Nigeria’s Economic Outlook 2022 (Part 3) by Ugodre Obi-Chukwu, Nairametrics

- FISCAL POLICY

- Government plans to spend N17 trillion for 2022 budget out of which N6.9 trillion is recurrent expenditure, N5.9 trillion is capital expenditure and N3.61 trillion is for debt service.

- 2022 budget is based on its National Development Plan 2021-2025 estimated at N348 trillion. Public Sector contribution is just N49.7 trillion, balance N298.3 trillion from private sector.

- Despite this lofty ambition, government is unlikely to meet its revenue targets which will impact spending on capex.

- Government accepts it can’t cut recurrent expenditure or debt service and will rather focus on revenue drive to meet its budgetary expectations

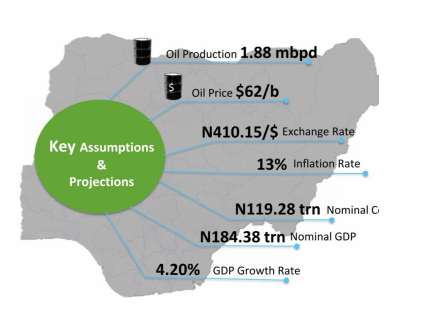

- Budget is based on 1.88mbpd whereas Nigeria currently averages 1.44mbpd.

Effect of Fiscal Policy

- Finance Act 2021 is expected to boost government revenues, but crude oil theft and gas shortages will negatively impact it

- Government is unlikely to curb oil theft in the short term.

- Clampdown on illegal refinery already affecting diesel supply

- Government may not remove fuel subsidy due to fear of labour unrest

- Government will continue to borrow to fund budget deficits

- Burden of new taxes such as digital tax, sugar tax will force businesses to pass through cost to consumers

- Disputes over tax collection will impede tax drive – Stamp duty, VAT etc.

- Businesses to face more risk of multiple taxation

- Focus on completing key capital projects – 2nd Niger Bridge, N690b on Power transmission and generation, N168 billion in roads, N510 billion on social investments. Government is unlikely to cash back all these programs

GDP Growth Outlook

• Over the past 5 years, Nigeria’s Real GDP grew by N4.46 trillion to N72.3 trillion (2021) compared to N67.9 trillion (2016) reflecting a compounded annual growth rate of 1.3%..Remarkably since 2016 the N4.46 trillion of growth can largely be attributed to only two sectors: Agriculture (N2.1 trillion expansion) and Info/Communications (N3.3 trillion expansion).

Furthermore, only 10 out of 19 sectors (just half the economy) has grown since 2016, whilst other sectors have declined in aggregate. Thus, the risk of economic contraction can potentially be viewed from the perspective of these GDP “growth” sectors.

Broad-brush estimates show that demand contraction higher than 1% across these key GDP sectors will result in a recession for Nigeria’s economy. This is especially if ongoing actions by businesses to shut down operations, withdraw services/products, or reduce business hours persists through July/August 2022.

More on GDP Growth Outlook

- The Government targets a GDP Growth rate of 4.2% for 2022. CBN projects 3.24% and IMF 2.7% for 2022 respectively.

- We expect GDP Growth rate to grow at less than 2% in 2022 and could face risk of contraction if energy crisis persist.

- Inflationary pressure remains a major risk to economic growth in 2022 as businesses struggle to contain cost.

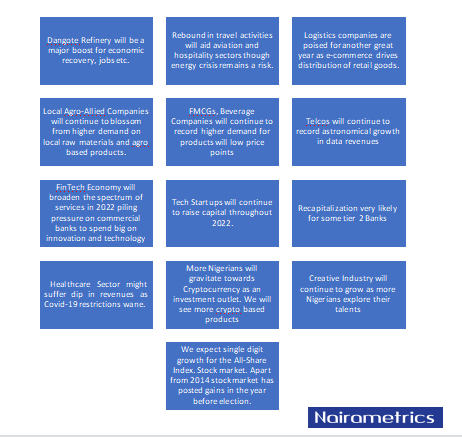

- However, key drivers of growth this year will be Trade, Telecommunications, Oil and Gas, Real Estate, Food & Beverage, Finance & Insurance Sectors.

