Internet Subscriptions grows 5.6% y/y in Nigeria as at June 2023 to stand at 159.5 million

According to the most recent Nigerian Communications Commission (NCC) figures, internet subscriptions reached at 159.5 million in June ’23, representing a 5.6% year on year rise. Meanwhile, on a month-to-month basis, internet subscriptions fell by -0.06% (c.99,000). Despite the country’s cloudy macroeconomic situation, Internet subscribers remain resilient.

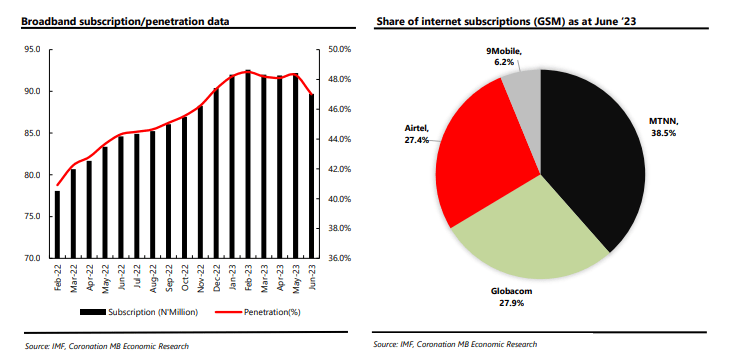

In June ’23, MTN had the highest share of internet subscriptions (38.5%). Globacom, Airtel, and 9mobile accounted for 27.9%, 27.4%, and 6.2% of the market, respectively. It should be noted that mobile network operators (MNOs) such as MTN, Airtel, and 9mobile saw small m/m reductions in internet subscriptions of -1.1%, -0.5%, and -0.6%, respectively. Globacom, on the other hand, increased during the period.

According to MTN’s H1 2023 statistics, service revenue climbed by 21.6% year on year. Increases in data revenue (34.8% year on year) as well as revenue from fintech (7.8%) and digital (50.8%) services might be linked to the growth. Furthermore, as a result of the FGN’s recent forex policy adjustments, some MNOs posted fx losses in their respective 2023 half-year financial statements. The primary issues in the telecoms business include high input costs owing to currency depreciation, insecurity, and vandalism of essential telecoms infrastructure throughout the country.

Despite these difficulties, the telecoms industry has proven to be robust. According to the latest National Bureau of Statistics (NBS) national accounts, the industry rose by 9.7% in Q2 ’23 and contributed around 16.1% to GDP.

The proposed 5% excise levy on telecoms has been suspended as part of President Tinubu’s four executive directives. This can be seen as a good for consumption patterns, as additional tax modifications would result in higher data costs. According to the NBS’s most recent inflation report, headline inflation increased by +129 basis points to 24.08% year on year, up from 22.79% the prior month.

According to a separate NCC report, the overall volume of data used climbed by 46% year on year to 518,381.8TB at the end of December ’22, up from 353,118.9TB in the same time in 2021. Increased internet subscriptions throughout the time, as a result of better reliance on digital connections, as well as competitive product offerings across the major networks, can be ascribed to the increases in data usage. Furthermore, overall FDI into the Nigerian telecoms industry fell by -46.8% year on year to USD399m at the end of 2022, compared to USD753m at the end of 2021, according to the research.

Broadband penetration climbed to 47% in June ’23, up from 44.3% in the same month in 2022. This year-on-year growth can be attributed mostly to an increase in ecommerce and fintech activity. The National Communications Commission recently approved the launch of Starlinks broadband services, a satellite-based wireless broadband service. We note that licensing more active broadband service providers should help to deepen broadband penetration, allowing the NCC to meet its broadband objective of 70% by 2025.

It is worth mentioning that mobile network operators (MNOs) continue to dominate the Nigerian internet service market. Meanwhile, corporates outnumber homes as customers of broadband providers. In terms of 5G spectrum, MTNN has rolled out the spectrum in 13 states and now has approximately 700 locations in Nigeria. Meanwhile, AirtelNG has launched in four states (Rivers, Lagos, Ogun, and the Federal Capital Territory).