Zenith Bank’s Second Quarter 2022 Results First Look by Coronation Asset Management

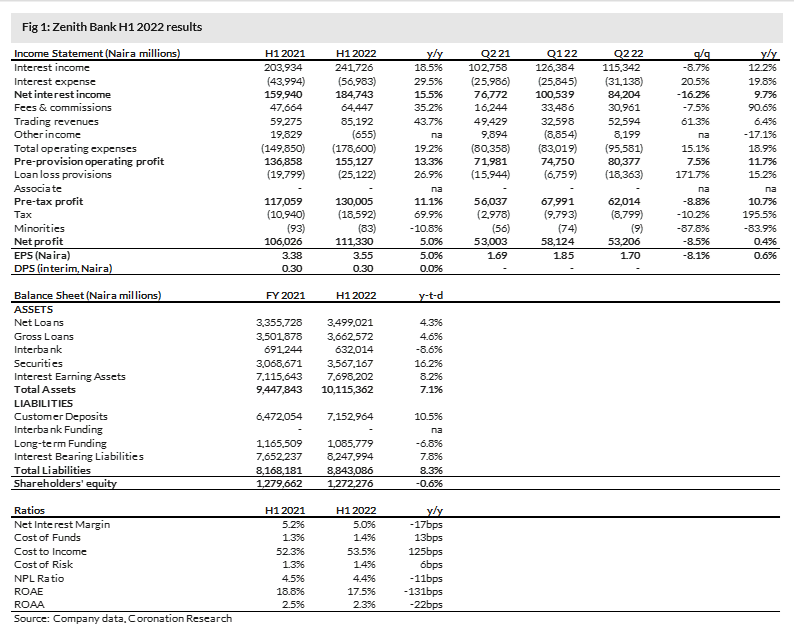

| Zenith Bank (ZENITHBANK) released its H1 22 audited results during trading hours today (23 August). The group reported Pre-tax profits (+11.1% y/y) and Net profits (+5.0% y/y) growth for the period. Q2 standalone earnings were flat y/y, with Net profits growing by a marginal 0.4% y/y. On the H1 22 Earnings per Share (EPS) of N3.55, the board has proposed an interim dividend of N0.30/s, in line with our expectations. This implies an interim dividend yield of 1.4% on today’s closing price. Funded and non-funded income drive modest H1 earnings growth Stock Rating: BUY Price Target: N30.86 Price (23-Aug-2022): N22.00 Potential Upside / Downside: +40.3% Tickers: ZENITHBA NL / ZENITHB.LG On balance, earnings were driven by solid growth in both Net interest income and Non-interest revenues. However, when annualised, Net profits were behind our and consensus growth forecasts for FY 22 by 18.4% and 12.4%, respectively, owing to negative surprises in the Other income and Operating expenses lines. The market’s initial reaction was neutral. Year-to-date, ZENITHBANK is down 12.5%. |

| Decent loan growth boosts NII Interest income grew by 18.5% y/y in H1 22 and was primarily supported by a 20.7% y/y (Q2 22: +6.9% y/y) growth in Interest earned on loans to customers. The rise came as the group recorded 4.6% y-t-d growth in gross loans in H1 22. We note, however, that gross loans unexpectedly declined by 1.1% q/q in Q2 22. Interest expense rose by 29.5% y/y in H1 22, driven by a 36.8% y/y increase in Interest paid on customer deposits as the group grew term deposits (+49.1% y-t-d) faster than Current and Savings Account (CASA) deposits (+7.6% y-t-d). The deterioration in the CASA mix to 90.6% (H1 21: 93.0%) led to a 13bps y/y increase in the group’s cost of funds to 1.4%. Nonetheless, Net Interest income grew by 15.5% y/y. However, the Net Interest Margin (NIM) compressed by 17bps to 5.0%, on our calculations, due to slightly lower yields generated on earning assets than in the previous period. Diversification benefits of Non-interest revenue reapedNon-interest revenue (NIR) grew by 17.5% y/y, driven by a 47.3% y/y surge in Trading revenues. The growth was due to a Net gain on treasury bills fair value through profit or loss (FVTPL) of N80.74bn (vs Net gain of N47.70bn in H1 21). In addition, Fee and commission income also impressed, growing by 35.2% y/y in H1 22 on the back of robust growth in Fees on electronic products. However, surprisingly, the group recorded Other losses of N655m in H1 22 (vs Other income of N19.83bn in H1 21) following a N6.25bn Foreign currency revaluation loss, dampening the growth in NIR. Elsewhere, Operating expenses surged 19.2% y/y in H1 22, mainly on increased regulatory costs (AMCON) and Fuel and maintenance costs (+55.2% y/y), reflecting rising energy costs. For context, we estimate that Fuel and maintenance costs per branch rose from N19.2m in H1 21 to N29.8m in H1 22. Consequently, the group’s Cost-to-Income ratio rose 125bps y/y to 53.5%. However, following the larger growth in net revenue than costs, Pre-provision operating profits rose by 13.3% y/y. Further down the P&L, Loan Loss Provisions grew by 26.9% y/y, leading to 11.1% growth in Pre-Tax Profits. Asset quality and capital remain strongAsset quality metrics remained strong, with the NPL ratio settling at 4.3% (FY 21: 4.2%), below the 5.0% statutory limit, and the Coverage ratio rising to 131.7% (FY 21: 114.4%). Elsewhere, the group’s total capital adequacy ratio closed at 21.0%, significantly higher than the minimum regulatory requirement of 15.0%. ConclusionNet interest income was in line with our expectations. However, profits were lower than our and the market’s expectations following higher-than-expected operating expenses and the surprising FX revaluation losses. We are worried about the q/q shrinkage in the group’s loan book, while concerns remain around the elevated operating expense profile. The market’s reaction in the near term is likely to be negative. On the positive, as we expected, interest rates have risen significantly in recent weeks. As a result, the benefits of rising asset yields are likely to filter through to funded income and support earnings in Q3. In addition, the stock has declined by 12.5% y-t-d, making its valuation even more compelling and dividend yield more attractive than at the beginning of the year. Accordingly, we maintain our BUY recommendation on the stock. SOURCE: Coronation Asset Management |