IMF Says Nigeria Growing Too Slowly, Urges Single Naira Rate

The International Monetary Fund IMF said Nigeria’s economy was growing too slowly to reduce poverty or joblessness and urged the government to boost revenue and scrap its system of multiple exchange rates.

“Growth is not enough,” Amine Mati, the IMF’s mission chief for Nigeria, said in an interview in Lagos on Wednesday as the Washington-based lender released its latest Article IV report for Africa’s biggest oil producer. “Our number-one recommendation is to get the revenue ratio up.”

The economy is recovering from the 2014 crash in crude prices and the IMF forecasts that growth will accelerate to 2.1 percent this year from 1.9 percent in 2018. That would still leave it as one of Africa’s least buoyant economies and will be below the rate of population growth, which is almost 3 percent. The jobless rate was 23 percent in September

Lagging Peers

Nigeria’s economy is growing more slowly than emerging markets as a whole

Source: International Monetary Fund, Bloomberg surveys

Part of the problem is the government’s small tax base, which hinders its ability to bolster demand through spending. Its ratio of revenue to gross domestic product is one of lowest in the world and will fall to 7 percent in 2019 from 8 percent last year, the IMF said.

Increasing value-added tax from the current 5 percent could be a first step for the government, according to Mati.

Nigeria should “urgently” implement structural reforms to diversify the economy from oil, the IMF said. As well as boosting revenue, these include easing restrictions on businesses buying foreign exchange, increasing fuel and electricity prices and making state-owned companies more efficient, the IMF said.

“Under current policies, the outlook remains muted,” the lender said in the report. “Over the medium term, absent strong reforms, growth would hover around 2.5 percent, implying no per-capita growth as the economy faces limited increases in oil production and insufficient adjustment four years after the oil-price shock.”

Nigeria caps gasoline at 145 naira per liter ($0.40, or $1.51 a gallon), among the 10 cheapest levels worldwide, according to GlobalPetrolPrices.com. Low power tariffs have long hindered distribution companies and cause regular blackouts.

Raising gasoline prices may initially increase poverty levels, but that could be more than offset by using the money saved on social programs, Mati said. Nigeria spent 623 billion naira ($1.7 billion) keeping prices down last year, the IMF estimates.

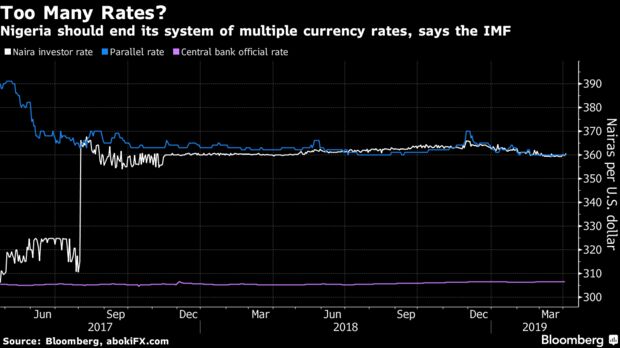

President Muhammadu Buhari opposes higher fuel prices or a devaluing the naira’s official exchange rate of 306 per dollar, which is almost 20 percent stronger than the market-determined price of 360.

While Nigeria has merged most of its various exchange rates in the past two years, the continued existence of at least three rates and curbs on using hard currency to purchase imports are deterring foreign direct investment, Mati said. Most recent capital inflows came from fixed-income traders buying short-term debt and not investors taking a long-term view, he said.

The central bank said last week that there have been about $6 billion of inflows since the February election, mostly into money markets. Rates on naira bonds average 14.4 percent, the fourth-highest among large emerging markets, according to data compiled by Bloomberg.

The IMF also said the central bank should stop its development-finance operations, which include lending to farmers and manufacturers at subsidized interest rates, and focus more on price stability and banking supervision.

SOURCE: BLOOMBERG