Update on the Federal Government of Nigeria Savings Bond (FGNSB)

The Federal Government of Nigeria in a bid to improve the savings culture of the average Nigerian and enable them participate in the Nigerian Bond market, has announced its intention to commence regular issuance of Federal Government of Nigeria Savings Bond (FGNSB) through the Debt Management Office (DMO).

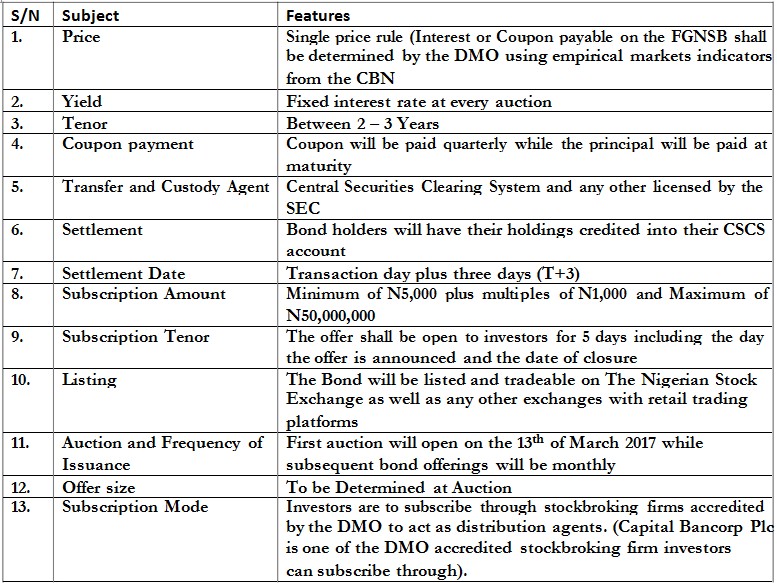

The Savings Bond will have almost all the features of the existing FGN Bond plus other features/benefits to the bondholder. It will be backed by the full faith of the Federal Government of Nigeria and is therefore deemed risk free.

Features of the Proposed FGNSB:

New Market Structure

In view of this addition to the FGN securities market, the new market structure for the FGN securities

market will be as follows:

FGN Savings Bonds – minimum subscription N5,000, maximum N50,000,000

Nigerian Treasury Bills – minimum subscription N50,001,000

FGN Bonds – minimum subscription N50,001,000.

Please note that the new market structure takes effect from March 6, 2017.

*The implication of the new market structure is that investors will not be able to invest directly in Nigerian Treasury Bills and Federal Government Bonds if they do not have N50,001,000 and above.

Benefits of FGNSB:

It should offer better returns than interest rates currently being paid by banks on savings accounts

Steady source of income as coupon will be paid quarterly.

It offers capital preservation as the Bondholder needs not worry about losing his/ her capital if held to maturity.

Provides an alternative source of portfolio diversification

Interest income from investments are tax free

The investment can be used as collateral for a loan from Bancorp Finance (one of our subsidiaries) and other sources.

It helps investors save towards larger investments or retirement

Coupons can be reinvested to increase holdings and yield to maturity.

How to Apply and Make Purchase FGNSB

Open a stockbroking / CSCS account with a capital market operator (This should be done before auction date)

Fill and submit the Subscription form

Credit your capital market operator bank account with the said amount On settlement date CSCS credits investors account with volume of bonds purchased

Transaction Cost

Primary Auction: There are no charges for purchases made through the primary auction

Secondary Market: A transaction cost of 1% of total consideration will be charged for secondary market

Buy / Sell transaction.

All forms required to open an account and apply to purchase the instrument are available from your stock broker and from the debt management office website Form FGNSB).

For further information kindly contact your stock broker staff below:

Download FGNSB Forms

pdf FGN Saving Bond Subscription Form

pdf List of Stockbroking Firms acredited by the DMO to Market and Distribute FGN Savings Bond

video Savings Bond Video Jingle – Pidgin

video Savings Bond Video Jingle – English

pdf Public Notice on the FGN Savings Bond