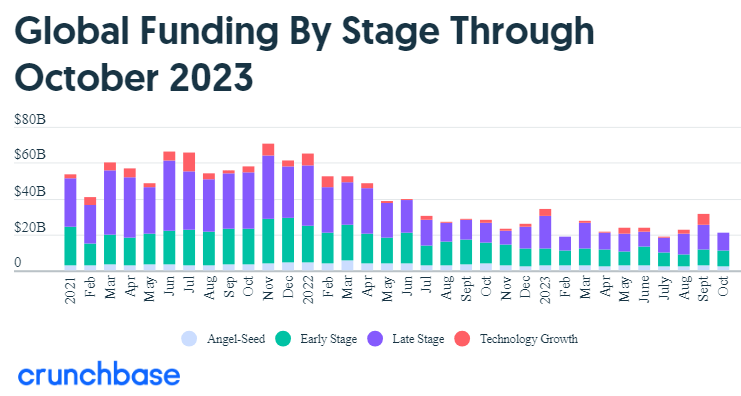

Global Venture Funding In October Fall Below The 2023 Average – Gené Teare, Crunchbase

According to Crunchbase data, global venture funding hit $21 billion in October 2023, a few billion dollars less than the average monthly funding level for 2023 to yet.

October amounts are around 24% less than the $28 billion invested in October 2022, indicating that funding is still decreasing year over year. To provide some perspective, the funding for the previous month was less than one-third of what it was during the peak months of 2021.

As investors continued to cut down, seed and early-stage funding also decreased by almost a third year over year. According to Crunchbase data, late-stage funding decreased by 18% over the previous year. $11 billion in venture capital was given to American businesses, or slightly more than half of all funding worldwide.

Closures and M&A

The well-known unicorn businesses Olive AI, which manages health care claims, and Convoy, which operates trucks, both closed their doors in October. Each business had raised about $1 billion in capital and was estimated to be worth close to $4 billion.

More companies that raised at record rates in 2021 and the first half of 2022 face a financing cliff, so well-funded late-stage companies won’t be the sole casualties in this slower funding climate.

In the meantime, October saw a rise in M&A activity.

Among the notable acquisitions were the $100 million purchase of Arcion by cloud data business Databricks, and the $975 million acquisition of Loom, a video chat company, by Atlassian. For $795 million, Instructure purchased the academic certification platform Parchment in the edtech space.

Health care and AI lead

Additionally, according to Crunchbase data, artificial intelligence businesses are receiving a larger portion of investment funds.

With almost $5 billion invested in each of those industries last month, AI and healthcare startups raised the most money. With an initial $500 million investment and a pledge of up to $2 billion, Google increased its stake in Anthropic, an OpenAI rival.

Techniques

This report covers venture-backed companies’ seed, angel, venture, corporate venture, and private equity funding rounds. Data from Crunchbase as of November 3, 2023 is shown below.

Keep in mind that data gaps are especially noticeable in the early phases of venture activity, with seed financing levels rising sharply following the quarter’s end.

Unless specified otherwise, all financing values are expressed in U.S. dollars. The foreign currencies are converted to U.S. dollars by Crunchbase using the current spot rate as of the reporting date of fundraising rounds, acquisitions, initial public offerings, and other financial events. Foreign exchange transactions are converted at the historical spot price, even if those events were added to Crunchbase well after they were publicized.

An acronym for funding terms

We have changed the way corporate funding rounds are included in our reporting as of January 2023. Only companies that have secured equity funding at seed through a venture series funding round are included in the corporate rounds.

Pre-seed, angel rounds, and seed make up Seed and Angel. Additionally, Crunchbase lists convertible notes with a value of little more than $3 million (USD) or its equivalent in converted USD, equity crowdfunding, and venture rounds of unknown series.

Series A and Series B rounds, together with other round types, comprise the early stage. Venture rounds from unknown series, corporate venture and other rounds above $3 million, and rounds less than or equal to $15 million are all included in Crunchbase.

Series C, D, E, and later-lettered venture rounds that adhere to the “Series [Letter]” naming standard are considered late-stage. Unknown series venture rounds, corporate venture rounds, and other rounds over $15 million are also featured.

A company that has previously raised a “venture” round raises private equity in technology growth. (In other words, any round from the stages that were previously specified.) SOURCE: Gené Teare, Crunchbase