The global economy could enter a recession in 2023, warns the World Bank – Bloomberg

According to the World Bank additional adverse shocks could cause the global economy to enter a recession in 2023, with tiny states being particularly vulnerable. The cautionary statement is found in the abstract of the bank’s biannual Global Economic Prospects study, which is scheduled to be released on Tuesday January 10.

Even in the absence of a new crisis, the World Bank predicted that this year’s global growth is expected to decelerate sharply, reflecting synchronous policy tightening aimed at containing very high inflation, worsening financial conditions, and continued disruptions from Russia’s invasion of Ukraine.

Said the World Bank: Due to declining policy support, ongoing COVID-19 flare-ups, and persistent supply bottlenecks, the global recovery is expected to slow down. Output in emerging market and developing nations will continue to be significantly below pre-pandemic patterns during the predicted horizon, in contrast to that in advanced economies. The potential for fresh COVID-19 outbreaks, the prospect of inflation expectations being unanchored, and financial stress in the face of record-high debt levels all cast a shadow over the forecast. Restructuring debt will be more challenging to accomplish than in the past if some nations eventually need it. The nearly two-thirds of emerging market and developing economies that depend largely on commodity exports may face difficulties as a result of climate change, which will underline the importance of asset diversification. The rise in inequality brought on by the pandemic may exacerbate social tensions. These difficulties highlight the value of improved international cooperation in advancing a sustainable, resilient, and inclusive road to recovery.

In emerging market and developing economies (EMDEs), where investment growth is anticipated to remain below the average of the previous two decades, urgent global and national efforts are required to reduce the risk of such a downturn as well as debt distress, according to the Washington-based lender.

The statement said that It is crucial that EMDE policymakers ensure that any budgetary support is targeted on vulnerable individuals, that inflation expectations remain well-anchored, and that financial systems continue to be resilient.

Central bankers from all around the world have made such demands as they aggressively boost interest rates to reduce pricing pressures while governments help businesses and people by keeping energy costs in check.

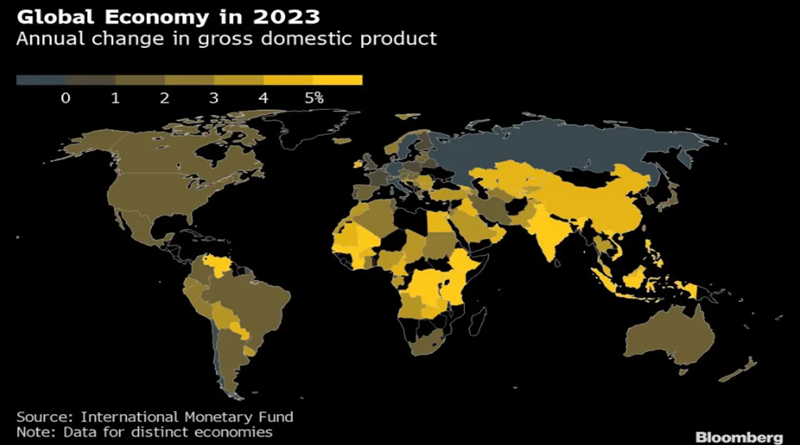

The managing director of the International Monetary Fund, Kristalina Georgieva, warned that 2023 would be a terrible year, harsher than the year we leave behind for the world. Because the US, the EU, and China are all slowing down at the same time, one-third of the world economy will be in recession, she said in an interview with CBS’s Face the Nation on January 01. (Bloomberg)