Quarter 2, 2018; The NOIPolls Nigeria Consumer Confidence Index at 67-points

Abuja, Nigeria. July 24th, 2018 –

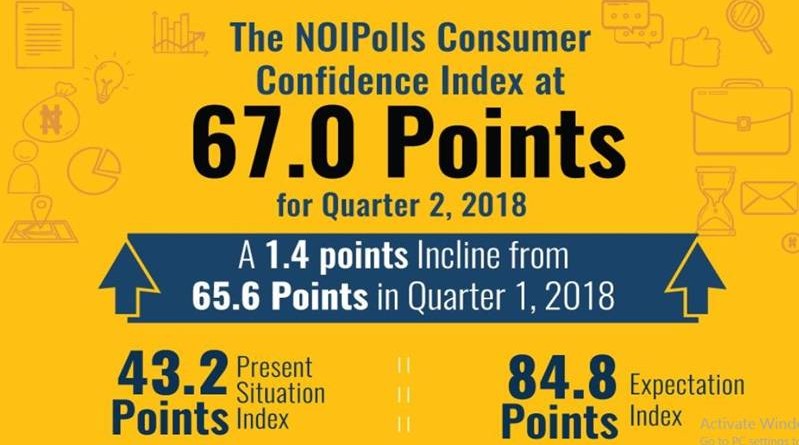

The NOIPolls Consumer Confidence Index (CCI) report released by NOIPolls for Q2, 2018 has revealed a 1.4-points increase in the CCI to stand at 67-points in Q2, 2018 from 65.6-points in Q1, 2018. This signifies that the tendency of Nigerian househo

lds to spend slightly increased in Q2, 2018. The NOIPolls Consumer Confidence Index measures how optimistic or pessimistic

consumers are regarding their present and future economic prospects. This slight increase in the NOIPolls CCI corroborates findings from the Consumer Expectation Survey (CES) conducted by the Central Bank of Nigeria and Trading Economics, which revealed that Consumer Confidence in Nigeria increased in the second quarter of 2018.[1]

Furthermore, t

he two variables that make up the CCI; the Present Situation Index (PSI) and the Expectation Index (EI) both experienced an increase. The PSI increased by 4.2-points from the results obtained in Q1, 2018 to stand at 43.2 -points in Q2, 2018. Similarly, the EI increased by 4.9-points to stand at 84.8-points. These are the key highlights from the Q2, 2018 Portfolio of Indices Press Release.

In February 2014,

NOIPolls Limited introduced its portfolio of indices; the NOIPolls Personal Well-Being Index (PWBI), the NOIPolls Consumer Confidence Index (CCI) and the NOIPolls Eagle 30 Business Confidence Index (EBCI). The NOIPolls Personal Well-Being Index measures factors impacting on the lives of everyday Nigerians; thereby producing a complete view of the individual’s personal well-being. The NOIPolls Consumer Confidence Index provides consumer assessments of the economic situation and their intentions and expectations for the future. The NOIPolls Eagle 30 Business Confidence Index measures business leaders’ perceptions and expectations about the Nigerian business environment using the top 30 companies in the country.

Nigerian businesses, financial and government agencies largely depend on their perceptions and micro assessment of consumers’ expectation in making decisions. At best, they draw conclusion on the business environment based on information from their immediate surroundings while the minorities conduct surveys that are time and money consuming. However, the introduction of these indices provides indicators that will ensure stakeholders can detect and respond to changes in consumer behaviour, the economy, and the business environment in Nigeria.

This report presents the Q2, 2018 results for the NOIPolls Consumer Confidence Index (CCI).

THE NOIPOLLS CONSUMER CONFIDENCE INDEX (CCI)

The NOIPolls Consumer Confidence Index (CCI) in Q2, 2018 experienced an increase of 1.4-points to stand at 67-points. This is instructive that citizen’s tendencies to spend in Q2, 2018 increased slightly, and may have had a direct impact on the flow of some business activities within that period.

