pawaPass secures Partners with Mchezo to Facilitate $2m Shares Distribution to betPawa Customers

The sports and technology company Mchezo and pawaPass, a regtech platform that offers user authentication and compliance solutions for African enterprises, have formed a historic alliance. Through this partnership, an economic inclusion program will be initiated, enabling the distribution of $2 million worth of shares to more than 200,000 betPawa’s devoted client base. This announcement comes after pawaPass recently obtained a Trust & Corporate Service Provider [TCSP] license from the Central Bank of Rwanda [BNR]. This license will guarantee a safe and legal implementation of the large-scale share distribution.

pawaPass, founded in 2022 by Sylvia Brune, is transforming online fraud and abuse prevention in Africa through a special fusion of non-ID-based user verification, low-touch data points, and extremely precise anti-duplication technologies. PawaPass is ideally positioned to oversee the safe custody of shares because of its state-of-the-art face and document verification technology, which satisfies the strictest security and encryption standards. With the support of this effort, end users in 11 African markets will have more influence over the betPawa sports betting brand, operated by Mchezo. PawaPass and Mchezo have been working together since early 2022 to create a cutting-edge solution that would redefine economic inclusion in the African market and launch this month.

The Rwandan Central Bank granted TCSP licenses in September 2022, confirming pawaPass’s compliance with strict security, governance, and compliance guidelines both domestically and globally. Every application goes through a thorough assessment procedure that is usually finished in less than a month, guaranteeing that businesses that fit the requirements are awarded this certificate. PawaPass now has more power to protect and handle assets on behalf of other parties thanks to this license, which is crucial for managing the share distribution process for betPawa clients.

“Traditionally, the process of onboarding investors and safeguarding assets in line with Know Your Customer (KYC) and Anti-Money Laundering (AML) standards is a costly and manual process that makes it impossible for micro-shareholders to own digital assets like shares,” said Sylvia Brune, CEO of pawaPass, in reference to the partnership. We ultimately started the TCSP licensing route to develop a custom solution for Mchezo that not only verifies individuals chosen to become micro-shareholders but also protects their shares as part of our mission to make this process more scalable and efficient.

“By making the process more inclusive and scalable, we have opened up the door for more inclusive investment opportunities, thus enabling hundreds of thousands of people to take part in the economic landscape with confidence and ease.“

“We have wanted to make our loyal customers co-owners of the betPawa brand because they are the reason we exist,” said Kresten Buch, a director at Mchezo. However, it has been extremely challenging to accomplish this in a way that is compliant, safe, and economical; for this reason, we are happy that pawaPass has given us a means of doing so at last.

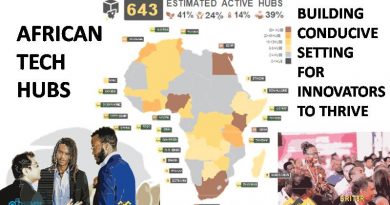

People in sub-Saharan Africa have enormous obstacles when attempting to access and engage in the formal economy and the opportunities it offers, as nearly half of the region’s population lacks basic identity documents. By bridging this gap, pawaPass’s approach allows a group of people who have hitherto been shut out of digital financial systems to become shareholders. This is a significant step in the direction of removing structural obstacles to economic inclusion and creating an environment in which financial empowerment no longer depends on having access to identity.

Malik Shaffy, a businessman from Rwanda who recently joined pawaPass as a Board Director, said, “We need solutions that are inclusive, scalable, and resistant to fraud and abuse because we are allocating about $10 of shares to over 200,000 people across multiple African markets.” We had to develop a straightforward yet secure biometric user verification system in response to the increase in online fraud and the number of new internet users, together with a digital “safe” that would manage the sharing of information. Because of this, even those without access to official identity or even the most basic smartphones can confidently own and use their possessions without jeopardizing security. My motivation to provide inventive solutions that safeguard and involve everyone is what drew me to the PawaPass board as an entrepreneur.”