- A possible warning signal is the diesel crisis. According to MAN, capacity utilization was going down due to the unsustainable cost of running daily production on diesel. An output cut will be bad for GDP Growth thus our view that a recession could occur if not tamed.

The Digital Nomads

- More younger employees will demand remote working and give preference to firms that offer this capability.

- Employers will struggle with staff retention forcing a hike in staff cost to retain talents

- Hiring will also be more difficult for employers seeking to replace gaps in key roles, particularly those occupied by young Nigerians.

- Tech related jobs, technology, business analysts, financial analysts, engineers, creatives, will be the hardest to fill.

- Firms that offer flexible working timelines will hire the best talents regardless of salaries

- Skilled workers will be more nomadic as they seek to rise high the

- food chain.

- Migration of skilled workers to greener pastures will persist as election draws nearer.

- Job seekers will spend more on training and manpower development as they seek to upskill for better opportunities.

- Freelancing and multiple job will be pervasive.

- Job hubs and talent centers will increase as a source for hiring highly skilled workers.

More on socio- economic outlook

- Insecurity will remain pervasive as poverty and income gap widens.

- Clamp down on oil thefts, oil bunkering, illegal refineries will stretch security operatives.

- Labour unrest to continue with medical practitioners, lecturers embarking on protracted strikes.

- 2022 elections to dominate discourse in traditional media, electronic media and social media.

- Regional conflicts likely to trigger refugee crisis in sub-Saharan Africa.

- Traffic gridlock, work pressures, family squabbles, high inflation will trigger mental health issues, stress etc.

High-Cost Environment also creates Opportunities

Individuals

- Upskill existing Labour for productivity (e.g. hiring freezes leads to more responsibilities for existing staff)

- Higher skilled Labour can then seek to boost earnings either domestically or remote work overseas

- Rise of the creative industry will birth new entrepreneurs .

Businesses

- Adjust products pricing for higher margins (e.g. shrinkflation)

- Revamping operational processes to increase efficiency

Banks

- Adjust interest rates on products or withdraw unprofitable products (i.e., enhance interest income )

- Review lending portfolio (e.g., switch to sectors that will gain e.g., tech sector, energy sectors) – reduce NPL risk

- Aggressively deploy tech solutions to reduce operational costs (fewer branches, enhanced mobile app, digitization of administrative processes) – in Nigeria this is a double benefit for banks…lower staff/branch costs coupled with higher electronic services income

- More young Nigerians will open bank accounts as they formalize their businesses.

Government

- Innovative growth policies (PAPSS, pan-African trade AfCFTA) (tech budget spending – (cyber security, automation, IOT)

- Cash rich businesses (with strong balance sheet) will seek opportunities to acquire weaker firms (e.g. vertical integration or eliminate competition)

- Higher demand for fitness and mental health practitioners.Renewables and Climate Change based companies

Banks

- Adjust interest rates on products or withdraw unprofitable products (i.e., enhance interest income )

- Review lending portfolio (e.g., switch to sectors that will gain e.g., tech sector, energy sectors) – reduce NPL risk

- Aggressively deploy tech solutions to reduce operational costs (fewer branches, enhanced mobile app, digitization of administrative processes) – in Nigeria this is a double benefit for banks…lower staff/branch costs coupled with higher electronic services income

- More young Nigerians will open bank accounts as they formalize their businesses.

Government

- Innovative growth policies (PAPSS, pan-African trade AfCFTA)(tech budget spending – (cyber security, automation, IOT)

- Cash rich businesses (with strong balance sheet) will seek opportunities to acquire weaker firms (e.g. vertical integration or eliminate competition)

- Higher demand for fitness and mental health practitioners.

- Renewables and Climate Change based companies

- Take urgent action to cut waste and revenue leakages

- Accountability in governance

- Increased economic activity especially in service and manufacturing sector.

SOURCE: Nairametrics. by Ugodre Obi-Chukwu, Nairametrics