The figure below shows the two variables that make up the NOIPolls Consumer Confidence Index; the Present Situation Index (PSI) and the Expectation Index (EI). The Present Situation Index (PSI) which measures the current perception of consumers regarding their propensity to spend stood at 43.2-points in Q2. Also, the Expectation Index is based on consumers’ perceptions of their future (3 months) and it stood at 84.8-points in Q2, 2018.

There are 7 variables that comprise the PSI and EI and each of these variables indicated positive increase except for the Expected Country’s Economic Situation, Expected Employment Condition and Expected prices of goods and services indices which all experienced a decrease. These are highlighted below;

Current Economic Situation Index – 44.1

The Current Economic Situation Index experienced the highest increase of 4.9-points to stand at 44.1-points compared to the result obtained in Q1, 2018 (39.2-points).

Expectation of the Country’s Economic Situation Index – 93.7

This index decreased by 0.2-point to stand at 93.7 in Q2 2018, signifying that consumers are hopeful that the country’s economic situation will improve.

Current Employment Condition Index – 58.5

The Current Employment Situation index increased by 4.8-point to stand at 58.5 in Q2, 2018.

Expected Employment Condition Index – 97.6

This Index decreased by 0.4-point to stand at 97.6-points in Q2, 2018.

Current Prices of Goods and Services Index – 27.0

The Current Prices of Goods and Services Index experienced an increase of 3-points in Q2, 2018.

Expectation of Prices of Goods and Services Index – 81.1

The Expectation of Prices of Goods and Services Index decreased by 0.2-points to stand at 81.1-points in Q2, 2018.

Expected Total Family Income Index – 66.7

The Expected Total Family Income Index increased by 1.8-points to stand at 66.7-points in Q2, 2018.

TREND ANALYSIS

Trend analysis revealed that the CCI, PSI and the EI all increased when compared with results obtained in Q1, 2018.

In conclusion, the NOIPolls Consumer Confidence Index increased by 1.4-points in Q2, 2018 to stand at 67-points when compared to Q1, 2018. The CCI helps in measuring the degree of optimism consumers have about the economy and their personal finances. It is important to note that the CCI is an opinion poll therefore, consumers may overreact or underreact to certain aspects of the economy, and their opinions will reflect this. Therefore, investors and stock market analysts are advised to monitor the Consumer Confidence Index closely so as to know when to buy stocks if the consumer confidence index rises, as indicated in this data. Finally, investors should be cautious as the stock market can move dramatically on the day the Index is published especially if there is a lot of uncertainty about the economy.

Survey Methods

The Consumer Confidence Index Poll was conducted in Quarter 2, 2018. The CCI involved telephone interviews of a random nationwide sample. 1,000 randomly selected phone-owning Nigerians aged 18 years and above, representing the six geopolitical zones in the country, were interviewed. With a sample of this size, we can say with 95% confidence that the results obtained are statistically precise – within a range of plus or minus 3%. NOIPolls Limited, No1 for country specific polling services in West Africa. We conduct periodic opinion polls and studies on various socio-economic and political issues in Nigeria. More information is available at www.noi-polls.com

Disclaimer

This press release has been produced by NOIPolls Limited to provide information on all issues which form the subject matter of the document. Kindly note that while we are willing to share results from our polls with the general public, we only request that NOIPolls be acknowledged as author whenever and wherever our poll results are used, cited or published. NOIPolls hereby certifies that all the views expressed in this document accurately reflect its views of respondents surveyed for the poll, and background information is based on information from various sources that it believes are reliable; however, no representation is made that it is accurate or complete. Whilst reasonable care has been taken in preparing this document, no responsibility or liability is accepted for errors or fact or for any views expressed herein by NOIPolls for actions taken as a result of information provided in this report. Any ratings, forecasts, estimates, opinions or views herein constitute a judgment as at the date of this document. If the date of this document is not current, the views and content may not reflect NOIPolls’ current findings and/or thinking.

Press Contact

The Editor

Email: [email protected]