Nigeria’s public debt rose to N87.9 trillion in September 2023

According to the Debt Management Office (DMO) of Nigeria, the country’s total public debt saw a slight increase of 0.6% quarter-on-quarter or N0.5 trillion, reaching N87.9 trillion by the end of September 2023. On a year-on-year basis, public debt increased by 99.5%. At the end of September 2023, the public debt accounted for 44.1% of the nominal GDP for 2022. Although this exceeds the DMO’s debt-to-GDP ratio target of 40% for the period of 2020-2023, it is still below the World Bank’s limit of 55% for countries in Nigeria’s peer group. It is worth noting that Nigeria’s debt-to-GDP ratio is relatively low compared to other emerging economies in Africa, such as Ghana (88.8%), Egypt (87.2%), South Africa (67.4%), and Kenya (67.3%). However, there are plans underway to raise Nigeria’s debt-to-GDP ratio target.

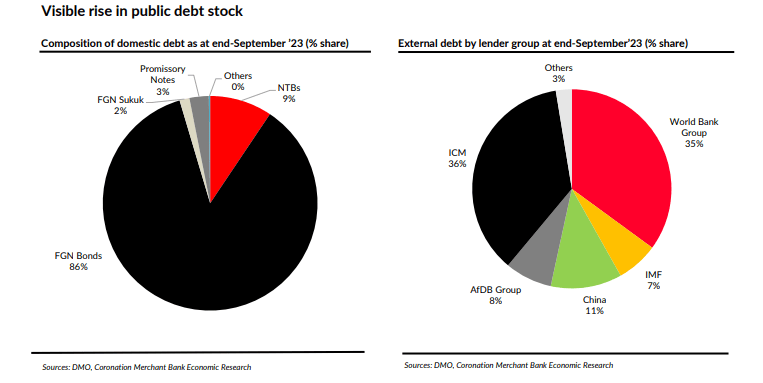

In terms of domestic debt, there was a 3.3% quarter-on-quarter increase to N55.9 trillion by the end of September 2023. This increase was observed in FGN bonds (2.9% q/q), FGN Savings bond (10.5% q/q), and promissory notes (89.6% q/q).

For the fiscal year 2023, the DMO had initially aimed to raise a maximum of N4.3 trillion through FGN bonds. However, our estimates indicate that approximately N5.8 trillion has been raised through cumulative FGN bond issuances, surpassing the target by 34.9%. This amount represents 82.5% of the total domestic borrowing target of N7.04 trillion. Other sources of borrowing include net NTB issuances (N2.1 trillion) and FGN SUKUK bonds (N350 billion). With the passage of a supplementary budget of N2.1 trillion, it is likely that the FGN will exceed its initial domestic borrowing target by the end of 2023.

On the other hand, the domestic debt of states and the Federal Capital Territory (FCT) experienced a decline of -1.2% quarter-on-quarter, amounting to N5.7 trillion by the end of September 2023, compared to N5.8 trillion recorded at the end of June 2023. However, on a year-on-year basis, it grew by 7.1%.

Lagos, Delta, Ogun, Rivers, and Imo are among the states with the highest debt in Nigeria. Lagos tops the list with a debt of N960.4 billion, followed by Delta with N371.4 billion, Ogun with N293.2 billion, Rivers with N232.5 billion, and Imo with N218.8 billion.

On the other hand, the country’s external debt stock decreased by 3.7% quarter-on-quarter, reaching N31.9 trillion (USD41.5 billion) by the end of September ’23. This is compared to N33.2 trillion (USD43.1 billion) recorded at the end of June ’23. The Debt Management Office (DMO) attributes this decline to the redemption of a USD500 million Eurobond and the repayment of USD413.8 million as the first principal installment of the USD3.4 billion loan obtained from the International Monetary Fund (IMF) in 2020.

When it comes to the composition of external debt, multilateral lenders such as the World Bank, IMF, African Development Bank (AFDB), as well as bilateral lenders like China, Japan, India, and France, collectively account for 63% of the total. Commercial loans, including Eurobonds and Diaspora bonds, along with syndicated loans, make up the remaining 37%.

In regards to debt servicing, it is important to highlight that as of the end of September ’23, the Federal Government of Nigeria (FGN) had allocated approximately N5.2 trillion towards debt servicing. Out of this amount, N3.2 trillion was spent domestically, while N1.9 trillion was allocated for external debt servicing. The debt-service-to-revenue ratio, based on the latest available data, stood at 60%. This ratio indicates the proportion of government revenue that is utilized for debt servicing.

Looking ahead, we anticipate that debt service costs will remain high in nominal terms. This is primarily due to the impact of the foreign exchange liberalization policy and the FGN’s additional borrowing to cover the budget deficit.

According to a separate report by the federal ministry of finance, the projected debt-service-to-revenue ratio for the budget in 2024 is 45%, which is an improvement compared to the 57% ratio in FY2023. This projection reflects the FGN’s optimism regarding increased government revenue in 2024.

Moody’s Investors Service recently upgraded Nigeria’s sovereign credit rating outlook from “stable” to “positive,” while Fitch Ratings maintained the country’s long-term foreign-currency issuer default rating at ‘B-‘ with a stable outlook. It is worth noting that although a stable outlook is positive, the absolute rating of B- suggests a speculative and somewhat risky macroeconomic environment.

To ensure long-term fiscal sustainability, Nigeria must strike a balance between its developmental and growth needs and prudent debt management practices. It is crucial for the FGN to ensure that borrowed funds are effectively utilized to generate positive economic returns, fostering growth and revenue generation to service the debt. SOURCE: Coronation Merchant Bank