Nigeria’s Air Transport Sector Grows by 4.37% year-on-year

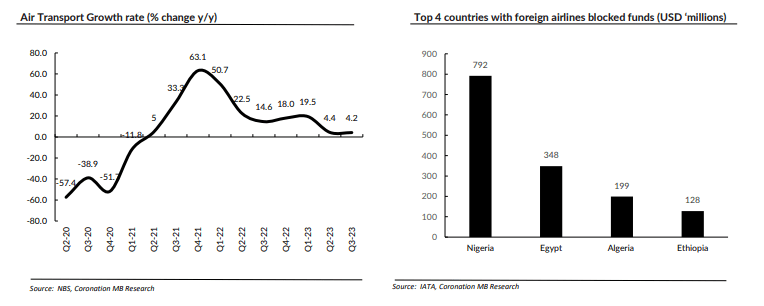

The latest national accounts for Q3 ’23 reveal that Nigeria’s air transport sector experienced a growth rate of 4.37% year-on-year, contributing to 13.8% of the total transport GDP. Over the past eight quarters, this segment has shown an average growth rate of 24.6%. However, in Q3 ’23, air transport had the slowest growth compared to rail (18.2% y/y) and water (7.27% y/y) within the transportation sector. The challenges faced by airline operators have been further intensified in recent times, particularly due to the depreciation of foreign exchange rates. As airlines often need to pay for international expenses in USD, fluctuations in exchange rates directly impact their profitability. Moreover, there are limitations to the extent airlines can pass on the increased costs to consumers, considering the continuous inflationary pressure that burdens consumers’ pockets.

Jet A1 fuel stands out as one of the most significant operating expenses for airlines. The price of Jet A1, which is aviation fuel, is largely influenced by global oil price movements. In Q3, the average oil price remained above USD80 per barrel, primarily due to the extension of production cuts by OPEC+ members until the end of 2023. However, it is worth noting that in December, oil prices moderated to USD79 per barrel. Although the price of Jet A1 has witnessed a decline from approximately N700 per liter in 2022 to around N653.5 per liter as of 22nd December ’23, airlines have still been compelled to raise ticket prices in order to offset the increased fuel costs.

According to data from the NBS “Transport Fare Watch” series, the average airfare for select routes (one-way) increased by 7.62% year-on-year to N78,778 in October ’23. On a zonal basis, the South-South region recorded the highest average airfare of N81,500 for select routes (one-way) in October ’23, followed by the North-East (N81,300), North-West (N79,557), South-West (N79,006), South-East (N78,350), and North-Central (N73,564).

Recently, our investigations have revealed that domestic airfares have experienced a significant increase of over 100% on select routes. Major domestic airlines have set their minimum base fare at N120,000 for one-way tickets and N300,000 for return tickets on certain routes. As a result of these skyrocketing prices, Nigerians are exploring alternative modes of transportation, such as road travel, and even reconsidering the timing of their trips to take advantage of lower-priced tickets during off-peak periods. Road travel has become particularly popular due to its affordability and flexibility.

The surge in ticket prices coincides with the festive season, a time when many Nigerians typically travel. These price hikes have compelled travelers to reevaluate their holiday plans and seek alternative ways to celebrate without breaking the bank.

The challenges related to currency depreciation, limited access to foreign exchange, and delayed fund repatriation have led foreign airline carriers to reconsider their presence in the Nigerian market. The potential resumption of operations by Emirates, which is currently being discussed with the Federal Government of Nigeria, brings a glimmer of hope and emphasizes the importance of constructive dialogue and collaborative efforts in resolving the pressing issues within the aviation sector.

As of December ’23, the International Air Transport Association (IATA) has identified Nigeria as one of the top four markets where foreign airlines have blocked funds. Nigeria owes approximately USD792 million, followed by Egypt with USD348 million, Algeria with USD199 million, and Ethiopia with USD128 million. Africa remains the largest market for passenger flows to and from Nigeria, accounting for 73.3% of the total, followed by Europe at 10.7% and the Middle East at 6.7%.

Improving Nigeria’s aviation sector requires a focused and intentional approach. One of the key recommendations is to regulate ticket prices and reduce travel costs, making air travel more accessible to a wider population. This will not only boost domestic tourism but also facilitate business travel. Safety should be a top priority, with stringent standards and effective maintenance procedures in place.

To position Nigeria as a regional aviation hub, it is important to consider offering incentives to international airlines to operate routes through Nigerian airports. This will create healthy competition and drive down fares. Incentives such as reduced landing fees, tax breaks, and marketing support can be considered. Streamlining regulatory processes and reducing bureaucracy will attract foreign carriers and encourage domestic airlines to expand their regional networks.

Additionally, modernizing air traffic control systems and navigation infrastructure is crucial for enhanced safety, reduced flight delays, and improved overall efficiency of international travel. Establishing a strong national carrier with a global reach is also vital. Such an airline can represent Nigeria internationally and enhance the country’s reputation in the global aviation community. While the launch of Nigeria Air has faced delays and uncertainties, it remains an important project. The House of Representatives has announced plans for a forensic audit of the national carrier project, indicating a commitment to ensuring its success.

The consistent surge in airline ticket prices presents a significant challenge for frequent travelers, impacting their ability to travel frequently and their loyalty towards airlines. In order to tackle these challenges, airlines should focus on enhancing their loyalty programs, improving transparency in fare pricing, and exploring innovative pricing models. Government interventions may also be necessary, such as regulating ticket prices, particularly for essential routes. Implementing price caps or subsidies on specific routes can help ensure that air travel remains affordable.

One potential solution that airlines should consider is introducing subscription-based models, similar to popular services like Netflix or Amazon Prime. This would provide frequent fliers with more predictable and cost-effective travel options. Subscribers could enjoy a certain number of flights per month or year at a fixed rate, giving them greater flexibility and peace of mind.

The fluctuations in ticket prices have far-reaching implications, contributing to inflation, influencing consumer behavior, and impacting the sustainability of Nigeria’s aviation industry. It is crucial for all stakeholders, including airlines, regulators, and policymakers, to collaborate and find balanced solutions that support the growth of the aviation sector while ensuring that air travel remains affordable and accessible for everyone. SOURCE: Coronation Merchant Bank