic unit economics are themselves profitable — on each ride, Uber makes money. More importantly, people who take Uber rides tend to take more Uber rides over time.

Net negative churn

For Uber founder Travis Kalanick, one of the first indications that Uber might be a huge opportunity — bigger than just disrupting the taxi industry — was the negative churn exhibited by its users.

Early on at Uber, the team saw that a new Uber user in the San Francisco area was worth about $40 — $50 a month in net revenue and $8 — $10 in net profit.

Over their months on the service, however, according to Brad Stone and early investors in Uber like AngelList’s Naval Ravikant, that number rose.

People took more and more trips the longer they had the app installed — giving Uber negative churn.

Negative churn exists when you’re driving more revenue from new & existing users than you’re losing through those deleting the app or using the app less.

If you have negative churn, you aren’t just adding new customers to your product every month — you’re making more and new kinds of money from all of the existing customers you have.

With negative churn, your revenue growth rate increases over time rather than tending to increase in a linear fashion. Source: Tomasz Tunguz

That means that over time, revenue compounds rather than increasing at a linear rate tied to rate of new customer acquisition.

Naval Ravikant of AngelList was an early investor in Uber.

With negative churn, spending on customer acquisition decreases over time, and a company doesn’t need to attract as many new users because the current ones stick around and use the app more over time.

In the long run, this makes it easier to achieve profitability, which Uber has found to be the case in its more stable, mature markets.

Negative churn was one of the first real indicators that Uber wasn’t just replacing taxis within a limited set of transportation contexts — i.e., “I live in the suburbs, need to get to the airport fast, and don’t know if I can reliably get a cab right now.” If that were true, one would expect usage of the app to remain relatively steady among users.

In reality, people were using Uber more and more the longer they had the app. Those specific urgent contexts may have been the occasion for them to try Uber, but once they had the app installed, they began using it in other cases — cases where, for example, they might have previously driven, taken the bus, biked, or waited for a traditional yellow cab.

In 2014, Benchmark VC Bill Gurley proposed that Uber might one day completely eclipse the car-for-hire market and go on to challenge the multi-trillion dollar market for traditional car ownership.

But Uber wouldn’t be the only company to challenge for the ride-hailing crown.

Competition

Uber has dealt with competition since its launch. The product invites it — drivers can easily drive for two or three ride-hailing services simultaneously (because they are independent contractors, not employees), and riders can switch over by just opening another app.

Today, however, Lyft — Uber’s main competitor in the US — poses more of a problem for Uber than ever before. Because of the high commoditization of ride-hailing and Lyft’s now very well-capitalized team, Uber is ramping up investments in adjacent businesses such as bikes and scooters, in addition to food delivery.

Uber does have one key advantage over most competitors, and that’s scale. Scale is important because the main lever in this business is price. Price is what users care about — when they find lower prices on one ride-hailing service, they switch. That means if Lyft lowers its prices, Uber must lower its prices, and so on. But Uber has always been able to sustain lower prices for longer. If it needs to, thanks to the money raised, it can afford to lower prices for riders and pay drivers higher surge prices, pulling both riders and drivers to its platform.

By 2017, Uber and Lyft’s aggressive surges were leading drivers away from Juno and back towards the new duopoly in ride-hailing.

By 2017, Uber and Lyft’s aggressive surges were leading drivers away from Juno and back towards the new duopoly in ride-hailing.

In New York, this was the problem that rival services like Juno and Gett ran into. They could deeply discount rides for a time, and up driver incentives. They just couldn’t sustain those discounts the way Uber or Lyft could.

This eventually led to many of Juno’s drivers going back to Uber and Lyft. When they did, Juno’s passengers would have had trouble finding reliable and timely rides, and they would have gone back to the source of consistent supply as well.

What Juno’s initial success and final collapse demonstrated was that ride-hailing is a commodity.

For that reason, many critics believed Uber would eventually beat Lyft easily. With more money in the bank, they had pricing power, and could starve Lyft out of the market.

Since Uber’s tumultuous 2017, however, Lyft no longer struggles to raise money. In 2017, its ride growth figure doubled. And shortly after that, Waymo (Google’s self-driving car firm) started a partnership with Lyft. Lyft ended 2017 with triple the revenue growth of Uber, albeit off of a lower base.

Uber: forecasting the future

At Recode’s Code Conference, Dara Khosrowshahi gave one glimpse into his thinking on the subject of the future at Uber, and offered a rationale for making scooters a vital part of the Uber portfolio:

We are thinking about alternative forms of transport. If you look at Jump, the dockless bicycle startup Uber acquired earlier this year, the average length of a trip at Jump is 2.6 miles. That is, 30 to 40 percent of our trips in San Francisco are 2.6 miles or less. Jump is much, much cheaper than taking an UberX. To some extent it’s like, “Hey, let’s cannibalize ourselves.” Let’s create a cheaper form of transportation from A to B, and for you to come to Uber, and Uber not just being about cars, and Uber not being about what the best solution for us is, but really being about the best solution for here.

Then there’s Uber Eats — now the fastest-growing meal delivery service in the US — which benefits significantly from the constant movement of Uber cars around America’s metropolitan areas by turning them all into delivery vehicle on-demand. Uber Eats is today the most profitable part of Uber.

Of course, as Ben Thompson points out in Stratechery, Uber Eats is not just layering a complementary service on top of Uber — it is bundling another opportunity and another retention mechanism for drivers.

Typically, there’s little friction keeping an Uber driver from switching apps and becoming a Lyft driver if Uber slows down. When Uber drivers always have the option to do jobs for either Uber or Uber Eats, however, it means less downtime and more utilization. And if Uber can incentivize drivers to stick around in this Uber ecosystem, then bundling services in this way could be a powerful way to differentiate from Lyft.

Uber’s fate now belongs to the public markets.

To be a successful public company, Uber must bring down its costs and increase its revenues. The company’s leadership has spoken publicly and experimented with various methods of doing this, from delivery to carpooling to scooters and autonomous cars. Whether or not these services can find traction, profitability, and growth — and bring down Uber’s biggest cost centers without driving new expenses up too much — will be key to Uber’s success in the future.