Oil prices could jump to $200 a barrel if US and Iran go to war in Persian Gulf, analyst says

Military conflict between the United States and Iran would threaten to shut the world’s busiest seaway for oil exports and send oil prices to all-time highs, perhaps even to $200 a barrel, according to one analyst.

President Donald Trump on Sunday night warned Iranian President Hassan Rouhani on Twitter that his country would “SUFFER CONSEQUENCES THE LIKES OF WHICH FEW THROUGHOUT HISTORY HAVE EVER SUFFERED BEFORE” if Rouhani ever threatened the United States again.

Trump appeared to be responding to comments over the weekend from Rouhani, who said, “Iran’s power is deterrent and we have no fight or war with anybody but the enemies must understand well that war with Iran is the mother of all wars,” according to an English translation on the Iranian president’s official website.The rhetoric has been heating up as the first of two U.S.-imposed deadlines for international businesses to cut ties with Iran approaches next month. By November, the United States expects most oil buyers to reduce purchases of Iranian crude to zero or face U.S. sanctions.

In May, Trump pulled out of an international nuclear accord with Iran and restored sanctions against the nation, the world’s fifth biggest oil producer.

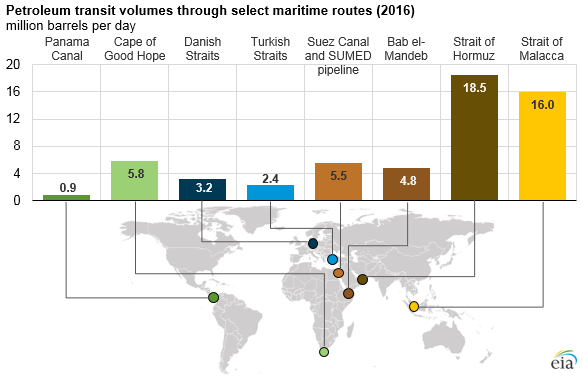

This weekend, Iran renewed its threats to shut the Strait of Hormuz, the world’s most important seaborne passageway for crude oil shipments. Rouhani mentioned the strait in his speech on Sunday, and Iran’s Supreme Leader Ayatollah Ali Khamenei on Saturday endorsed the president’s threat to shut the chokepoint if U.S. sanctions disrupt Iran’s exports.

“Mr Trump! We are the people of dignity and guarantor of security of the waterway of the region throughout the history. Don’t play with the lion’s tail; you will regret it,” Rouhani said.

“Mr Trump! We are the people of dignity and guarantor of security of the waterway of the region throughout the history. Don’t play with the lion’s tail; you will regret it,” Rouhani said.

John Kilduff, founding partner at energy hedge fund Again Capital, said Brent crude — the international benchmark for oil prices — is on a path to $90 a barrel because the Trump administration is unlikely to issue many sanctions waivers. Top Cabinet officials have recently said countries could get sanctions relief on a case-by-case basis if they cannot entirely cut off purchases from Iran by November.

However, if Iran opts for the “nuclear option” of shutting down the Strait of Hormuz, Brent could pop to several hundred dollars a barrel, in Kilduff’s view.

“The numbers on a blockage or any kind of upset or military situation in the Strait of Hormuz, that is off to the races. Pick your number — $150, $200 — it goes sky high,” he said. “Because we are talking about an abject shortage of oil then in the global market.”

Brent crude is currently trading just above $73 a barrel. It hit a record high above $147 a barrel in 2008.

To be sure, the U.S. military and its Gulf allies would be able to reopen the strait in a matter of days, according to Admiral James Stavridis, former Supreme Allied Commander at NATO. However, Iran could repeatedly shut the strait on a temporary basis by mining its waters and using other surreptitious methods, he told CNBC.

Rouhani also hinted that Iran could cause problems in other regional sea routes. Those could include Bab el-Mandeb, the strait off the coast of Yemen, where Iranian-aligned rebels are fighting a Saudi-led coalition, said Helima Croft, global head of commodity strategy at RBC Capital Markets.

“I don’t think anyone believes that with the U.S. Fifth Fleet in Bahrain that we cannot protect ships going through there, but if we start having to deploy those military resources, I think that’s going to put additional pressure on oil,” said Croft.

“That’s the scenario for a real breakout in oil prices in the back half of this year,” she told CNBC’s “Squawk on the Street” on Monday.

The risk of conflict is rising because the Trump administration is signaling that its ultimate goal is regime change in Iran, according to both Croft and Kilduff. On Sunday, Secretary of State Mike Pompeo gave a speech that was fiercely critical of Iran’s leadership to an audience largely composed of members of the Iranian diaspora.

On Monday, Trump’s national security advisor, John Bolton — who has argued for launching a military strike on Iran’s nuclear infrastructure — doubled down on Trump’s late-night tweet.

“I spoke to the President over the last several days, and President Trump told me that if Iran does anything at all to the negative, they will pay a price like few countries have ever paid before,” he said in a statement on Monday.

— CNBC’s Jason Gewirtz and Mike Calia contributed reporting to this story.